Answered step by step

Verified Expert Solution

Question

1 Approved Answer

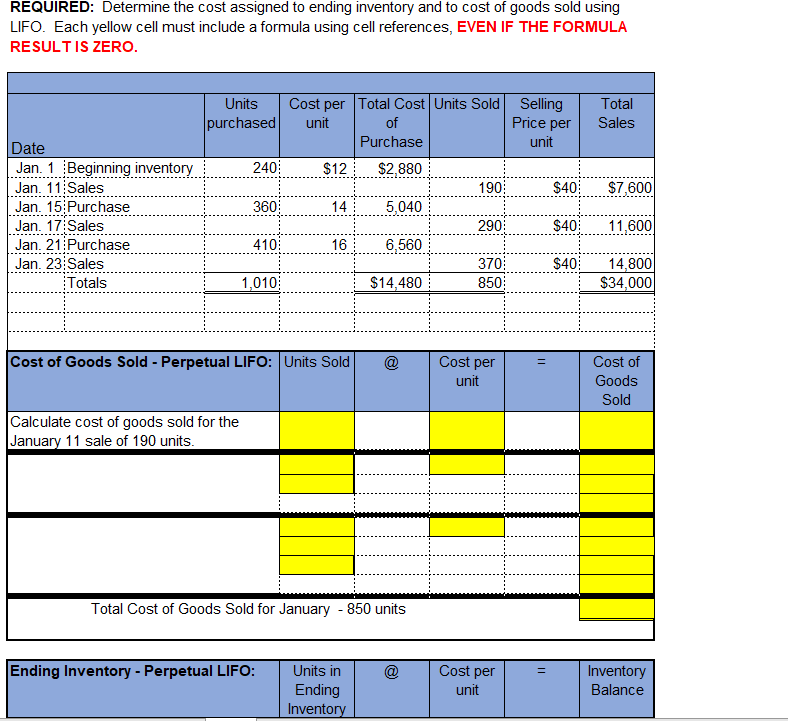

Click on the FIFO tab and enter your name in Cell C1. If Cell C1 is left blank, you will not be able to

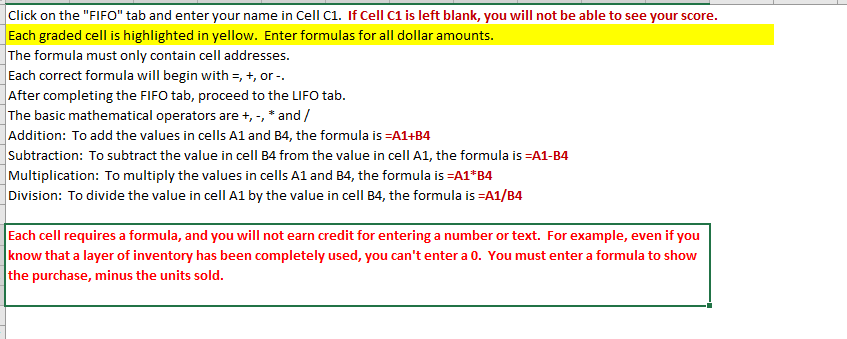

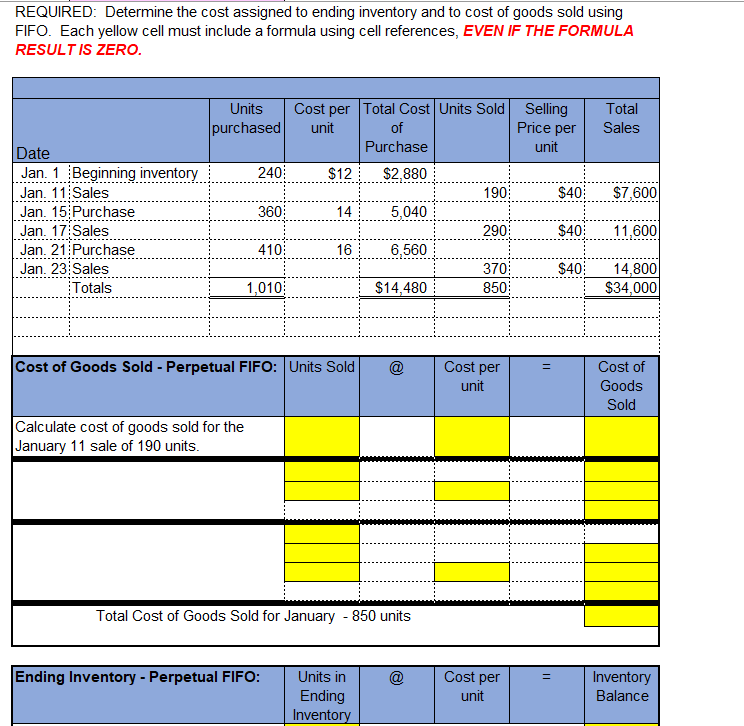

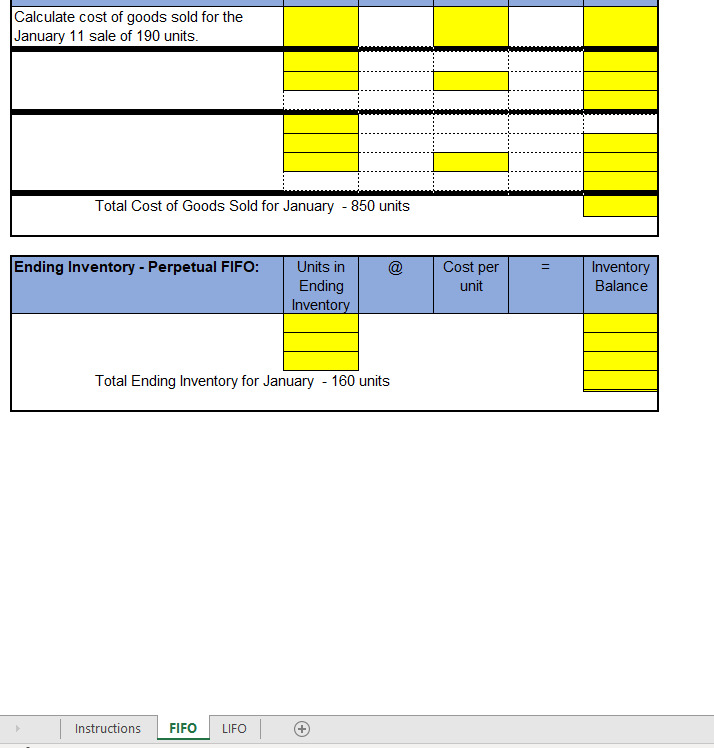

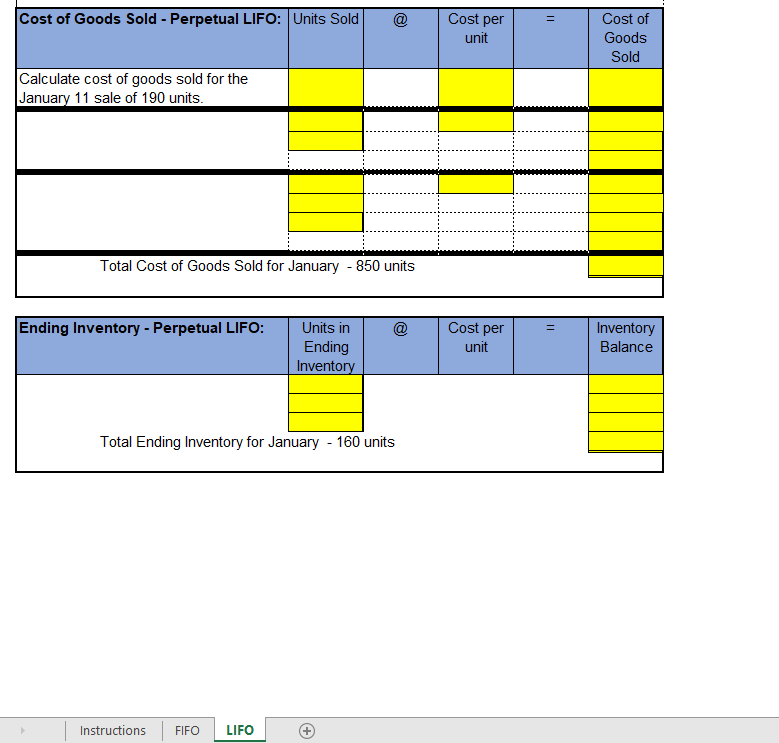

Click on the "FIFO" tab and enter your name in Cell C1. If Cell C1 is left blank, you will not be able to see your score. Each graded cell is highlighted in yellow. Enter formulas for all dollar amounts. The formula must only contain cell addresses. Each correct formula will begin with =, +, or -. After completing the FIFO tab, proceed to the LIFO tab. The basic mathematical operators are +, -, * and/ Addition: To add the values in cells A1 and B4, the formula is =A1+B4 Subtraction: To subtract the value in cell B4 from the value in cell A1, the formula is =A1-B4 Multiplication: To multiply the values in cells A1 and B4, the formula is =A1*B4 Division: To divide the value in cell A1 by the value in cell B4, the formula is =A1/B4 Each cell requires a formula, and you will not earn credit for entering a number or text. For example, even if you know that a layer of inventory has been completely used, you can't enter a 0. You must enter a formula to show the purchase, minus the units sold. REQUIRED: Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Each yellow cell must include a formula using cell references, EVEN IF THE FORMULA RESULT IS ZERO. Units purchased unit Cost per Total Cost Units Sold of Selling Price per Total Sales Purchase unit Date Jan. 1 Beginning inventory 240 $12 $2,880 Jan. 11 Sales 190 $40 $7,600 Jan. 15 Purchase 360 14 5,040 Jan. 17 Sales 290 $40: 11,600 Jan. 21 Purchase 410: 16 6,560 Jan. 23 Sales 370 $40 14,800 Totals 1,010 $14,480 850 $34,000 Cost of Goods Sold - Perpetual FIFO: Units Sold Calculate cost of goods sold for the January 11 sale of 190 units. Total Cost of Goods Sold for January - 850 units Ending Inventory - Perpetual FIFO: Units in Ending Inventory Cost per unit = Cost of Goods Sold Cost per unit Inventory Balance Calculate cost of goods sold for the January 11 sale of 190 units. Total Cost of Goods Sold for January - 850 units Ending Inventory - Perpetual FIFO: Units in Ending Inventory Total Ending Inventory for January - 160 units Instructions FIFO LIFO Cost per unit = Inventory Balance REQUIRED: Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Each yellow cell must include a formula using cell references, EVEN IF THE FORMULA RESULT IS ZERO. Units purchased Cost per Total Cost Units Sold unit of Selling Price per Total Sales Purchase unit Date Jan. 1 Beginning inventory 240 $12 $2,880 Jan. 11 Sales 190 $40 $7,600 Jan. 15 Purchase 360 14 5,040 Jan. 17 Sales 290: $40 11,600 Jan. 21 Purchase 410 16 6,560 Jan. 23 Sales 370 $40 14,800 Totals 1,010 $14,480 850 $34,000 Cost of Goods Sold - Perpetual LIFO: Units Sold @ Cost per unit Calculate cost of goods sold for the January 11 sale of 190 units. Total Cost of Goods Sold for January - 850 units Cost of Goods Sold Ending Inventory - Perpetual LIFO: Units in Ending Cost per unit Inventory Balance Inventory Cost of Goods Sold - Perpetual LIFO: Units Sold Cost per unit Calculate cost of goods sold for the January 11 sale of 190 units. Total Cost of Goods Sold for January - 850 units Cost of Goods Sold Ending Inventory - Perpetual LIFO: Units in @ Cost per = Ending Inventory unit Inventory Balance Total Ending Inventory for January - 160 units Instructions FIFO LIFO +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started