Answered step by step

Verified Expert Solution

Question

1 Approved Answer

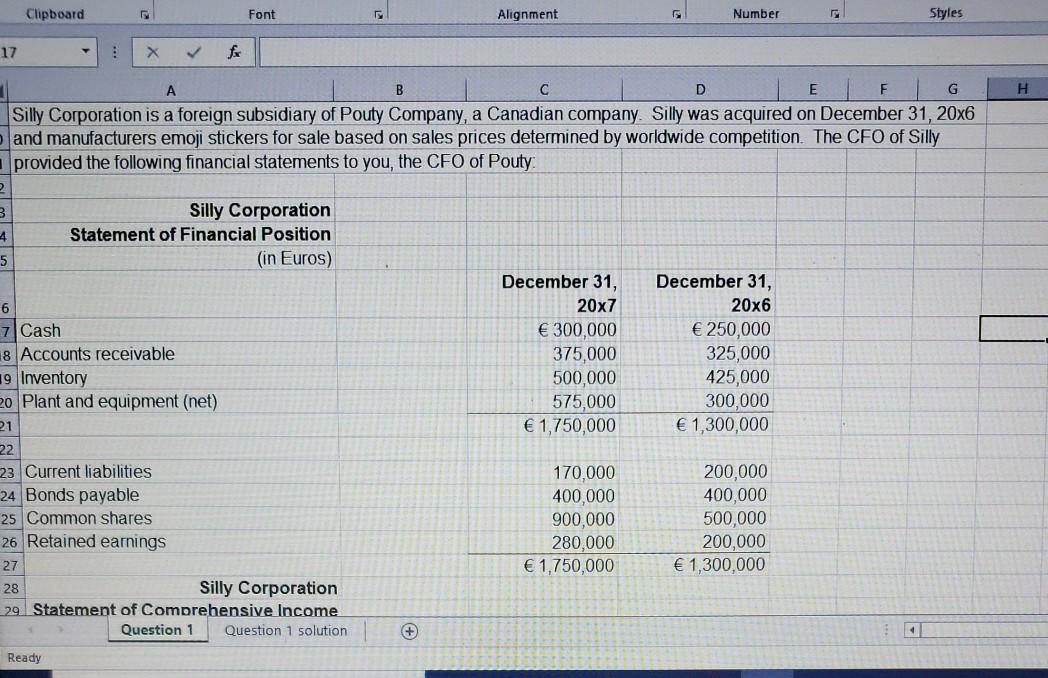

Clipboard Font Alignment Number Styles 17 fo A B D F G H Silly Corporation is a foreign subsidiary of Pouty Company, a Canadian company.

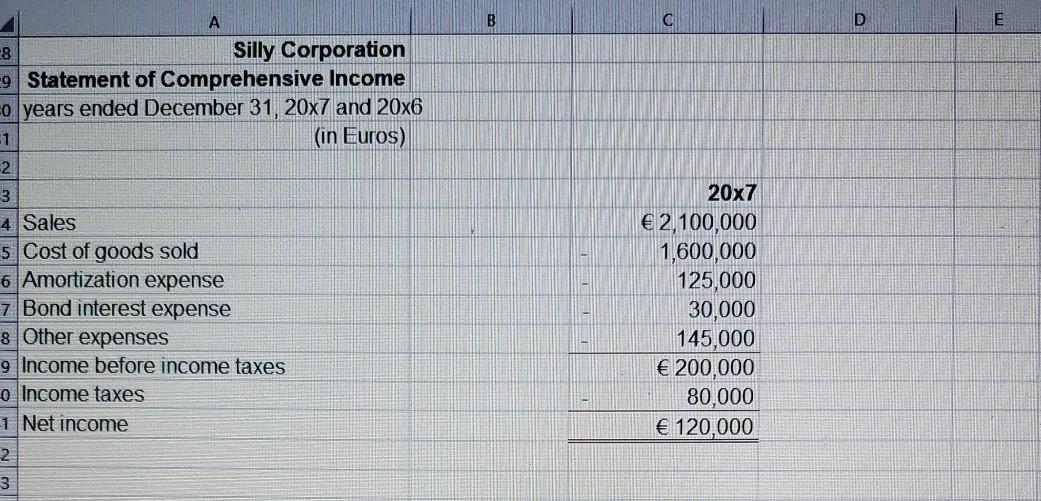

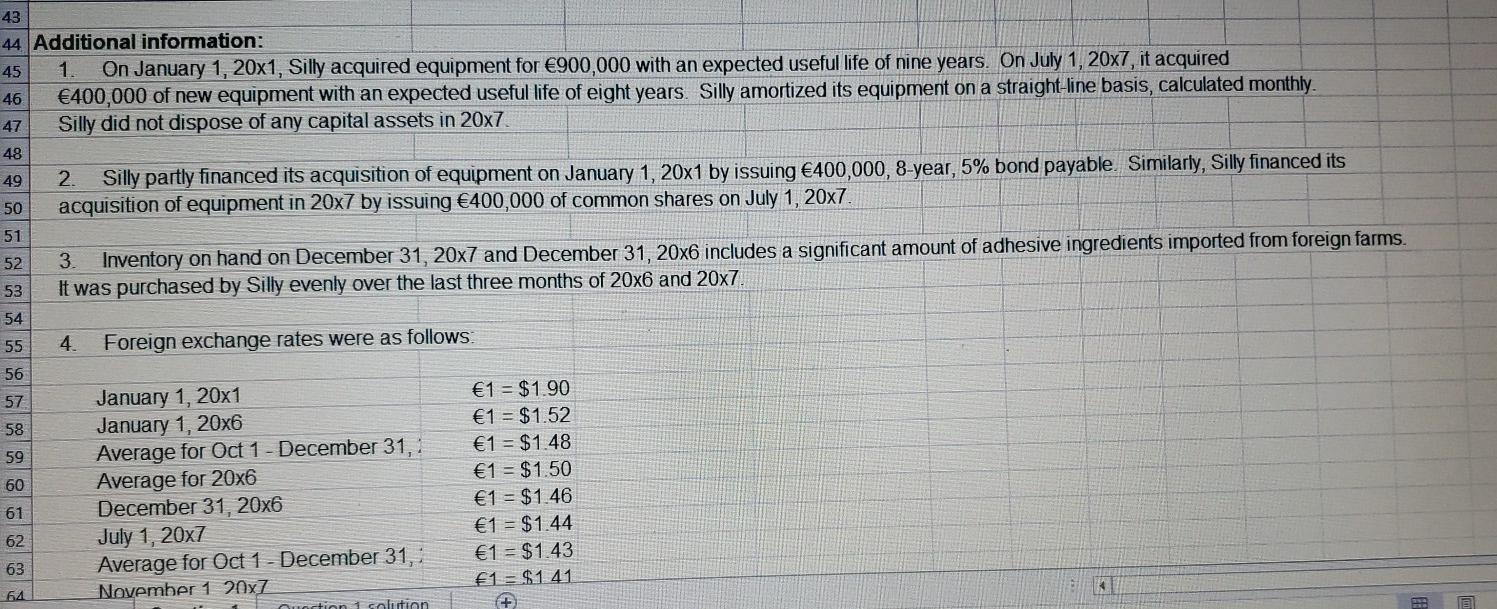

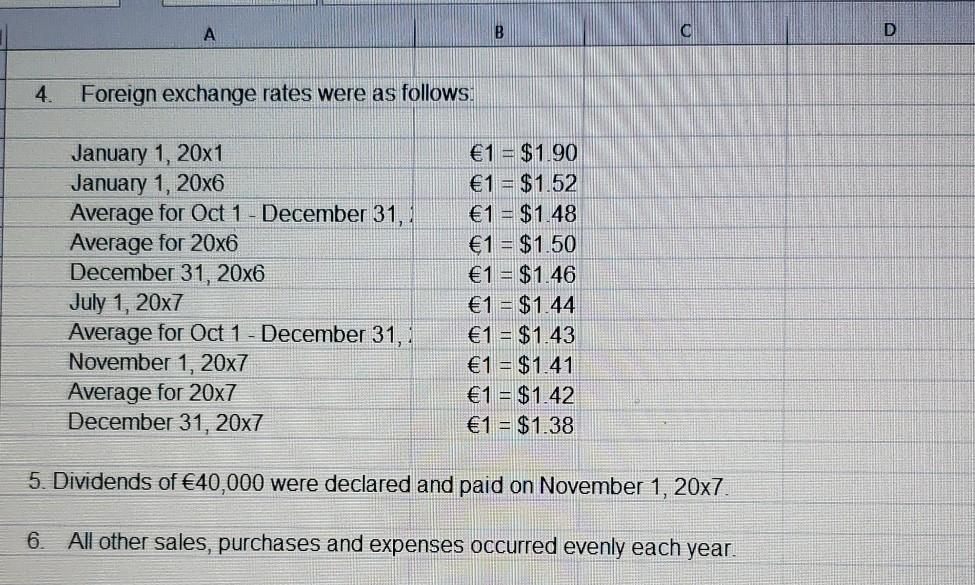

Clipboard Font Alignment Number Styles 17 fo A B D F G H Silly Corporation is a foreign subsidiary of Pouty Company, a Canadian company. Silly was acquired on December 31, 20x6 and manufacturers emoji stickers for sale based on sales prices determined by worldwide competition. The CFO of Silly provided the following financial statements to you, the CFO of Pouty 3 4 Silly Corporation Statement of Financial Position (in Euros) 5 6 7 Cash 18 Accounts receivable 19 Inventory 20 Plant and equipment (net) December 31, 20x7 300,000 375,000 500,000 575,000 1,750,000 December 31, 20x6 250,000 325,000 425,000 300,000 1,300,000 21 22 23 Current liabilities 24 Bonds payable 25 Common shares 26 Retained earnings 170,000 400,000 900,000 280,000 1.750,000 200,000 400,000 500,000 200,000 1,300,000 27 28 Silly Corporation 29 Statement of Comprehensive Income Question 1 Question 1 solution # Ready A B D E 8 Silly Corporation 9 Statement of Comprehensive Income 0 years ended December 31, 20x7 and 20x6 (in Euros) 1 2 3 20x7 4 Sales 5 Cost of goods sold 6 Amortization expense 7 Bond interest expense 8 Other expenses 9 Income before income taxes o Income taxes 1 Net income 2,100,000 1,600,000 125,000 30,000 145,000 200,000 80,000 120,000 2 3 43 45 44 Additional information: 1. On January 1, 20x1, Silly acquired equipment for 900,000 with an expected useful life of nine years. On July 1, 20x7, it acquired 400,000 of new equipment with an expected useful life of eight years. Silly amortized its equipment on a straight-line basis, calculated monthly Silly did not dispose of any capital assets in 20x7 46 47 48 49 2. Silly partly financed its acquisition of equipment on January 1, 20x1 by issuing 400,000, 8-year, 5% bond payable. Similarly, Silly financed its acquisition of equipment in 20x7 by issuing 400,000 of common shares on July 1, 20x7 50 51 52 3 Inventory on hand on December 31, 20x7 and December 31, 20x6 includes a significant amount of adhesive ingredients imported from foreign farms. It was purchased by Silly evenly over the last three months of 20x6 and 20x7. 53 54 55 4 Foreign exchange rates were as follows: 56 57 58 59 60 January 1, 20x1 January 1, 20x6 Average for Oct 1 - December 31, Average for 20x6 December 31, 20x6 July 1, 20x7 Average for Oct 1 - December 31, November 1 20x7 nortinn 1 solution 1 = $1.90 1 = $1.52 1 = $1.48 1 = $1.50 1 = $1.46 1 = $1.44 1 = $1.43 1 = $1.41 + 61 62 63 64 B D 4. Foreign exchange rates were as follows: January 1, 20x1 January 1, 20x6 Average for Oct 1 - December 31, Average for 20x6 December 31, 20x6 July 1, 20x7 Average for Oct 1 - December 31, 1 November 1, 20x7 Average for 20x7 December 31, 20x7 1 = $1.90 1 = $1.52 1 = $1.48 1 = $1.50 1 = $1.46 1 = $1.44 1 = $1.43 1 = $1.41 1 = $1.42 1 = $1.38 5. Dividends of 40,000 were declared and paid on November 1, 20x7. 6. All other sales, purchases and expenses occurred evenly each year. Clipboard Font Alignment Number Styles 17 fo A B D F G H Silly Corporation is a foreign subsidiary of Pouty Company, a Canadian company. Silly was acquired on December 31, 20x6 and manufacturers emoji stickers for sale based on sales prices determined by worldwide competition. The CFO of Silly provided the following financial statements to you, the CFO of Pouty 3 4 Silly Corporation Statement of Financial Position (in Euros) 5 6 7 Cash 18 Accounts receivable 19 Inventory 20 Plant and equipment (net) December 31, 20x7 300,000 375,000 500,000 575,000 1,750,000 December 31, 20x6 250,000 325,000 425,000 300,000 1,300,000 21 22 23 Current liabilities 24 Bonds payable 25 Common shares 26 Retained earnings 170,000 400,000 900,000 280,000 1.750,000 200,000 400,000 500,000 200,000 1,300,000 27 28 Silly Corporation 29 Statement of Comprehensive Income Question 1 Question 1 solution # Ready A B D E 8 Silly Corporation 9 Statement of Comprehensive Income 0 years ended December 31, 20x7 and 20x6 (in Euros) 1 2 3 20x7 4 Sales 5 Cost of goods sold 6 Amortization expense 7 Bond interest expense 8 Other expenses 9 Income before income taxes o Income taxes 1 Net income 2,100,000 1,600,000 125,000 30,000 145,000 200,000 80,000 120,000 2 3 43 45 44 Additional information: 1. On January 1, 20x1, Silly acquired equipment for 900,000 with an expected useful life of nine years. On July 1, 20x7, it acquired 400,000 of new equipment with an expected useful life of eight years. Silly amortized its equipment on a straight-line basis, calculated monthly Silly did not dispose of any capital assets in 20x7 46 47 48 49 2. Silly partly financed its acquisition of equipment on January 1, 20x1 by issuing 400,000, 8-year, 5% bond payable. Similarly, Silly financed its acquisition of equipment in 20x7 by issuing 400,000 of common shares on July 1, 20x7 50 51 52 3 Inventory on hand on December 31, 20x7 and December 31, 20x6 includes a significant amount of adhesive ingredients imported from foreign farms. It was purchased by Silly evenly over the last three months of 20x6 and 20x7. 53 54 55 4 Foreign exchange rates were as follows: 56 57 58 59 60 January 1, 20x1 January 1, 20x6 Average for Oct 1 - December 31, Average for 20x6 December 31, 20x6 July 1, 20x7 Average for Oct 1 - December 31, November 1 20x7 nortinn 1 solution 1 = $1.90 1 = $1.52 1 = $1.48 1 = $1.50 1 = $1.46 1 = $1.44 1 = $1.43 1 = $1.41 + 61 62 63 64 B D 4. Foreign exchange rates were as follows: January 1, 20x1 January 1, 20x6 Average for Oct 1 - December 31, Average for 20x6 December 31, 20x6 July 1, 20x7 Average for Oct 1 - December 31, 1 November 1, 20x7 Average for 20x7 December 31, 20x7 1 = $1.90 1 = $1.52 1 = $1.48 1 = $1.50 1 = $1.46 1 = $1.44 1 = $1.43 1 = $1.41 1 = $1.42 1 = $1.38 5. Dividends of 40,000 were declared and paid on November 1, 20x7. 6. All other sales, purchases and expenses occurred evenly each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started