Answered step by step

Verified Expert Solution

Question

1 Approved Answer

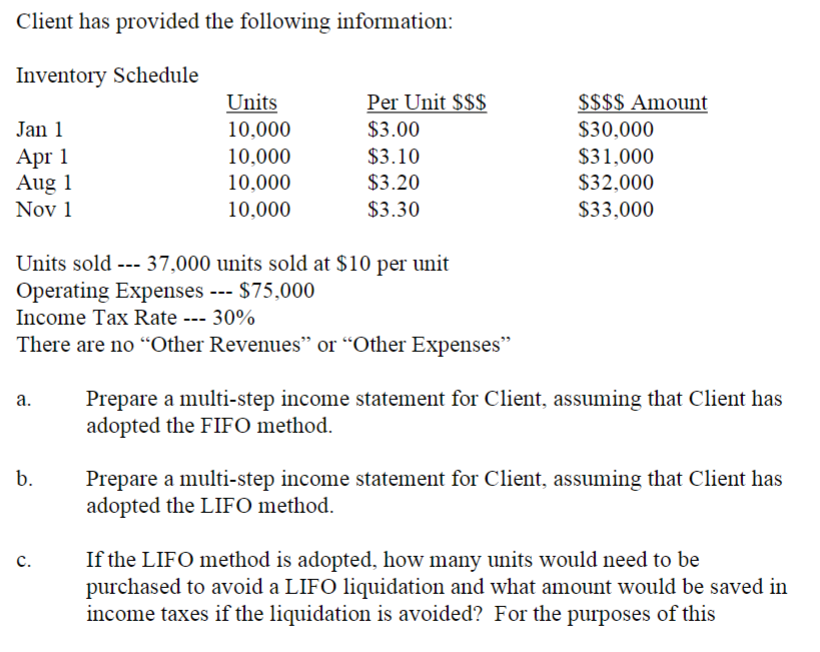

Client has provided the following information: Units sold --- 37,000 units sold at $10 per unit Operating Expenses --- $75,000 Income Tax Rate --- 30%

Client has provided the following information: Units sold --- 37,000 units sold at $10 per unit Operating Expenses --- $75,000 Income Tax Rate --- 30% There are no "Other Revenues" or "Other Expenses" a. Prepare a multi-step income statement for Client, assuming that Client has adopted the FIFO method. b. Prepare a multi-step income statement for Client, assuming that Client has adopted the LIFO method. c. If the LIFO method is adopted, how many units would need to be purchased to avoid a LIFO liquidation and what amount would be saved in income taxes if the liquidation is avoided? For the purposes of this problem, assume that the cost to acquire a unit of inventory in December is $3.30 per unit and the optimal inventory level is 10,000 units. Client has provided the following information: Units sold --- 37,000 units sold at $10 per unit Operating Expenses --- $75,000 Income Tax Rate --- 30% There are no "Other Revenues" or "Other Expenses" a. Prepare a multi-step income statement for Client, assuming that Client has adopted the FIFO method. b. Prepare a multi-step income statement for Client, assuming that Client has adopted the LIFO method. c. If the LIFO method is adopted, how many units would need to be purchased to avoid a LIFO liquidation and what amount would be saved in income taxes if the liquidation is avoided? For the purposes of this problem, assume that the cost to acquire a unit of inventory in December is $3.30 per unit and the optimal inventory level is 10,000 units

Client has provided the following information: Units sold --- 37,000 units sold at $10 per unit Operating Expenses --- $75,000 Income Tax Rate --- 30% There are no "Other Revenues" or "Other Expenses" a. Prepare a multi-step income statement for Client, assuming that Client has adopted the FIFO method. b. Prepare a multi-step income statement for Client, assuming that Client has adopted the LIFO method. c. If the LIFO method is adopted, how many units would need to be purchased to avoid a LIFO liquidation and what amount would be saved in income taxes if the liquidation is avoided? For the purposes of this problem, assume that the cost to acquire a unit of inventory in December is $3.30 per unit and the optimal inventory level is 10,000 units. Client has provided the following information: Units sold --- 37,000 units sold at $10 per unit Operating Expenses --- $75,000 Income Tax Rate --- 30% There are no "Other Revenues" or "Other Expenses" a. Prepare a multi-step income statement for Client, assuming that Client has adopted the FIFO method. b. Prepare a multi-step income statement for Client, assuming that Client has adopted the LIFO method. c. If the LIFO method is adopted, how many units would need to be purchased to avoid a LIFO liquidation and what amount would be saved in income taxes if the liquidation is avoided? For the purposes of this problem, assume that the cost to acquire a unit of inventory in December is $3.30 per unit and the optimal inventory level is 10,000 units Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started