Question

X Corporation is a company involved in manufacturing mining equipment. At the beginning of the year, the board of directors of the said company has

X Corporation is a company involved in manufacturing mining equipment. At the

beginning of the year, the board of directors of the said company has decided to enter into a

business combination with Y Corporation and Z Corporation, top suppliers

of materials in the mining industry which they use in production. The said acquisition is

expected to result in producing higher quality mining equipment with lower total cost. The

deal was closed on February 28, 2024 and the following information was gathered from the

books of the entities.

X, who has the legal and economic entity will issue 135,000 of its ordinary shares In

exchange for the acquisition of Y and P67,200 of its ordinary shares in exchange

for the acquisition of Z. The fair value of X's share is-P150,

In addition, the following adjustments should-be made to the current assets of Y and Z

which has a fair value of /2,700,000 and P1,380,000, "respectively. The noncurrent assets

has a fair value of P12,900,000 and R11,850.000 for Y and Z, respectively.

11. Compute the combined stakeholder's equity of the surviving company on the date of acquisition

12. Compute the combined assets

13. Combined liabilities

14. Compute on goodwill/gain on bargain on Y Corporation

15. Compute on goodwill/gain on bargain on Z Corporation

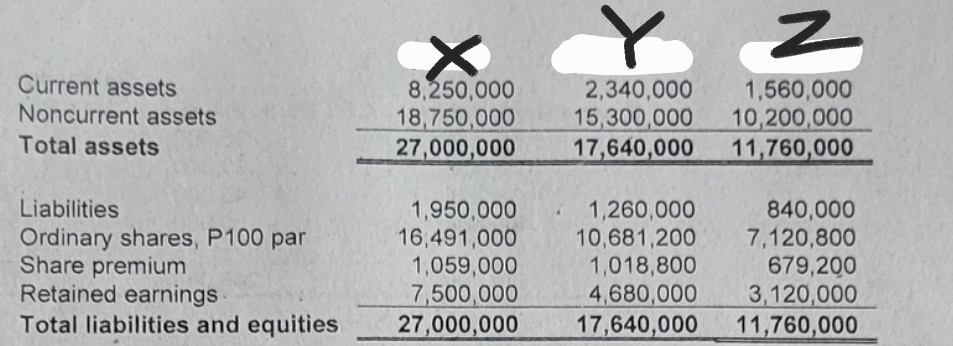

Current assets Noncurrent assets Total assets 8,250,000 18,750,000 2,340,000 15,300,000 1,560,000 10,200,000 27,000,000 17,640,000 11,760,000 Liabilities 1,950,000 A 1,260,000 840,000 Ordinary shares, P100 par 16,491,000 10,681,200 7,120,800 Share premium 1,059,000 1,018,800 679,200 Retained earnings. 7,500,000 4,680,000 3,120,000 Total liabilities and equities 27,000,000 17,640,000 11,760,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started