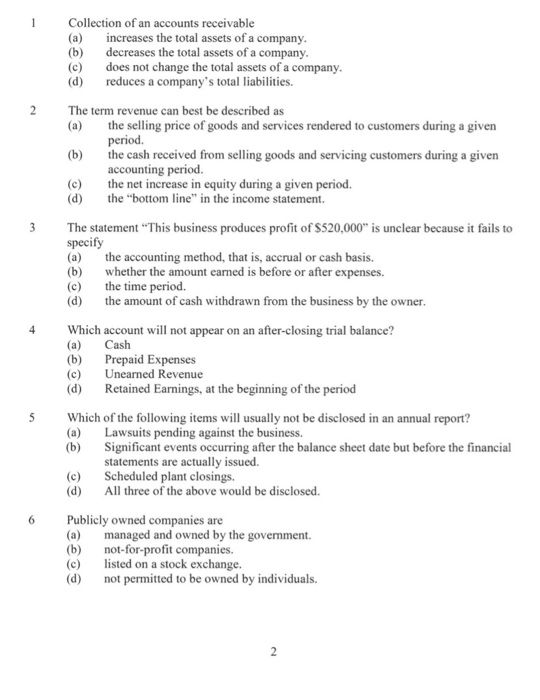

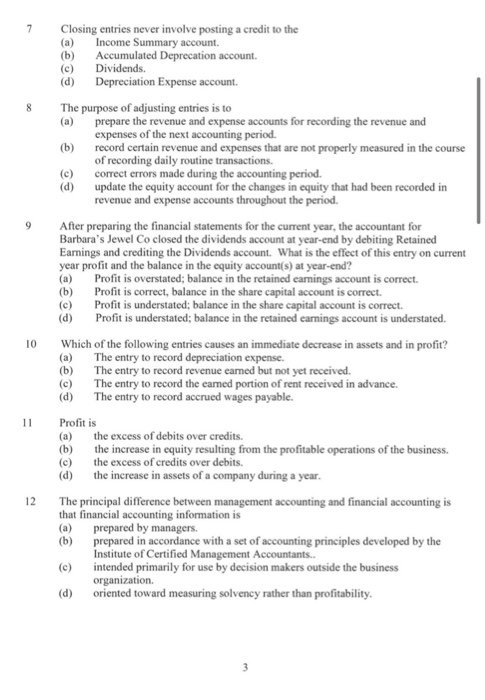

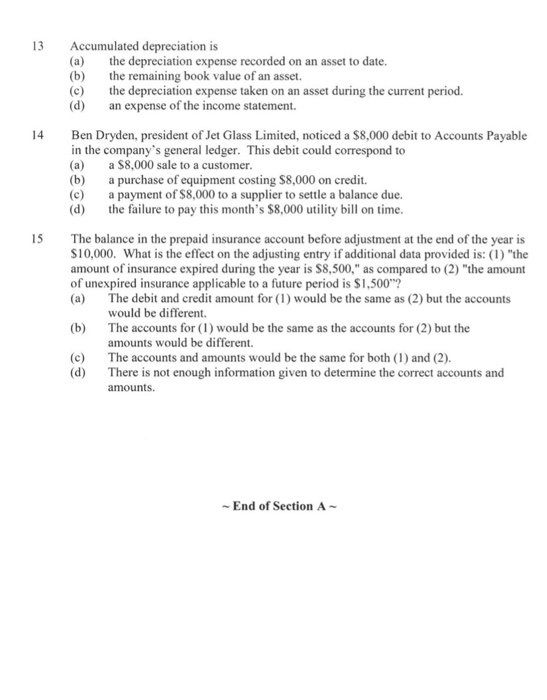

Collection of an accounts receivable (a) increases the total assets of a company. (b) decreases the total assets of a company. does not change the total assets of a company. reduces a company's total liabilities. (c) The term revenue can best be described as the selling price of goods and services rendered to customers during a given period. (b) the cash received from selling goods and servicing customers during a given accounting period. the net increase in equity during a given period. (d) the "bottom line" in the income statement. 3 The statement "This business produces profit of $520,000" is unclear because it fails to specify (a) the accounting method, that is, accrual or cash basis. (b) whether the amount earned is before or after expenses. (c) the time period. (d) the amount of cash withdrawn from the business by the owner. Which account will not appear on an after-closing trial balance? (a) Cash (b) Prepaid Expenses (c) Unearned Revenue (d) Retained Earnings, at the beginning of the period (b) Which of the following items will usually not be disclosed in an annual report? Lawsuits pending against the business. Significant events occurring after the balance sheet date but before the financial statements are actually issued. Scheduled plant closings. All three of the above would be disclosed. Publicly owned companies are (a) managed and owned by the government. (b) not-for-profit companies. (c) listed on a stock exchange. (d) not permitted to be owned by individuals. Closing entries never involve posting a credit to the (a) Income Summary account. (b) Accumulated Deprecation account. (c) Dividends. Depreciation Expense account. The purpose of adjusting entries is to prepare the revenue and expense accounts for recording the revenue and expenses of the next accounting period. record certain revenue and expenses that are not properly measured in the course of recording daily routine transactions correct errors made during the accounting period. (d) update the equity account for the changes in equity that had been recorded in revenue and expense accounts throughout the period (c) After preparing the financial statements for the current year, the accountant for Barbara's Jewel Co closed the dividends account at year-end by debiting Retained Earnings and crediting the Dividends account. What is the effect of this entry on current year profit and the balance in the equity account(s) at year-end? (a) Profit is overstated; balance in the retained camnings account is correct. (b) Profit is correct, balance in the share capital account is correct. (c) Profit is understated; balance in the share capital account is correct. (d) Profit is understated; balance in the retained earnings account is understated. 10 Which of the following entries causes an immediate decrease in assets and in profit? (a) The entry to record depreciation expense. (b) The entry to record revenue eamed but not yet received (c) The entry to record the eamed portion of rent received in advance. (d) The entry to record accrued wages payable. 11 Profit is (a) the excess of debits over credits. the increase in equity resulting from the profitable operations of the business. (c) the excess of credits over debits. (d) the increase in assets of a company during a year. (b) the The principal difference between management accounting and financial accounting is that financial accounting information is prepared by managers. (b) prepared in accordance with a set of accounting principles developed by the Institute of Certified Management Accountants.. (c) intended primarily for use by decision makers outside the business organization oriented toward measuring solvency rather than profitability, 13 Accumulated depreciation is (a) the depreciation expense recorded on an asset to date. (b) the remaining book value of an asset. (c) the depreciation expense taken on an asset during the current period. (d) an expense of the income statement. 14 Ben Dryden, president of Jet Glass Limited, noticed a $8,000 debit to Accounts Payable in the company's general ledger. This debit could correspond to (a) a $8,000 sale to a customer. (b) a purchase of equipment costing $8,000 on credit. a payment of $8,000 to a supplier to settle a balance due (d) the failure to pay this month's $8,000 utility bill on time. 15 The balance in the prepaid insurance account before adjustment at the end of the year is $10,000. What is the effect on the adjusting entry if additional data provided is: (1) "the amount of insurance expired during the year is $8,500," as compared to (2) "the amount of unexpired insurance applicable to a future period is $1,500"? (a) The debit and credit amount for (1) would be the same as (2) but the accounts would be different. (b) The accounts for (1) would be the same as the accounts for (2) but the amounts would be different. (c) The accounts and amounts would be the same for both (1) and (2). There is not enough information given to determine the correct accounts and amounts. -End of Section A