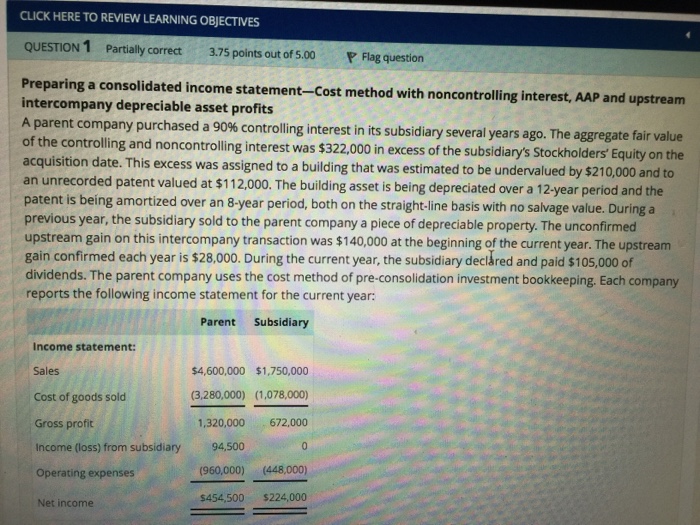

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Partially correct 3.75 points out of 5.00 PFlag question Preparing a consolidated income statement-Cost method with noncontrolling interest, AAP and upstream intercompany depreciable asset profits parent company purchased a 90% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $322,000 in excess of the subsidiary's Stockholders Equity on the acquisition date. This excess was assigned to a building that was estimated to b an unrecorded patent valued at $112,000. The building asset is being depreciated over a 12-year period and the patent is being amortized over an 8-year period, both on the straight-line basis with no salvage value. During a previous year, the subsidiary sold to the parent company a piece of depreciable property. The unconfirmed upstream gain on this intercompany transaction was $140,000 at the beginning of the current year. The upstream gain confirmed each year is $28,000. During the current year, the subsidiary declred and paid $105,000 of dividends. The parent company uses the cost method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: e undervalued by $210,000 and to Parent Subsidiary Income statement: Sales Cost of goods sold Gross profit Income (loss) from subsidiary Operating expenses $4,600,000 $1,750,000 (3,280,000) (1,078,000) 1,320,000 672,000 94,500 (960,000) (448,000) $454,500 $224,000 Net income CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 1 Partially correct 3.75 points out of 5.00 PFlag question Preparing a consolidated income statement-Cost method with noncontrolling interest, AAP and upstream intercompany depreciable asset profits parent company purchased a 90% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $322,000 in excess of the subsidiary's Stockholders Equity on the acquisition date. This excess was assigned to a building that was estimated to b an unrecorded patent valued at $112,000. The building asset is being depreciated over a 12-year period and the patent is being amortized over an 8-year period, both on the straight-line basis with no salvage value. During a previous year, the subsidiary sold to the parent company a piece of depreciable property. The unconfirmed upstream gain on this intercompany transaction was $140,000 at the beginning of the current year. The upstream gain confirmed each year is $28,000. During the current year, the subsidiary declred and paid $105,000 of dividends. The parent company uses the cost method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: e undervalued by $210,000 and to Parent Subsidiary Income statement: Sales Cost of goods sold Gross profit Income (loss) from subsidiary Operating expenses $4,600,000 $1,750,000 (3,280,000) (1,078,000) 1,320,000 672,000 94,500 (960,000) (448,000) $454,500 $224,000 Net income