Answered step by step

Verified Expert Solution

Question

1 Approved Answer

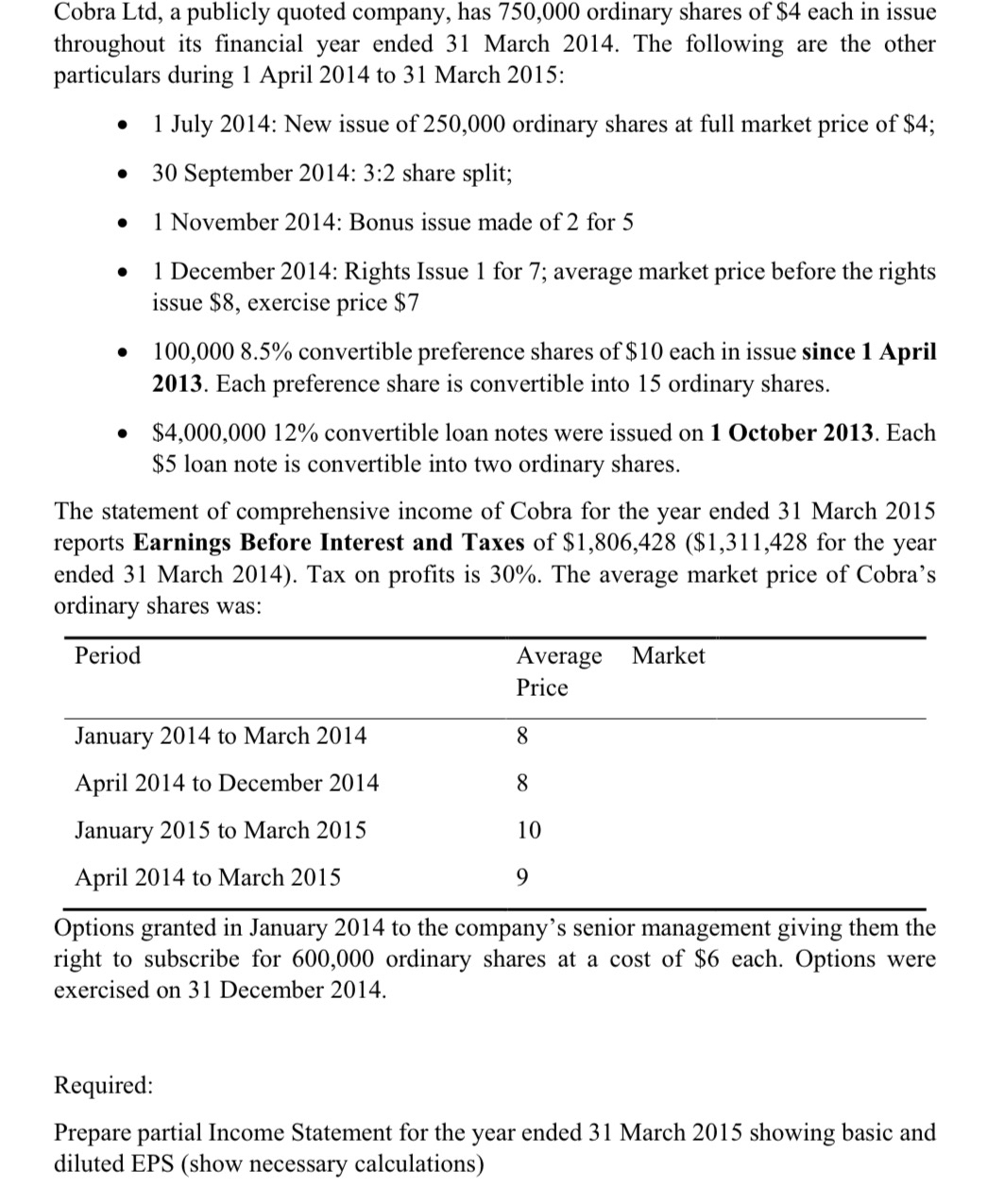

Cobra Ltd , a publicly quoted company, has 7 5 0 , 0 0 0 ordinary shares of $ 4 each in issue throughout its

Cobra Ltd a publicly quoted company, has ordinary shares of $ each in issue

throughout its financial year ended March The following are the other

particulars during April to March :

July : New issue of ordinary shares at full market price of $;

September : : share split;

November : Bonus issue made of for

December : Rights Issue for ; average market price before the rights

issue $ exercise price $

convertible preference shares of $ each in issue since April

Each preference share is convertible into ordinary shares.

$ convertible loan notes were issued on October Each

$ loan note is convertible into two ordinary shares.

The statement of comprehensive income of Cobra for the year ended March

reports Earnings Before Interest and Taxes of $$ for the year

ended March Tax on profits is The average market price of Cobra's

ordinary shares was:

Options granted in January to the company's senior management giving them the

right to subscribe for ordinary shares at a cost of $ each. Options were

exercised on December

Required:

Prepare partial Income Statement for the year ended March showing basic and

diluted EPS show necessary calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started