Question

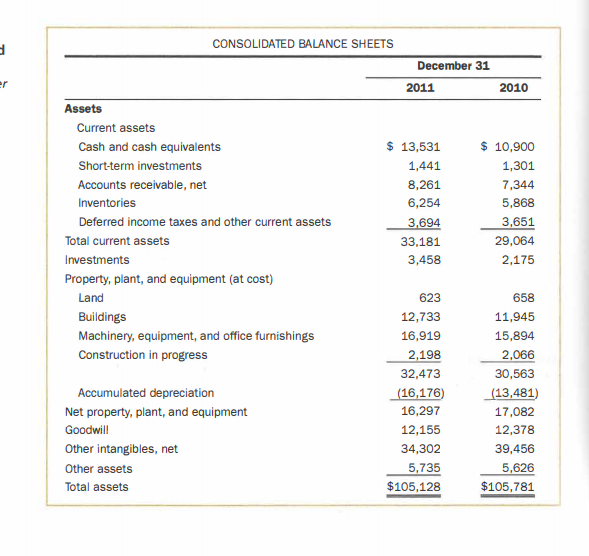

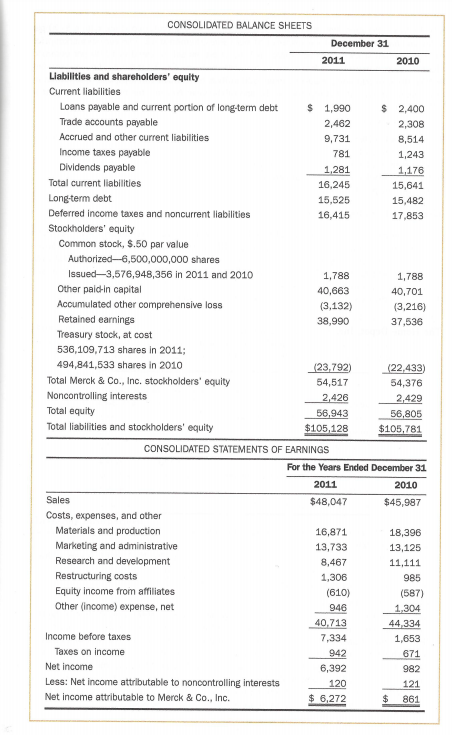

Co., Inc., the global pharmaceutical company, included the income statements and balance sheets in Exhibit 12-12 in its 2011 annual report. Additional information includes the

Co., Inc., the global pharmaceutical company, included the income statements and balance sheets in Exhibit 12-12 in its 2011 annual report. Additional information includes the following:

Average common shares outstanding of 3,071 million in 2011

Market price per share of $37.70 at December 30, 2011, the last trading day before its fiscal year-end of December 31, 2011

Dividends of $1.56 per share were paid on common stock during 2011

Interest expense in 2011 was $749 million

Compute the following ratios for 2011:

1. Current ratio

2. Quick ratio (use current assets - inventories as the numerator)

3. Average collection period (assume all sales are on credit)

4. Total-debt-to-total-assets (define total debt as total liabilities)

5. Total-debt-to-equity (define total debt as total liabilities)

6. Return on common stockholders' equity

7. Gross profit rate

8. Return on sales

9. Total asset turnover

10. Return on assets (defined as EBIT divided by average total assets)

11. EPS (basic)

12. P-E ratio

13. Dividend-yield ratio (for common stock)

14. Dividend-payout ratio (for common stock)

15. Market-to-book value

15. Market-to-book value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started