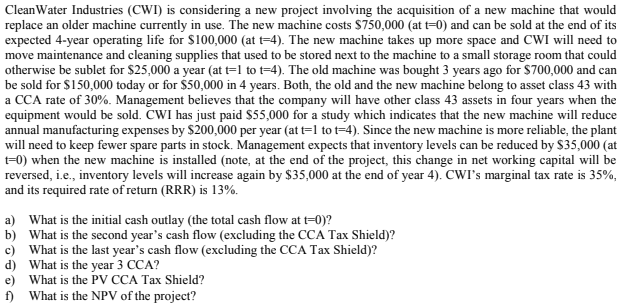

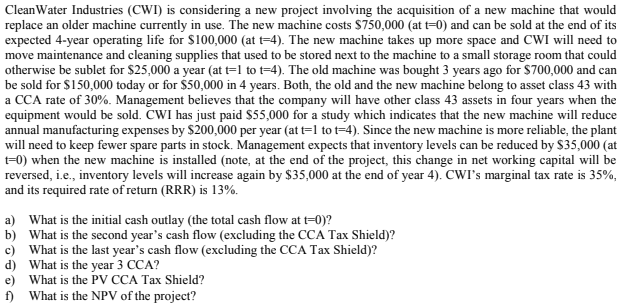

Clean Water Industries (CWI) is considering a new project involving the acquisition of a new machine that would replace an older machine currently in use. The new machine costs $750,000 (at t=0) and can be sold at the end of its expected 4-year operating life for $100,000 (at t=4). The new machine takes up more space and CWI will need to move maintenance and cleaning supplies that used to be stored next to the machine to a small storage room that could otherwise be sublet for $25,000 a year (at tl to t=4). The old machine was bought 3 years ago for $700,000 and can be sold for $150,000 today or for $50,000 in 4 years. Both, the old and the new machine belong to asset class 43 with a CCA rate of 30%. Management believes that the company will have other class 43 assets in four years when the equipment would be sold. CWI has just paid $55,000 for a study which indicates that the new machine will reduce annual manufacturing expenses by $200,000 per year (at t=1 to t=4). Since the new machine is more reliable, the plant will need to keep fewer spare parts in stock. Management expects that inventory levels can be reduced by $35,000 (at t=0) when the new machine is installed (note, at the end of the project, this change in net working capital will be reversed, i.e., inventory levels will increase again by $35,000 at the end of year 4). CWI's marginal tax rate is 35%, and its required rate of return (RRR) is 13%. a) What is the initial cash outlay (the total cash flow at t=0)? b) What is the second year's cash flow (excluding the CCA Tax Shield)? c) What is the last year's cash flow (excluding the CCA Tax Shield)? d) What is the year 3 CCA? e) What is the PV CCA Tax Shield? f) What is the NPV of the project? Clean Water Industries (CWI) is considering a new project involving the acquisition of a new machine that would replace an older machine currently in use. The new machine costs $750,000 (at t=0) and can be sold at the end of its expected 4-year operating life for $100,000 (at t=4). The new machine takes up more space and CWI will need to move maintenance and cleaning supplies that used to be stored next to the machine to a small storage room that could otherwise be sublet for $25,000 a year (at tl to t=4). The old machine was bought 3 years ago for $700,000 and can be sold for $150,000 today or for $50,000 in 4 years. Both, the old and the new machine belong to asset class 43 with a CCA rate of 30%. Management believes that the company will have other class 43 assets in four years when the equipment would be sold. CWI has just paid $55,000 for a study which indicates that the new machine will reduce annual manufacturing expenses by $200,000 per year (at t=1 to t=4). Since the new machine is more reliable, the plant will need to keep fewer spare parts in stock. Management expects that inventory levels can be reduced by $35,000 (at t=0) when the new machine is installed (note, at the end of the project, this change in net working capital will be reversed, i.e., inventory levels will increase again by $35,000 at the end of year 4). CWI's marginal tax rate is 35%, and its required rate of return (RRR) is 13%. a) What is the initial cash outlay (the total cash flow at t=0)? b) What is the second year's cash flow (excluding the CCA Tax Shield)? c) What is the last year's cash flow (excluding the CCA Tax Shield)? d) What is the year 3 CCA? e) What is the PV CCA Tax Shield? f) What is the NPV of the project