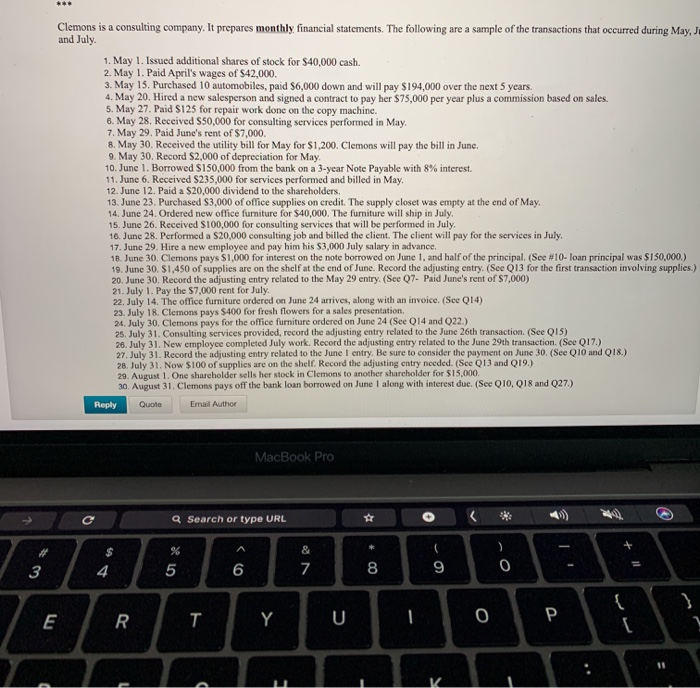

Clemons is a consulting company. It prepares monthly financial statements. The following are a sample of the transactions that occurred during May, J- and July 1. May 1, Issued additional shares of stock for $40,000 cash. 2. May 1. Paid April's wages of $42,000. 3. May 15. Purchased 10 automobiles, paid $6,000 down and will pay $194,000 over the next 5 years. 4. May 20. Hired a new salesperson and signed a contract to pay her $75,000 per year plus a commission based on sales. 5. May 27. Paid $125 for repair work done on the copy machine. 6. May 28, Received $50,000 for consulting services performed in May. 7. May 29. Paid June's rent of $7,000. 8. May 30. Received the utility bill for May for $1,200. Clemons will pay the bill in June. 9. May 30. Record S2,000 of depreciation for May 10. June 1. Borrowed S150,000 from the bank on a 3-year Note Payable with 8% interest. 11. June 6. Received $235,000 for services performed and billed in May. 12. June 12. Paid a $20,000 dividend to the shareholders. 13. June 23. Purchased $3,000 of office supplies on credit. The supply closet was empty at the end of May, 14. June 24. Ordered new office furniture for $40,000. The furniture will ship in July, 15. June 26. Received $100,000 for consulting services that will be performed in July 16. June 28. Performed a $20,000 consulting job and billed the client. The client will pay for the services in July. 17. June 29. Hire a new employee and pay him his $3,000 July salary in advance. 18. June 30. Clemons pays $1,000 for interest on the note borrowed on June 1, and half of the principal. (See #10-loan principal was $150,000.) 19. June 30. $1,450 of supplies are on the shelf at the end of June. Record the adjusting entry. (See Q13 for the first transaction involving supplies.) 20. June 30. Record the adjusting entry related to the May 29 entry. (See Q7. Paid June's rent of $7.000) 21. July 1. Pay the $7,000 rent for July 22. July 14. The office furniture ordered on June 24 arrives, along with an invoice. (See Q14) 23. July 18. Clemons pays $400 for fresh flowers for a sales presentation, 24. July 30. Clemons pays for the office furniture ordered on June 24 (See Q14 and 022) 25. July 31. Consulting services provided, record the adjusting entry related to the June 26th transaction. (See Q15) 26. July 31. New employee completed July work. Record the adjusting entry related to the June 29th transaction. (See Q17.) 27. July 31. Record the adjusting entry related to the June 1 entry. Be sure to consider the payment on June 30. (See Q10 and 18.) 28. July 31. Now $100 of supplies are on the shelf. Record the adjusting entry needed. (See 013 and Q19.) 29. August 1. One shareholder sells her stock in Clemons to another shareholder for $15,000 30. August 31. Clemons pays off the bank loan borrowed on June 1 along with interest due. (See Q10, Q18 and 927.) Reply Quote Email Author MacBook Pro * Q Search or type URL $ ( & 7 4 3 5 6 00 9 0 { E R T Y U 0 [ F Clemons is a consulting company. It prepares monthly financial statements. The following are a sample of the transactions that occurred during May, J- and July 1. May 1, Issued additional shares of stock for $40,000 cash. 2. May 1. Paid April's wages of $42,000. 3. May 15. Purchased 10 automobiles, paid $6,000 down and will pay $194,000 over the next 5 years. 4. May 20. Hired a new salesperson and signed a contract to pay her $75,000 per year plus a commission based on sales. 5. May 27. Paid $125 for repair work done on the copy machine. 6. May 28, Received $50,000 for consulting services performed in May. 7. May 29. Paid June's rent of $7,000. 8. May 30. Received the utility bill for May for $1,200. Clemons will pay the bill in June. 9. May 30. Record S2,000 of depreciation for May 10. June 1. Borrowed S150,000 from the bank on a 3-year Note Payable with 8% interest. 11. June 6. Received $235,000 for services performed and billed in May. 12. June 12. Paid a $20,000 dividend to the shareholders. 13. June 23. Purchased $3,000 of office supplies on credit. The supply closet was empty at the end of May, 14. June 24. Ordered new office furniture for $40,000. The furniture will ship in July, 15. June 26. Received $100,000 for consulting services that will be performed in July 16. June 28. Performed a $20,000 consulting job and billed the client. The client will pay for the services in July. 17. June 29. Hire a new employee and pay him his $3,000 July salary in advance. 18. June 30. Clemons pays $1,000 for interest on the note borrowed on June 1, and half of the principal. (See #10-loan principal was $150,000.) 19. June 30. $1,450 of supplies are on the shelf at the end of June. Record the adjusting entry. (See Q13 for the first transaction involving supplies.) 20. June 30. Record the adjusting entry related to the May 29 entry. (See Q7. Paid June's rent of $7.000) 21. July 1. Pay the $7,000 rent for July 22. July 14. The office furniture ordered on June 24 arrives, along with an invoice. (See Q14) 23. July 18. Clemons pays $400 for fresh flowers for a sales presentation, 24. July 30. Clemons pays for the office furniture ordered on June 24 (See Q14 and 022) 25. July 31. Consulting services provided, record the adjusting entry related to the June 26th transaction. (See Q15) 26. July 31. New employee completed July work. Record the adjusting entry related to the June 29th transaction. (See Q17.) 27. July 31. Record the adjusting entry related to the June 1 entry. Be sure to consider the payment on June 30. (See Q10 and 18.) 28. July 31. Now $100 of supplies are on the shelf. Record the adjusting entry needed. (See 013 and Q19.) 29. August 1. One shareholder sells her stock in Clemons to another shareholder for $15,000 30. August 31. Clemons pays off the bank loan borrowed on June 1 along with interest due. (See Q10, Q18 and 927.) Reply Quote Email Author MacBook Pro * Q Search or type URL $ ( & 7 4 3 5 6 00 9 0 { E R T Y U 0 [ F