Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clarksville Printing Company sold 1,500 finance books for $85 each to University of the West Indies (UWI) in 2019. These books cost Clarkesville $62 each

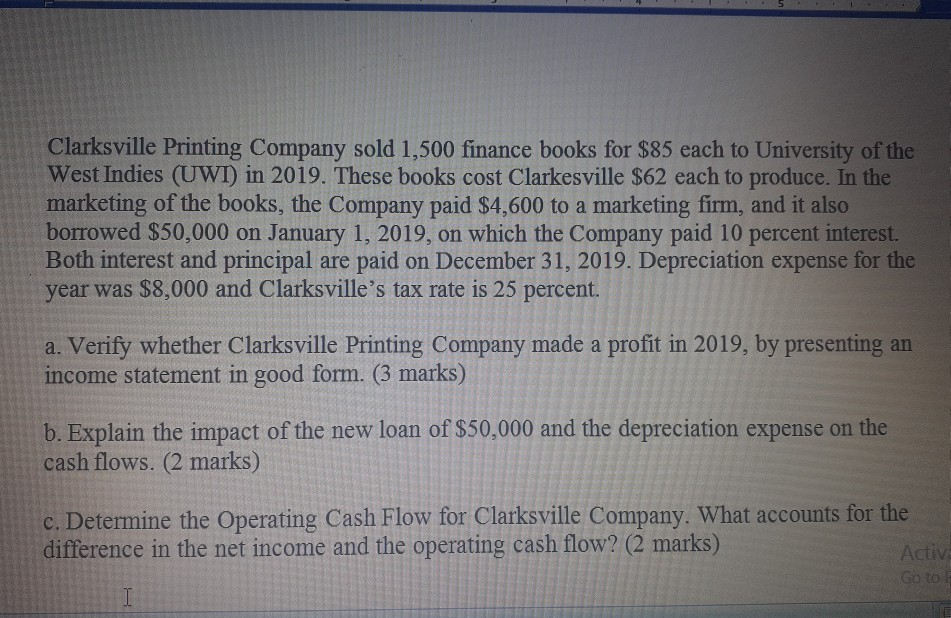

Clarksville Printing Company sold 1,500 finance books for $85 each to University of the West Indies (UWI) in 2019. These books cost Clarkesville $62 each to produce. In the marketing of the books, the Company paid $4,600 to a marketing firm, and it also borrowed $50,000 on January 1, 2019, on which the Company paid 10 percent interest. Both interest and principal are paid on December 31, 2019. Depreciation expense for the year was $8,000 and Clarksville's tax rate is 25 percent. a. Verify whether Clarksville Printing Company made a profit in 2019, by presenting an income statement in good form. (3 marks) b. Explain the impact of the new loan of $50,000 and the depreciation expense on the cash flows. (2 marks) c. Determine the Operating Cash Flow for Clarksville Company. What accounts for the difference in the net income and the operating cash flow? (2 marks) Active Go to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started