Answered step by step

Verified Expert Solution

Question

1 Approved Answer

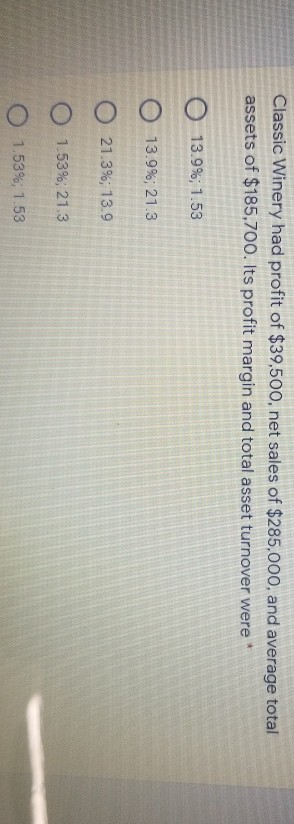

Classic Winery had profit of $39,500, net sales of $285,000, and average total assets of $185,700. Its profit margin and total asset turnover were 0

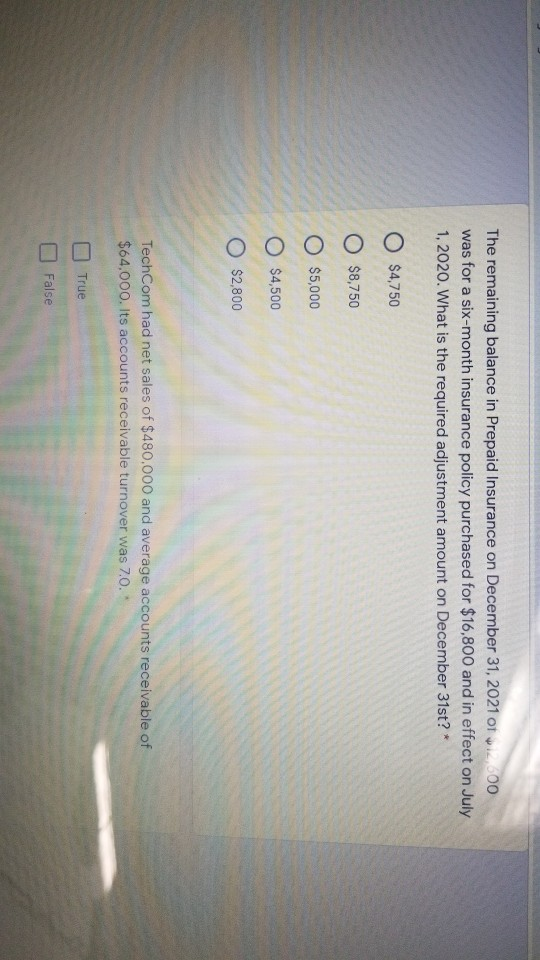

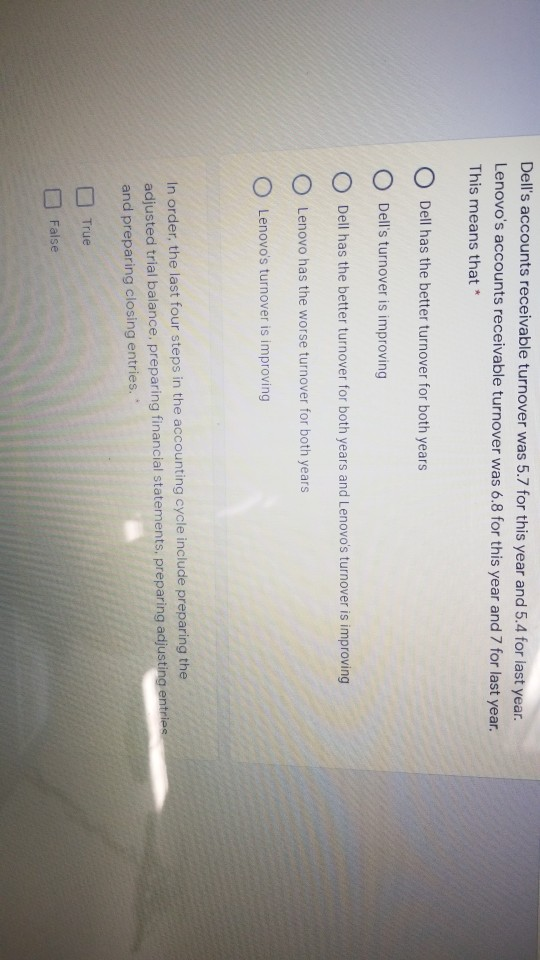

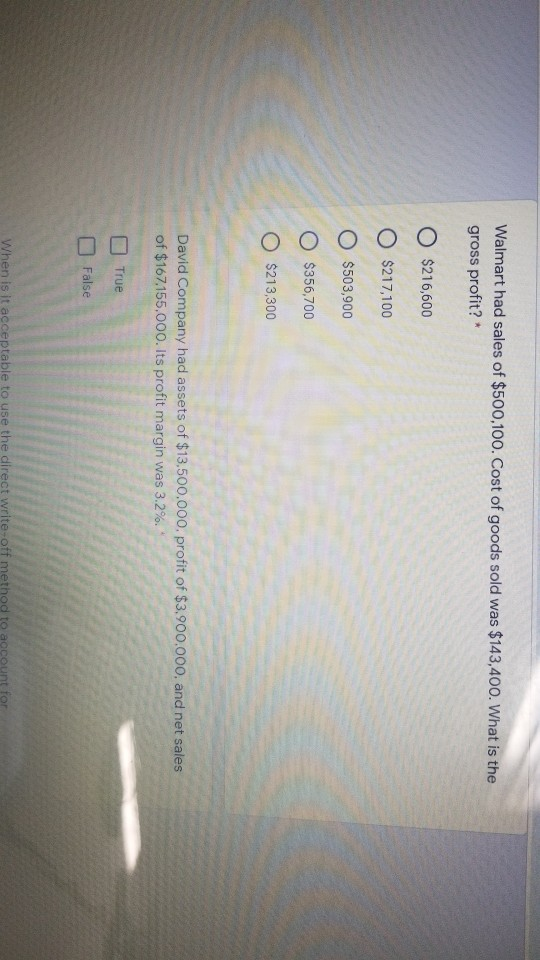

Classic Winery had profit of $39,500, net sales of $285,000, and average total assets of $185,700. Its profit margin and total asset turnover were 0 13.9%; 1.53 O 13.9% 21.3 O 21.3%; 13.9 O 1.53%; 21.3 0 1.53%; 1.53 The remaining balance in Prepaid Insurance on December 31, 2021 0 00 was for a six-month insurance policy purchased for $16,800 and in effect on July 1,2020. What is the required adjustment amount on December 31st? * O $4,750 O $8,750 O O O $5,000 $4,500 $2,800 TechCom had net sales of $480,000 and average accounts receivable of $64.000. Its accounts receivable turnover was 7.0. O True O False Dell's accounts receivable turnover was 5.7 for this year and 5.4 for last year. Lenovo's accounts receivable turnover was 6.8 for this year and 7 for last year. This means that O Dell has the better turnover for both years O Dell's turnover is improving O Dell has the better turnover for both years and Lenovo's turnover is improving O Lenovo has the worse turnover for both years O Lenovo's turnover is improving In order, the last four steps in the accounting cycle include preparing the adjusted trial balance, preparing financial statements, preparing adjusting entries and preparing closing entries. True False Walmart had sales of $500,100. Cost of goods sold was $143,400. What is the gross profit?* O O $216,600 $217,100 $503,900 $356,700 $213,300 David Company had assets of $13,500,000, profit of $3.900.000, and net sales of $167.155.000. Its profit margin was 3.2%. O True False When is it acceptable to use the direct write-off method to account for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started