Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cliff has owned his home for 15 years and expects to live in it for 5 more years. He originally borrowed $150,000 at 5% for

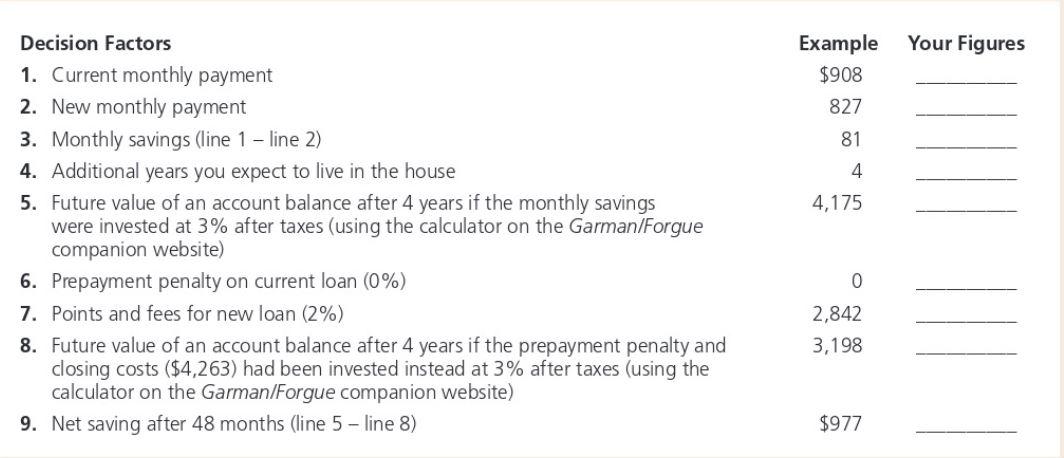

Cliff has owned his home for 15 years and expects to live in it for 5 more years. He originally borrowed $150,000 at 5% for 30 years to buy the home. He still owes $110,000 on the loan. Interest rates have fallen to 4% and Cliff wants to know if he should refinance the loan for 15 years. He would pay 2 points on the new loan with no prepayment penalty on the existing loan.

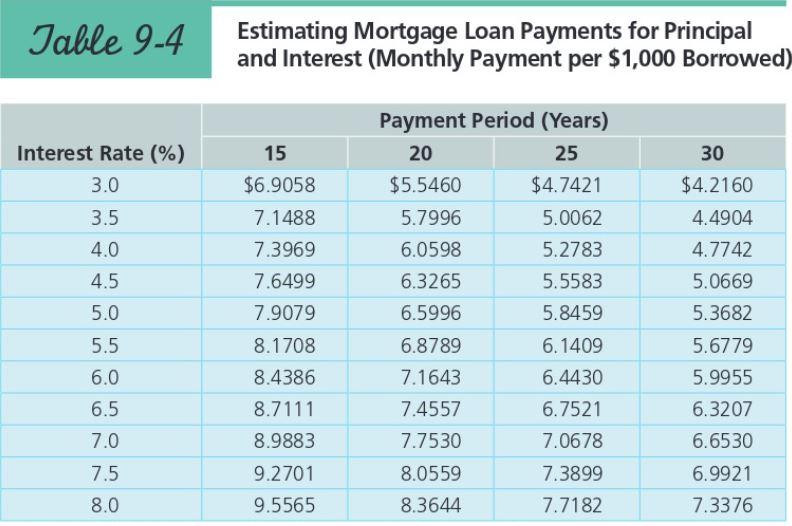

- What is Cliffs current monthly payment? Using Table 9-4

- Calculate the monthly payment on the new loan. Using Table 9-4

- Should Cliff refinance or not? Use the Run the Numbers worksheet. Any numbers existing on the worksheet but not in the scenario just leave blank

Table 9-4 Estimating Mortgage Loan Payments for Principal and Interest (Monthly Payment per $1,000 Borrowed) Interest Rate (%) 3.0 15 $6.9058 7.1488 7.3969 3.5 4.0 4.5 5.0 7.6499 7.9079 Payment Period (Years) 20 25 $5.5460 $4.7421 5.7996 5.0062 6.0598 5.2783 6.3265 5.5583 6.5996 5.8459 6.8789 6.1409 7.1643 6.4430 7.4557 6.7521 7.7530 7.0678 8.0559 7.3899 8.3644 7.7182 30 $4.2160 4.4904 4.7742 5.0669 5.3682 5.6779 5.9955 6.3207 6.6530 6.9921 7.3376 8.1708 5.5 6.0 8.4386 6.5 7.0 8.7111 8.9883 9.2701 9.5565 7.5 8.0 Your Figures Example $908 827 81 4 4,175 Decision Factors 1. Current monthly payment 2. New monthly payment 3. Monthly savings (line 1 - line 2) 4. Additional years you expect to live in the house 5. Future value of an account balance after 4 years if the monthly savings were invested at 3% after taxes (using the calculator on the Garman/Forgue companion website) 6. Prepayment penalty on current loan (0%) 7. Points and fees for new loan (2%) 8. Future value of an account balance after 4 years if the prepayment penalty and closing costs ($4,263) had been invested instead at 3% after taxes (using the calculator on the Garman/Forgue companion website) 9. Net saving after 48 months (line 5 - line 8) 0 2,842 3,198 $977

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started