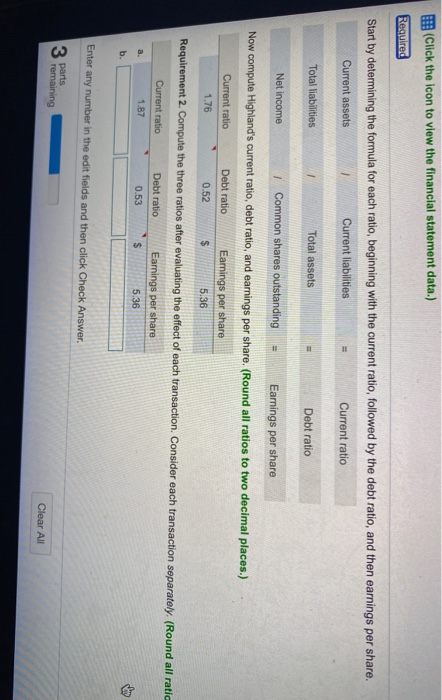

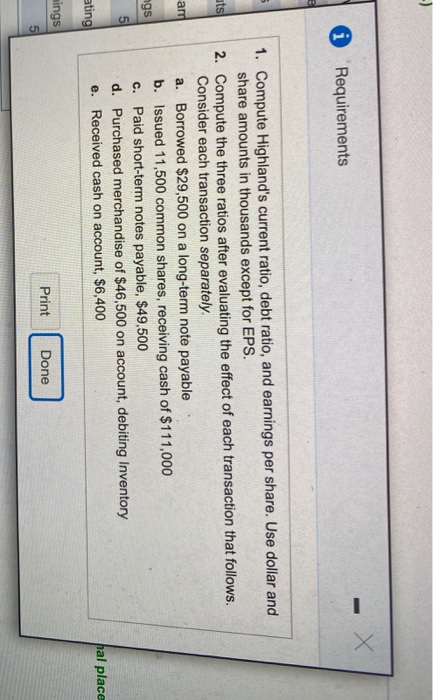

(Click the icon to view the financial statement data.) Required Start by determining the formula for each ratio, beginning with the current ratio, followed by the debt ratio, and then earnings per share. Current assets Current liabilities Current ratio Total liabilities Total assets Debt ratio Net income 1 Common shares outstanding Earnings per share Now compute Highland's current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places.) Current ratio Debt ratio Earnings per share 0.52 $ 5.36 1.76 Requirement 2. Compute the three ratios after evaluating the effect of each transaction. Consider each transaction separately. (Round all ratic Debt ratio Current ratio 1.87 Earnings per share 5.36 a. 0.53 S b. Enter any number in the edit fields and then click Check Answer parts remaining Clear All -) i Requirements ats arn 1. Compute Highland's current ratio, debt ratio, and earnings per share. Use dollar and share amounts in thousands except for EPS. 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. a. Borrowed $29,500 on a long-term note payable b. Issued 11,500 common shares, receiving cash of $111,000 c. Paid short-term notes payable, $49,500 d. Purchased merchandise of $46,500 on account, debiting Inventory e. Received cash on account, $6,400 ngs hal place ating mings Print Done 5 (Click the icon to view the financial statement data.) Required Start by determining the formula for each ratio, beginning with the current ratio, followed by the debt ratio, and then earnings per share. Current assets Current liabilities Current ratio Total liabilities Total assets Debt ratio Net income 1 Common shares outstanding Earnings per share Now compute Highland's current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places.) Current ratio Debt ratio Earnings per share 0.52 $ 5.36 1.76 Requirement 2. Compute the three ratios after evaluating the effect of each transaction. Consider each transaction separately. (Round all ratic Debt ratio Current ratio 1.87 Earnings per share 5.36 a. 0.53 S b. Enter any number in the edit fields and then click Check Answer parts remaining Clear All -) i Requirements ats arn 1. Compute Highland's current ratio, debt ratio, and earnings per share. Use dollar and share amounts in thousands except for EPS. 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. a. Borrowed $29,500 on a long-term note payable b. Issued 11,500 common shares, receiving cash of $111,000 c. Paid short-term notes payable, $49,500 d. Purchased merchandise of $46,500 on account, debiting Inventory e. Received cash on account, $6,400 ngs hal place ating mings Print Done 5