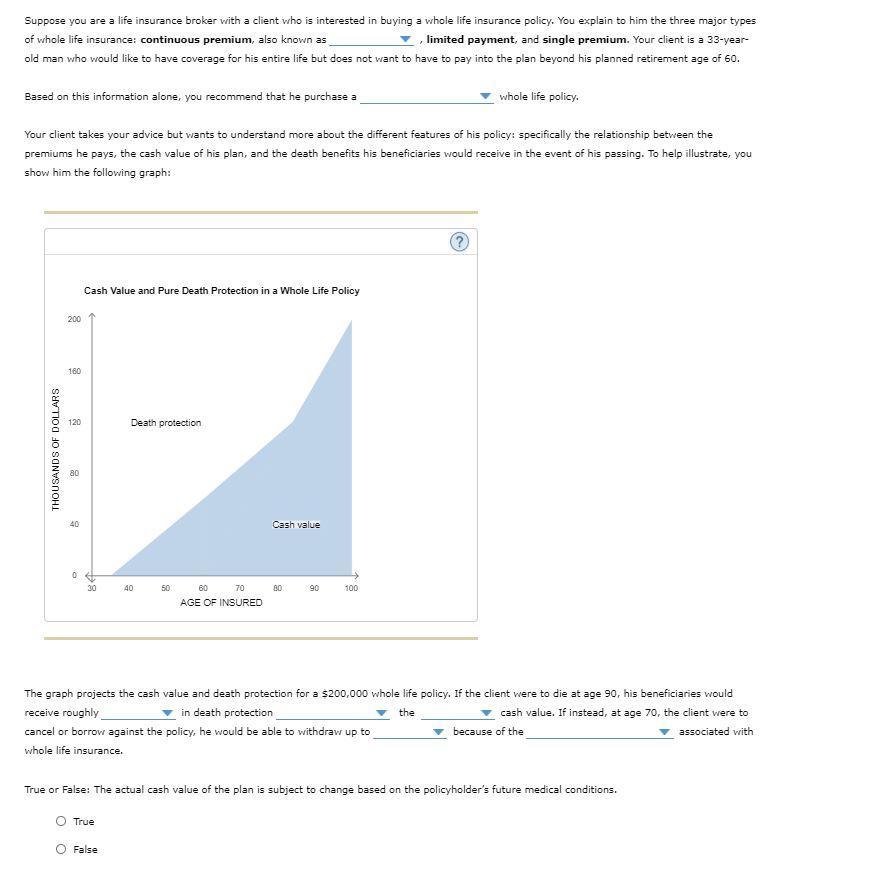

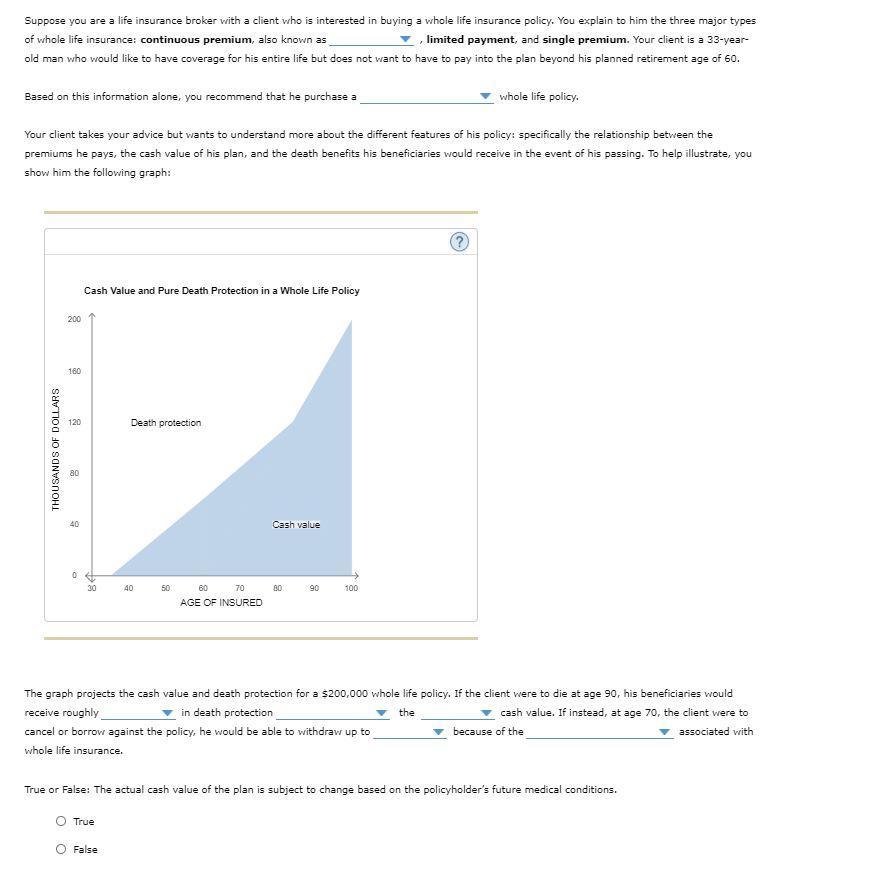

Suppose you are a life insurance broker with a client who is interested in buying a whole life insurance policy. You explain to him the three major types of whole life insurance continuous premium, also known as limited payment, and single premium. Your client is a 33-year- old man who would like to have coverage for his entire life but does not want to have to pay into the plan beyond his planned retirement age of 60. Based on this information alone, you recommend that he purchase a whole life policy. Your client takes your advice but wants to understand more about the different features of his policy: specifically the relationship between the premiums he pays, the cash value of his plan, and the death benefits his beneficiaries would receive in the event of his passing. To help illustrate, you show him the following graph: ? Cash Value and Pure Death Protection in a Whole Life Policy 200 160 20 Death protection THOUSANDS OF DOLLARS 80 40 Cash value 0 30 40 50 80 90 100 60 70 AGE OF INSURED The graph projects the cash value and death protection for a $200,000 whole life policy. If the client were to die at age 90, his beneficiaries would receive roughly in death protection the cash value. If instead, at age 70, the client were to cancel or borrow against the policy, he would be able to withdraw up to because of the associated with whole life insurance. True or False: The actual cash value of the plan is subject to change based on the policyholder's future medical conditions. True O False Suppose you are a life insurance broker with a client who is interested in buying a whole life insurance policy. You explain to him the three major types of whole life insurance continuous premium, also known as limited payment, and single premium. Your client is a 33-year- old man who would like to have coverage for his entire life but does not want to have to pay into the plan beyond his planned retirement age of 60. Based on this information alone, you recommend that he purchase a whole life policy. Your client takes your advice but wants to understand more about the different features of his policy: specifically the relationship between the premiums he pays, the cash value of his plan, and the death benefits his beneficiaries would receive in the event of his passing. To help illustrate, you show him the following graph: ? Cash Value and Pure Death Protection in a Whole Life Policy 200 160 20 Death protection THOUSANDS OF DOLLARS 80 40 Cash value 0 30 40 50 80 90 100 60 70 AGE OF INSURED The graph projects the cash value and death protection for a $200,000 whole life policy. If the client were to die at age 90, his beneficiaries would receive roughly in death protection the cash value. If instead, at age 70, the client were to cancel or borrow against the policy, he would be able to withdraw up to because of the associated with whole life insurance. True or False: The actual cash value of the plan is subject to change based on the policyholder's future medical conditions. True O False