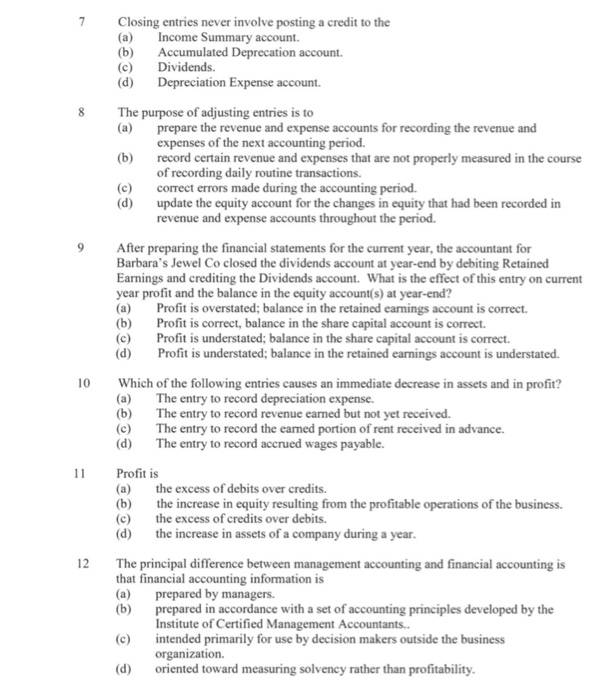

Closing entries never involve posting a credit to the (a) Income Summary account. (b) Accumulated Deprecation account. (c) Dividends. Depreciation Expense account The purpose of adjusting entries is to (a) prepare the revenue and expense accounts for recording the revenue and expenses of the next accounting period. (b) record certain revenue and expenses that are not properly measured in the course of recording daily routine transactions. (c) correct errors made during the accounting period. update the equity account for the changes in equity that had been recorded in revenue and expense accounts throughout the period. After preparing the financial statements for the current year, the accountant for Barbara's Jewel Co closed the dividends account at year-end by debiting Retained Earnings and crediting the Dividends account. What is the effect of this entry on current year profit and the balance in the equity account(s) at year-end? (a) Profit is overstated; balance in the retained earnings account is correct. (b) Profit is correct, balance in the share capital account is correct. (c) Profit is understated; balance in the share capital account is correct. Profit is understated; balance in the retained earnings account is understated. Which of the following entries causes an immediate decrease in assets and in profit? (a) The entry to record depreciation expense. (b) The entry to record revenue earned but not yet received. (c) The entry to record the earned portion of rent received in advance. (d) The entry to record accrued wages payable. Profit is (a) the excess of debits over credits. (b) the increase in equity resulting from the profitable operations of the business. (c) the excess of credits over debits. (d) the increase in assets of a company during a year. 12 (b) The principal difference between management accounting and financial accounting is that financial accounting information is (a) prepared by managers. prepared in accordance with a set of accounting principles developed by the Institute of Certified Management Accountants.. intended primarily for use by decision makers outside the business organization. oriented toward measuring solvency rather than profitability