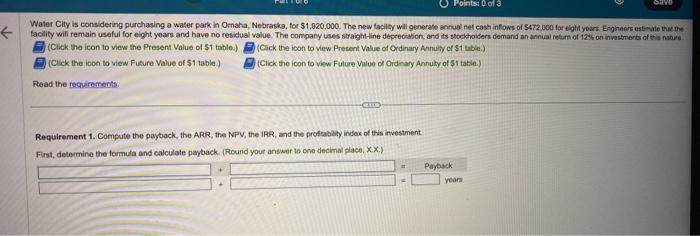

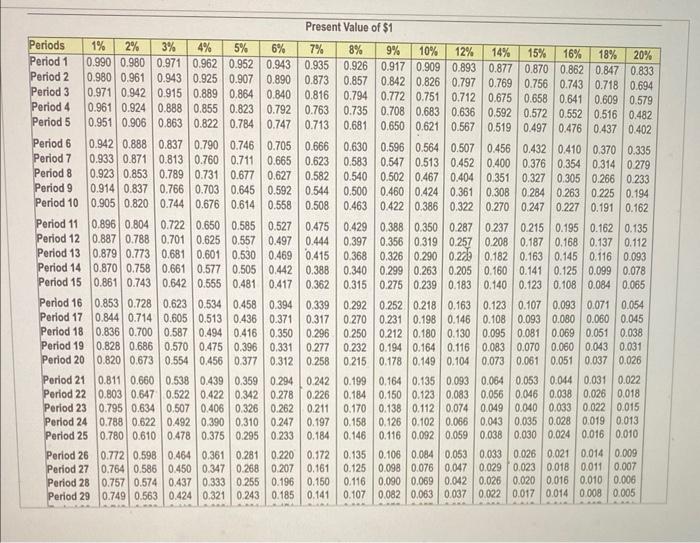

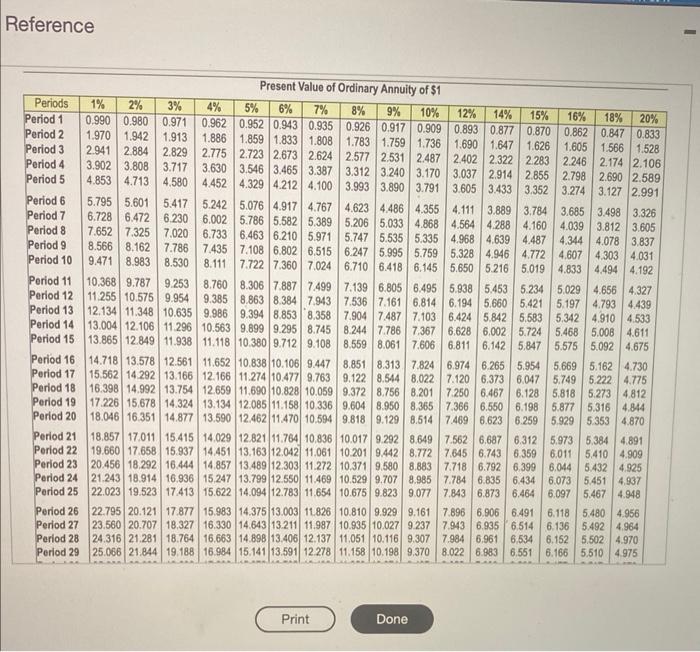

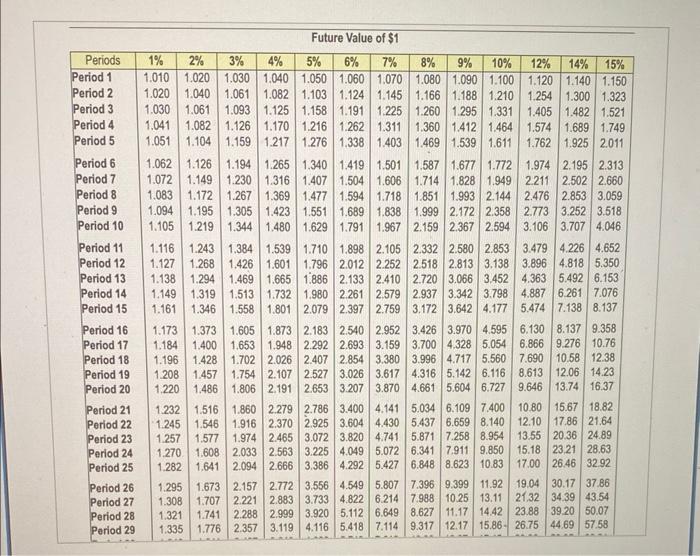

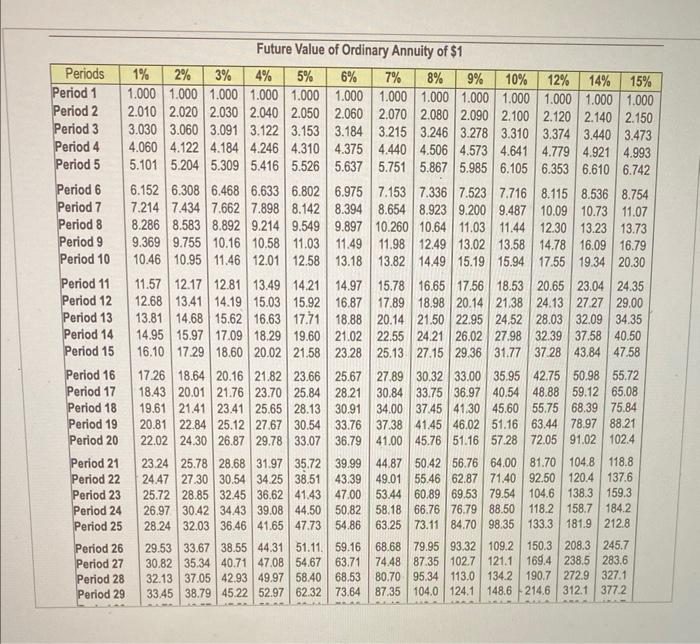

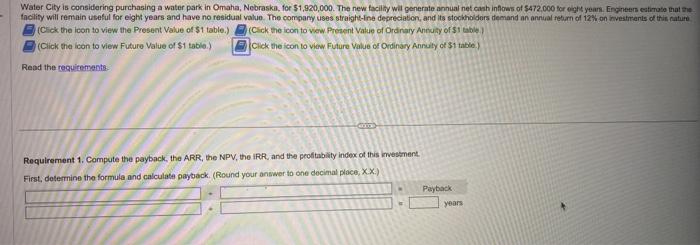

(Click the icon to view the Present Value of $1 tatie) (Cick the icon to view Presont Value of Ordinary Annuity of \$1 table.) (Click the icon to view Future Value of 51 table.) (Click the icon to view Fulure Vilue of Ordinary Annuly of $1 table.) Read the reguirements: Requirement 1. Compute the paytack, the ARR, the NPV, the IRR, and the proftabality indec of this investment. First, determine the formula and calculate payback. (Round your answer to cne decmal place, x.) Reference Future Value of $1 \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% \\ \hline Period 1 & 1.010 & 1.020 & 1.030 & 1.040 & 1.050 & 1.060 & 1.070 & 1.080 & 1.090 & 1.100 & 1.120 & 1.140 & 1.150 \\ Period 2 & 1.020 & 1.040 & 1.061 & 1.082 & 1.103 & 1.124 & 1.145 & 1.166 & 1.188 & 1.210 & 1.254 & 1.300 & 1.323 \\ Period 3 & 1.030 & 1.061 & 1.093 & 1.125 & 1.158 & 1.191 & 1.225 & 1.260 & 1.295 & 1.331 & 1.405 & 1.482 & 1.521 \\ Period 4 & 1.041 & 1.082 & 1.126 & 1.170 & 1.216 & 1.262 & 1.311 & 1.360 & 1.412 & 1.464 & 1.574 & 1.689 & 1.749 \\ Period 5 & 1.051 & 1.104 & 1.159 & 1.217 & 1.276 & 1.338 & 1.403 & 1.469 & 1.539 & 1.611 & 1.762 & 1.925 & 2.011 \\ Period 6 & 1.062 & 1.126 & 1.194 & 1.265 & 1.340 & 1.419 & 1.501 & 1.587 & 1.677 & 1.772 & 1.974 & 2.195 & 2.313 \\ Period 7 & 1.072 & 1.149 & 1.230 & 1.316 & 1.407 & 1.504 & 1.606 & 1.714 & 1.828 & 1.949 & 2.211 & 2.502 & 2.660 \\ Period 8 & 1.083 & 1.172 & 1.267 & 1.369 & 1.477 & 1.594 & 1.718 & 1.851 & 1.993 & 2.144 & 2.476 & 2.853 & 3.059 \\ Period 9 & 1.094 & 1.195 & 1.305 & 1.423 & 1.551 & 1.689 & 1.838 & 1.999 & 2.172 & 2.358 & 2.773 & 3.252 & 3.518 \\ Period 10 & 1.105 & 1.219 & 1.344 & 1.480 & 1.629 & 1.791 & 1.967 & 2.159 & 2.367 & 2.594 & 3.106 & 3.707 & 4.046 \\ Period 11 & 1.116 & 1.243 & 1.384 & 1.539 & 1.710 & 1.898 & 2.105 & 2.332 & 2.580 & 2.853 & 3.479 & 4.226 & 4.652 \\ Period 12 & 1.127 & 1.268 & 1.426 & 1.601 & 1.796 & 2.012 & 2.252 & 2.518 & 2.813 & 3.138 & 3.896 & 4.818 & 5.350 \\ Period 13 & 1.138 & 1.294 & 1.469 & 1.665 & 1.886 & 2.133 & 2.410 & 2.720 & 3.066 & 3.452 & 4.363 & 5.492 & 6.153 \\ Period 14 & 1.149 & 1.319 & 1.513 & 1.732 & 1.980 & 2.261 & 2.579 & 2.937 & 3.342 & 3.798 & 4.887 & 6.261 & 7.076 \\ Period 15 & 1.161 & 1.346 & 1.558 & 1.801 & 2.079 & 2.397 & 2.759 & 3.172 & 3.642 & 4.177 & 5.474 & 7.138 & 8.137 \\ Period 16 & 1.173 & 1.373 & 1.605 & 1.873 & 2.183 & 2.540 & 2.952 & \end{tabular} Future Value of Ordinary Annuity of \$1 (Cick the icon to view the Present Value of 51 table.) (Cick the icon to verw Present Vatue of Qrainary Antidity of $1 table. (Click the icon to view Future Yalue of $1 table.) Clek the icon to view Future Value or Ordinary Anruty of 31 tabie.) Rend the reguitempnte- Requirement 1. Compute the payback, the ARR, the NPV, the IRR. and the peoltability index of this ivesiment. Eiant dailamina the finrmula and calculate oavtock. (Round your answer to one decimal ploce, XX.)