Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help completing the last few numbers of the Geary Company's Statement of Cash Flows using the Geary Companys income statement and comparative balance sheets

Need help completing the last few numbers of the Geary Company's Statement of Cash Flows using the Geary Companys income statement and comparative balance sheets as of December 31 of the current and previous year.

Need help completing the last few numbers of the Geary Company's Statement of Cash Flows using the Geary Companys income statement and comparative balance sheets as of December 31 of the current and previous year.

I solved more of the question. I just need help with the remaining wrong answers.

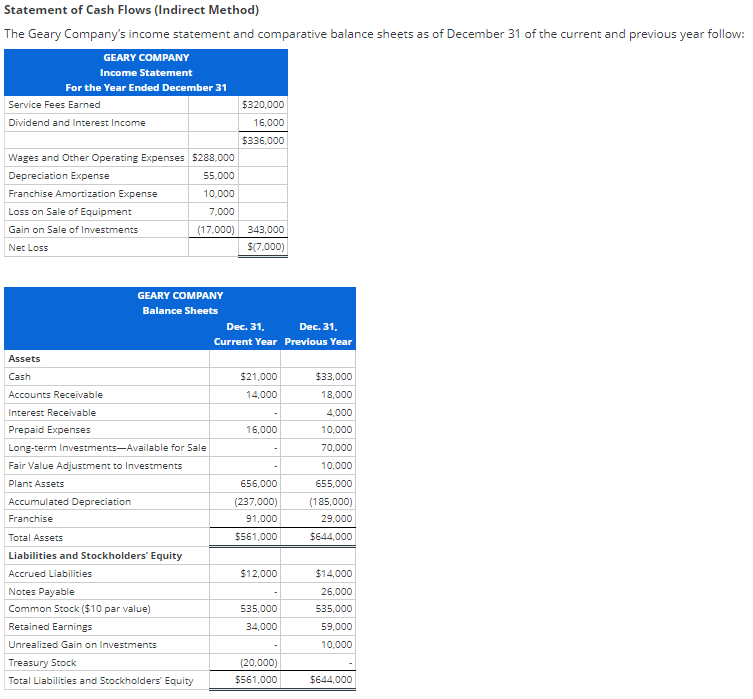

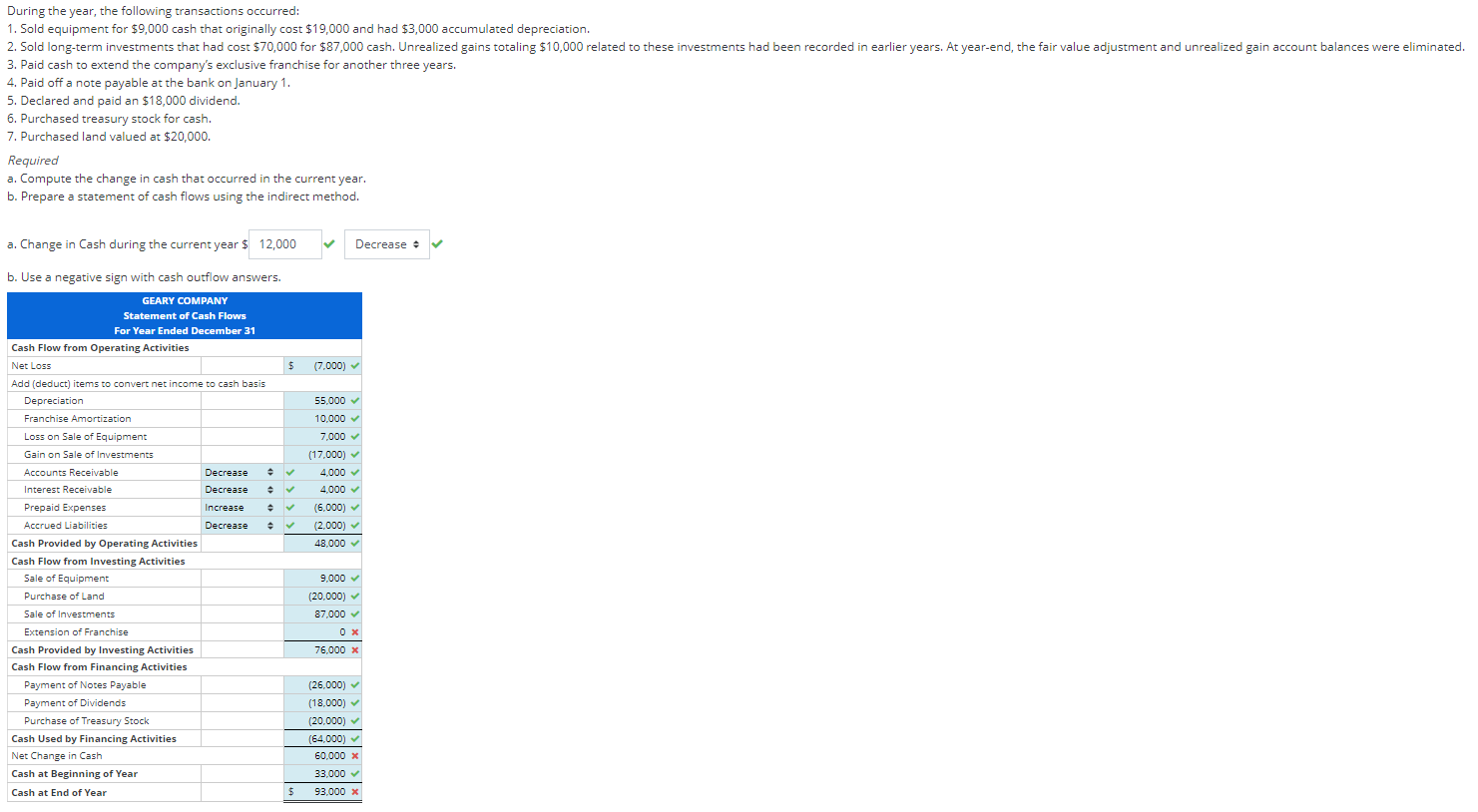

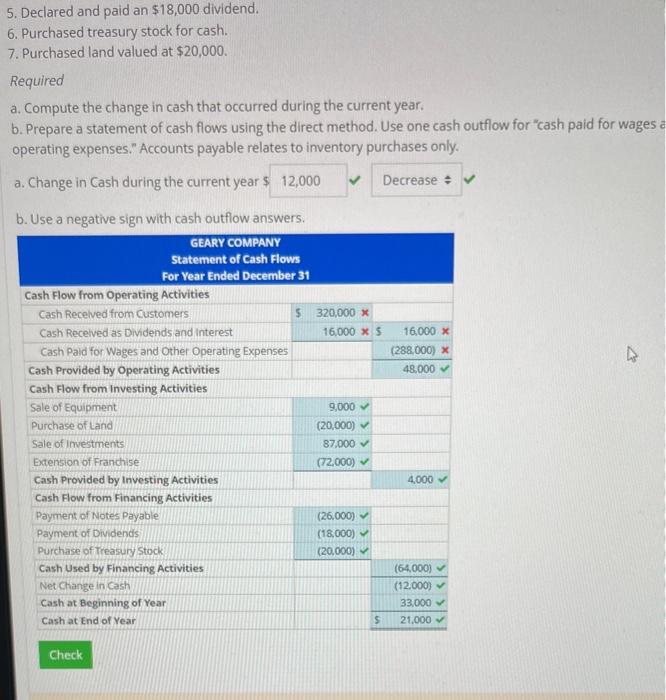

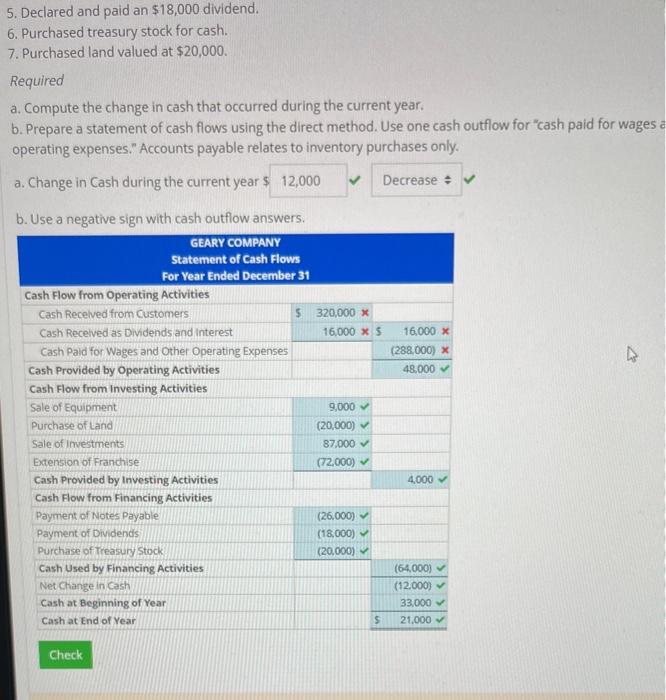

Statement of Cash Flows (Indirect Method) The Geary Company's income statement and comparative balance sheets as of December 31 of the current and previous year follow: During the year, the following transactions occurred: 1. Sold equipment for $9,000 cash that originally cost $19,000 and had $3,000 accumulated depreciation. 3. Paid cash to extend the company's exclusive franchise for another three years. 4. Paid off a note payable at the bank on January 1. 5. Declared and paid an $18,000 dividend. 6. Purchased treasury stock for cash. 7. Purchased land valued at $20,000. Required a. Compute the change in cash that occurred in the current year. b. Prepare a statement of cash flows using the indirect method. 5. Declared and paid an $18,000 dividend. 6. Purchased treasury stock for cash. 7. Purchased land valued at $20,000. Required a. Compute the change in cash that occurred during the current year. b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid for wages operating expenses." Accounts payable relates to inventory purchases only. a. Change in Cash during the current year $ b. Use a negative sign with cash outflow answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started