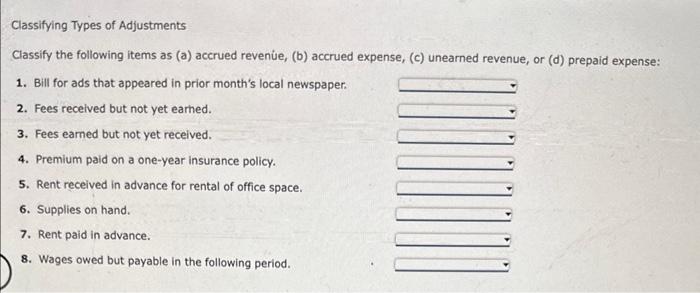

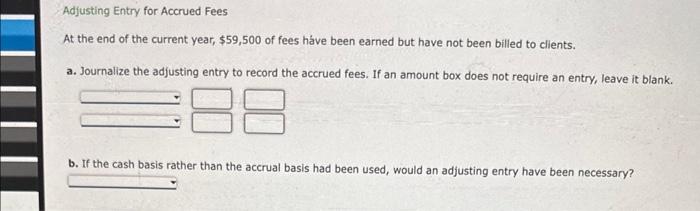

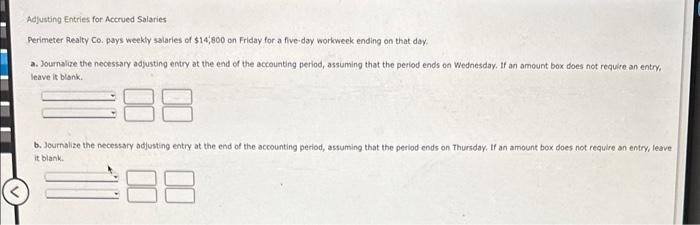

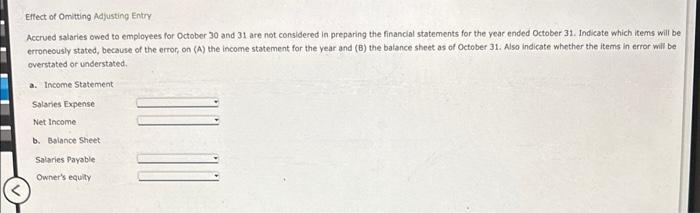

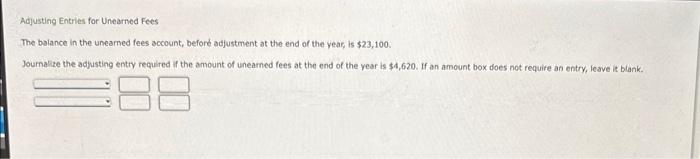

Classifying Types of Adjustments Classify the following items as (a) accrued revenuse, (b) accrued expense, (c) unearned revenue, or (d) prepaid expense: Adjusting Entry for Accrued Fees At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. If an amount box does not require an entry, leave it blank. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Adjusting Entries for Accrued Salaries Perimeter Realty Co. pays weekfy salaries of $14,800 on Friday for a five.day workweek ending on that day. a. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on wednesday. If an amount box does not require an entry, leave is bisnk. Eflect of Omitting Adyusting Entry Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31 . Indicate which items will be erroneously stated, because of the error, on (A) the income statement for the year and (B) the balance sheet as of october 31 . Also indicate whether the items in error will be overstated or understated. a. Income statement Salaries Expense Net Income. b. Bslance Sheet Salaries Payable Owner's equity Adjusting Entries for Unearned Fees The balance in the unearned fees account, before adjustment at the end of the yeac, is $23,100. Joumalize the adjusting entry requlred if the amount of unearned fees at the end of the year is $4,620. If an amount box does not require an entry, leave it blank. Classifying Types of Adjustments Classify the following items as (a) accrued revenuse, (b) accrued expense, (c) unearned revenue, or (d) prepaid expense: Adjusting Entry for Accrued Fees At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. If an amount box does not require an entry, leave it blank. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Adjusting Entries for Accrued Salaries Perimeter Realty Co. pays weekfy salaries of $14,800 on Friday for a five.day workweek ending on that day. a. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on wednesday. If an amount box does not require an entry, leave is bisnk. Eflect of Omitting Adyusting Entry Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31 . Indicate which items will be erroneously stated, because of the error, on (A) the income statement for the year and (B) the balance sheet as of october 31 . Also indicate whether the items in error will be overstated or understated. a. Income statement Salaries Expense Net Income. b. Bslance Sheet Salaries Payable Owner's equity Adjusting Entries for Unearned Fees The balance in the unearned fees account, before adjustment at the end of the yeac, is $23,100. Joumalize the adjusting entry requlred if the amount of unearned fees at the end of the year is $4,620. If an amount box does not require an entry, leave it blank