Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CNN Berhad issued new bonds in 2009 with par value of RM1,000, 12 percent coupon rate and 10 years maturity period and payments are

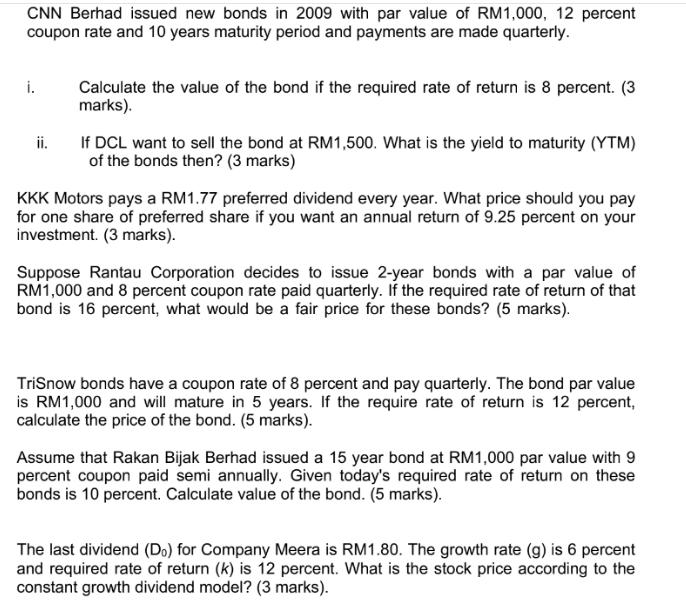

CNN Berhad issued new bonds in 2009 with par value of RM1,000, 12 percent coupon rate and 10 years maturity period and payments are made quarterly. i. ii. Calculate the value of the bond if the required rate of return is 8 percent. (3 marks). If DCL want to sell the bond at RM1,500. What is the yield to maturity (YTM) of the bonds then? (3 marks) KKK Motors pays a RM1.77 preferred dividend every year. What price should you pay for one share of preferred share if you want an annual return of 9.25 percent on your investment. (3 marks). Suppose Rantau Corporation decides to issue 2-year bonds with a par value of RM1,000 and 8 percent coupon rate paid quarterly. If the required rate of return of that bond is 16 percent, what would be a fair price for these bonds? (5 marks). TriSnow bonds have a coupon rate of 8 percent and pay quarterly. The bond par value is RM1,000 and will mature in 5 years. If the require rate of return is 12 percent, calculate the price of the bond. (5 marks). Assume that Rakan Bijak Berhad issued a 15 year bond at RM1,000 par value with 9 percent coupon paid semi annually. Given today's required rate of return on these bonds is 10 percent. Calculate value of the bond. (5 marks). The last dividend (Do) for Company Meera is RM1.80. The growth rate (g) is 6 percent and required rate of return (k) is 12 percent. What is the stock price according to the constant growth dividend model? (3 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ill provide the answers to your questions step by step Question 1 Calculate the value of the bond if the required rate of return is 8 percent To calculate the value of the bond you can use the formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started