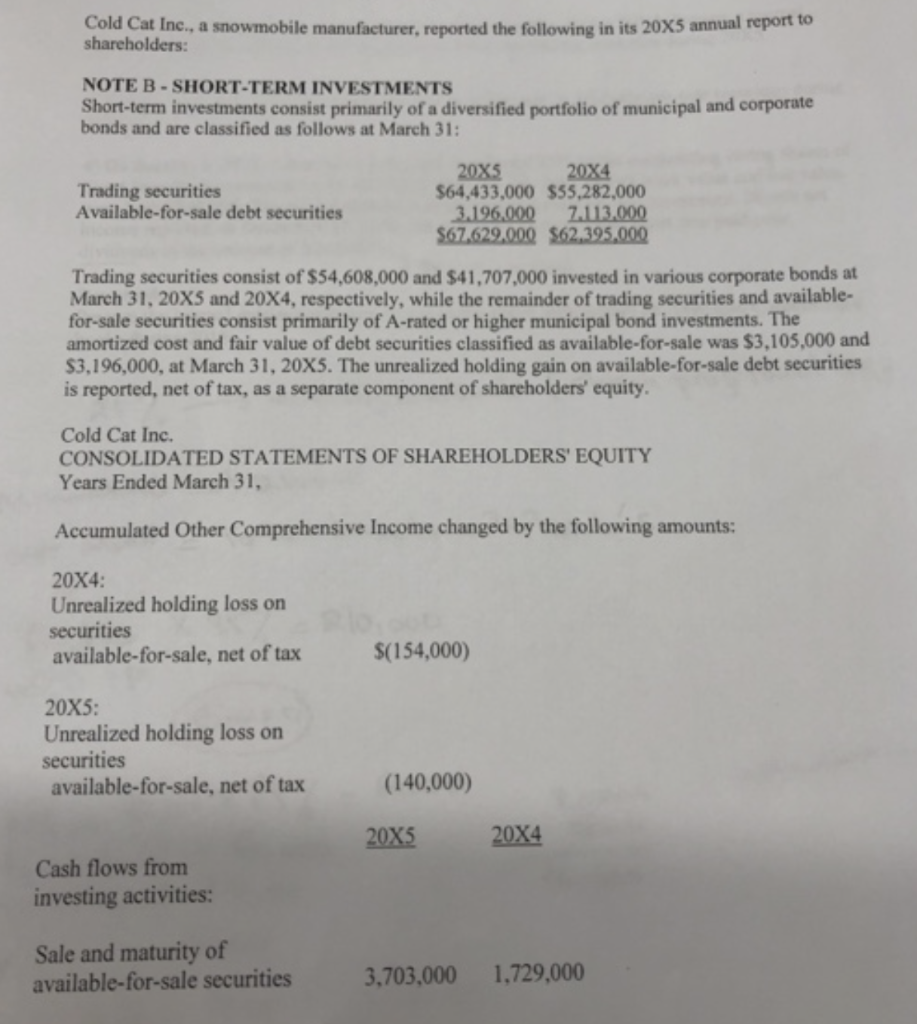

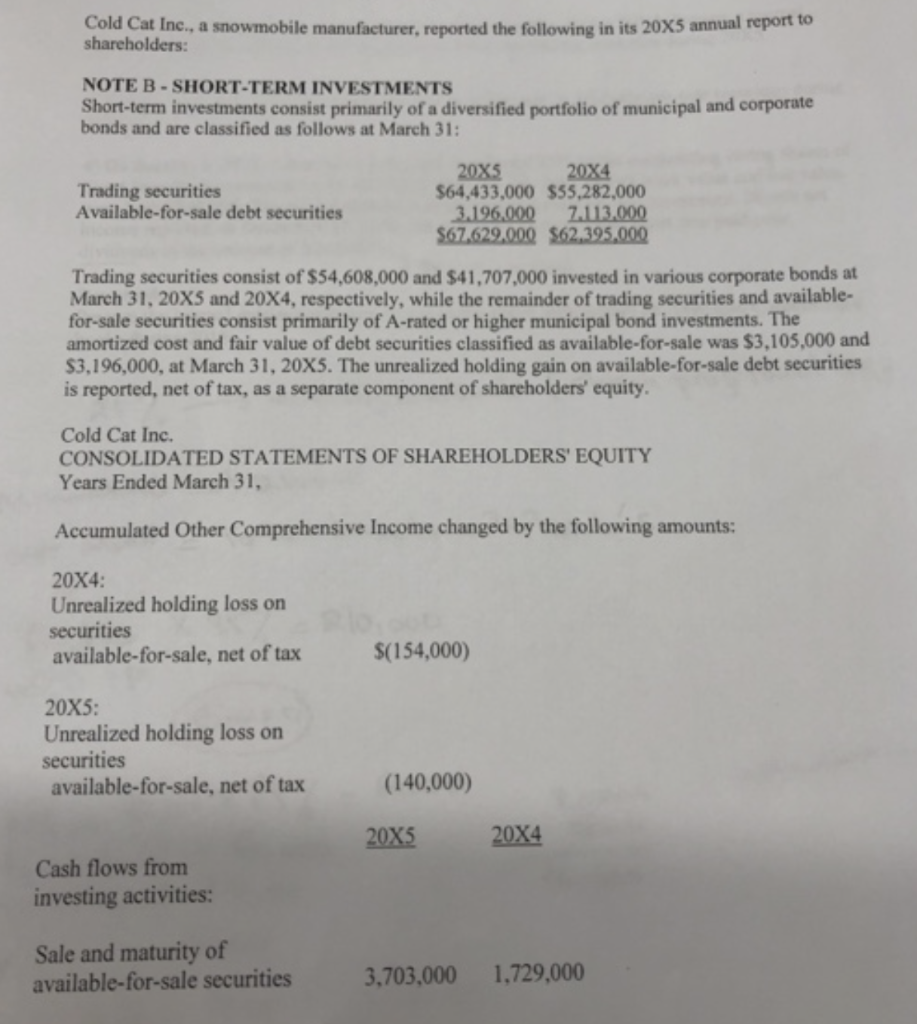

Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual repon shareholders: NOTE B - SHORT-TERM INVESTMENTS Short-term investments consist primarily of a diversified nortfolio of municipal and corporate bonds and are classified as follows at March 31: Trading securities Available-for-sale debt securities 20x5 20X4 $64,433,000 $55,282,000 3.196.000 7.113.000 $67.629,000 $62.395,000 Trading securities consist of $54,608,000 and $41.707.000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available- for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3.105.000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity Cold Cat Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Years Ended March 31, Accumulated Other Comprehensive Income changed by the following amounts: 20x4: Unrealized holding loss on securities available-for-sale, net of tax $(154,000) 20x5: Unrealized holding loss on securities available-for-sale, net of tax (140,000) 20X5 20x4 Cash flows from investing activities: Sale and maturity of available-for-sale securities 3,703,000 1.729.000 Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual repon shareholders: NOTE B - SHORT-TERM INVESTMENTS Short-term investments consist primarily of a diversified nortfolio of municipal and corporate bonds and are classified as follows at March 31: Trading securities Available-for-sale debt securities 20x5 20X4 $64,433,000 $55,282,000 3.196.000 7.113.000 $67.629,000 $62.395,000 Trading securities consist of $54,608,000 and $41.707.000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available- for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3.105.000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity Cold Cat Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Years Ended March 31, Accumulated Other Comprehensive Income changed by the following amounts: 20x4: Unrealized holding loss on securities available-for-sale, net of tax $(154,000) 20x5: Unrealized holding loss on securities available-for-sale, net of tax (140,000) 20X5 20x4 Cash flows from investing activities: Sale and maturity of available-for-sale securities 3,703,000 1.729.000