Answered step by step

Verified Expert Solution

Question

1 Approved Answer

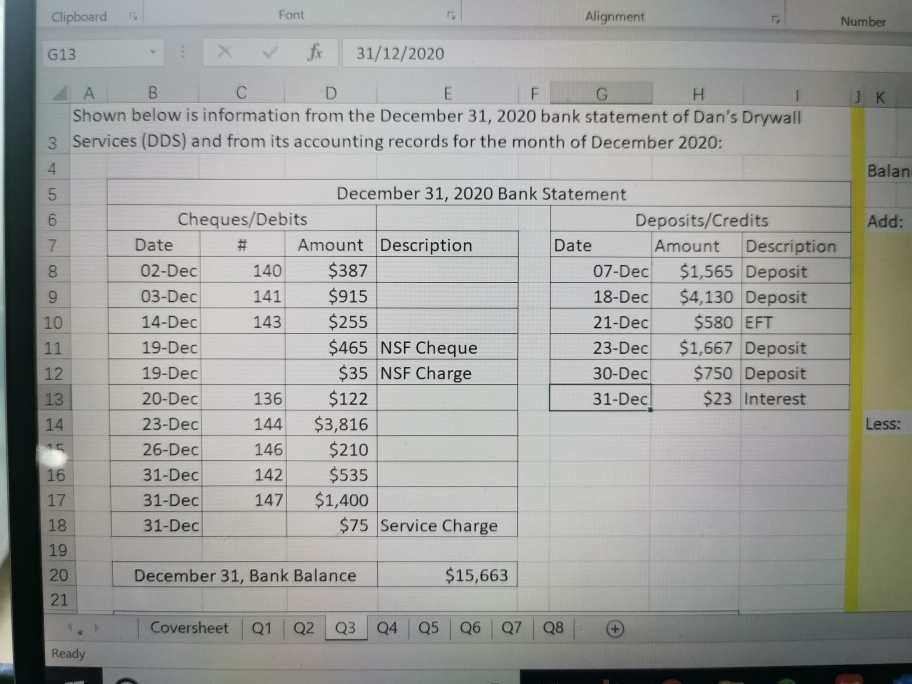

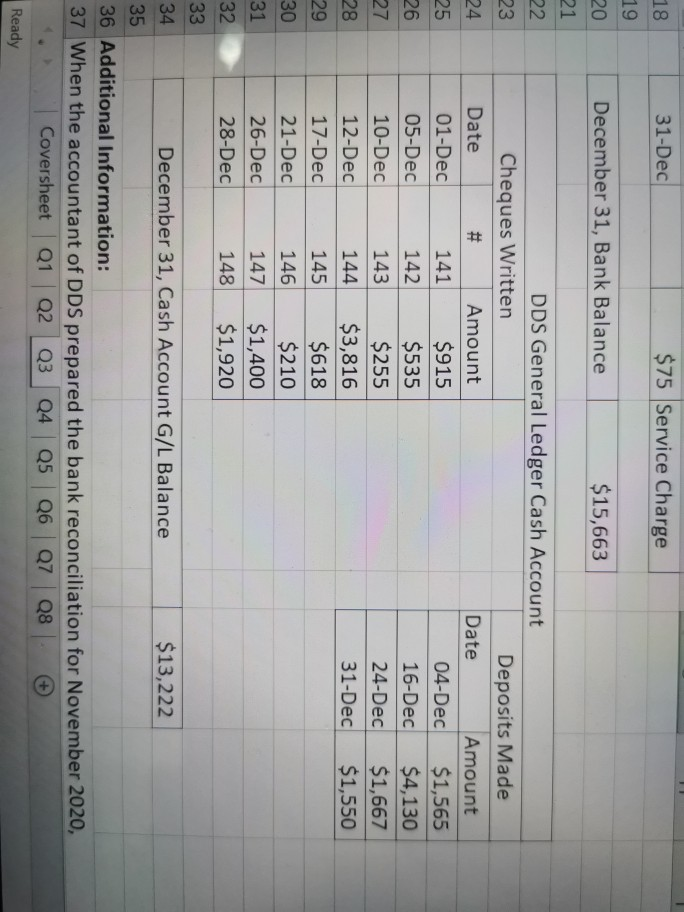

Clipboard Font Alignment Number G13 - X V fi 31/12/2020 A B C D E F G H I Shown below is information from the

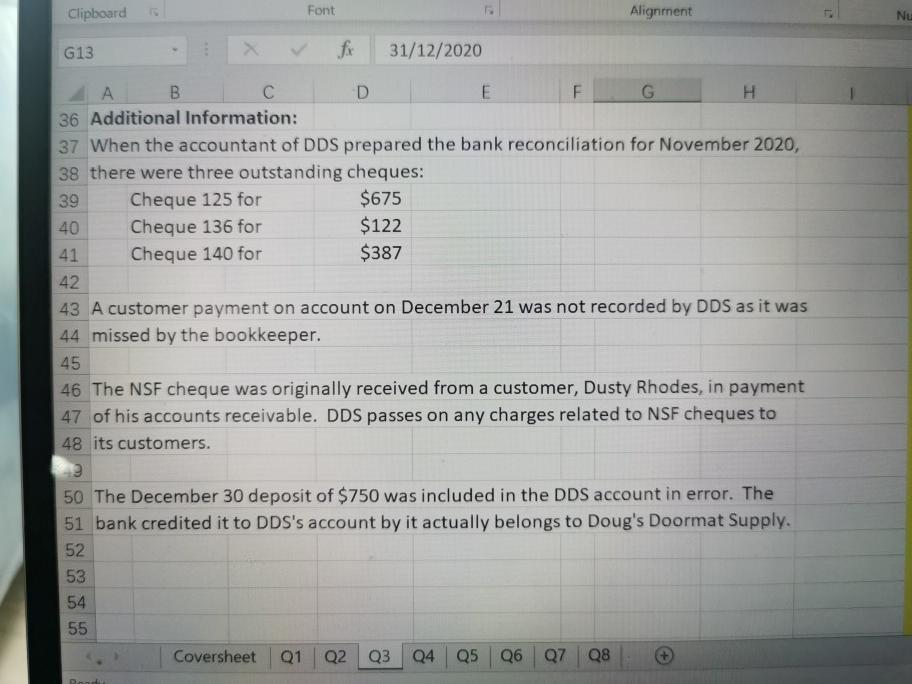

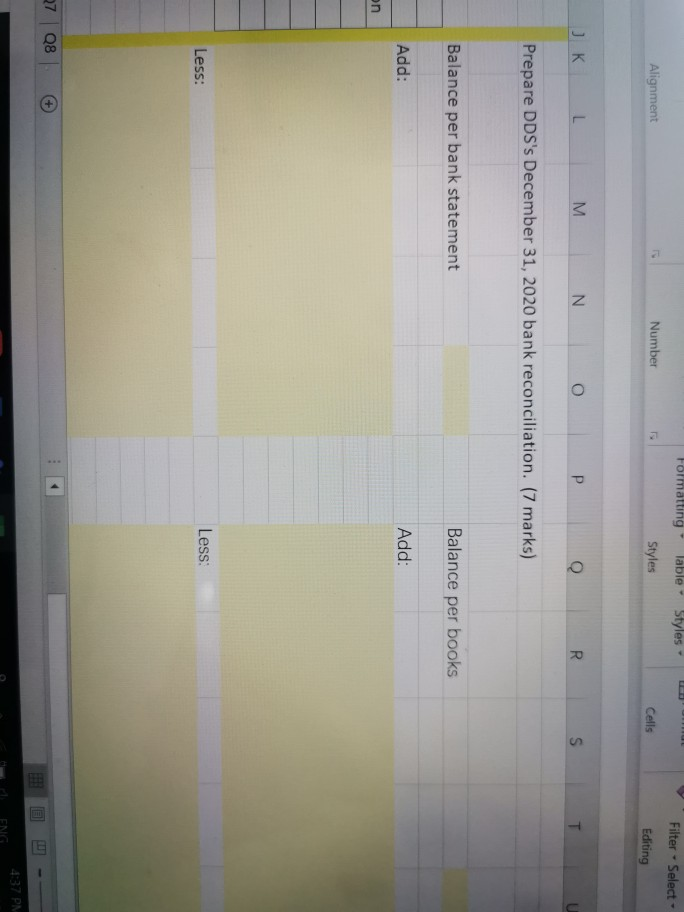

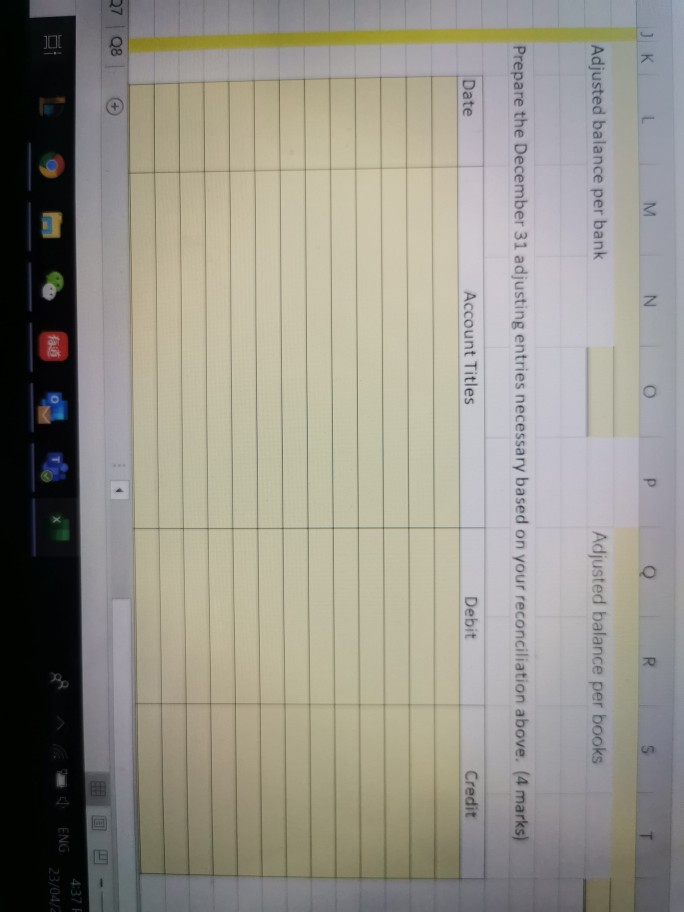

Clipboard Font Alignment Number G13 - X V fi 31/12/2020 A B C D E F G H I Shown below is information from the December 31, 2020 bank statement of Dan's Drywall 3 Services (DDS) and from its accounting records for the month of December 2020: JK Balan Add: Date December 31, 2020 Bank Statement Cheques/Debits Deposits/Credits # Amount Description Date Amount Description 02-Dec 140 $387 07-Dec $1,565 Deposit 03-Dec 141 $915 18-Dec $4,130 Deposit 14-Dec 143 $255 21-Dec $580 EFT 19-Dec $465 NSF Cheque 23-Dec $1,667 Deposit 19-Dec $35 NSF Charge 30-Dec $750 Deposit 20-Dec 136 $122 31-Dec $23 Interest 23-Dec 144 $3,816 26-Dec 146 $210 31-Dec 142 $535 31-Dec 147 $1,400 31-Dec $75 Service Charge Less: December 31, Bank Balance $15,663 Coversheet 01 02 03 04 05 06 07 08 Ready 18 31-Dec $75 Service Charge 79 20 December 31, Bank Balance $15,663 22 23 24 25 26 27 DDS General Ledger Cash Account Cheques Written Deposits Made Date # Amount Date Amount 01-Dec 141 $915 04-Dec $1,565 05-Dec 142 $535 16-Dec $4,130 10-Dec 143 $255 24-Dec $1,667 12-Dec 144 $3,816 31-Dec $1,550 17-Dec 145 $618 21-Dec 146 $210 26-Dec 147 $1,400 28-Dec 148 $1,920 28 29 30 31 32 33 December 31, Cash Account G/L Balance $13,222 34 35 36 Additional Information: 37 When the accountant of DDS prepared the bank reconciliation for November 2020, Coversheet Q1 Q2 Q3 Q4 25 26 27 28 Ready Clipboard Font Alignment Nu G13 for 31/12/2020 2 40 A B C D F G H 36 Additional Information: 37 When the accountant of DDS prepared the bank reconciliation for November 2020, 38 there were three outstanding cheques: Cheque 125 for $675 Cheque 136 for $122 41 Cheque 140 for $387 42 43 A customer payment on account on December 21 was not recorded by DDS as it was 44 missed by the bookkeeper. 45 46 The NSF cheque was originally received from a customer, Dusty Rhodes, in payment 47 of his accounts receivable. DDS passes on any charges related to NSF cheques to 48 its customers. 50 The December 30 deposit of $750 was included in the DDS account in error. The 51 bank credited it to DDS's account by it actually belongs to Doug's Doormat Supply. 52 Coversheet Q1 Q2 Q3 Q4 05 06 07 08 D. Formatting Table Styles Alignment Number Styles Filter Select Editing Cells J K L M N O P Q R S T Prepare DDS's December 31, 2020 bank reconciliation. (7 marks) Balance per bank statement Balance per books Add: Add: Less: Less: 27 08 + 437 PM FNG J K L No POR S T Adjusted balance per bank Adjusted balance per books Prepare the December 31 adjusting entries necessary based on your reconciliation above. (4 marks) Date Account Titles Debit Credit 27 28 ENG 437 F 23/04/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started