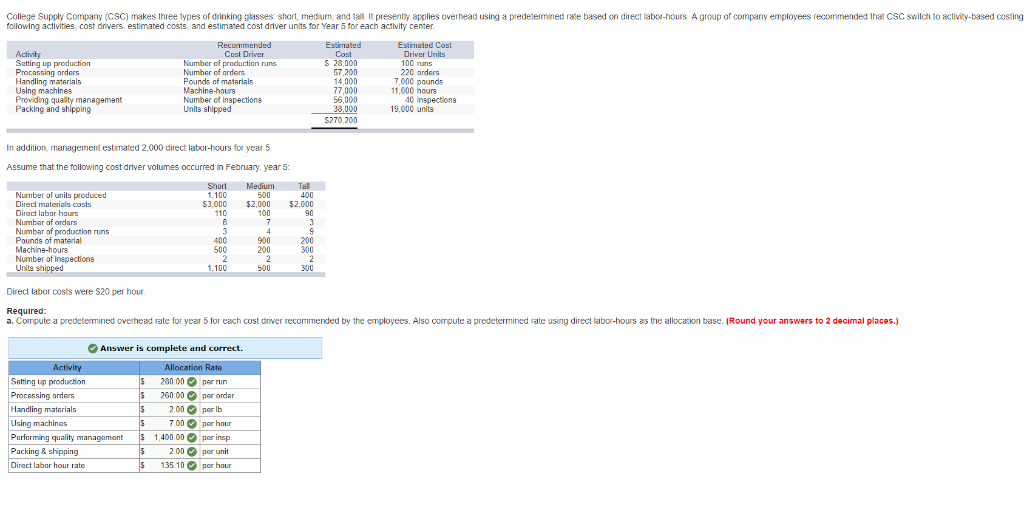

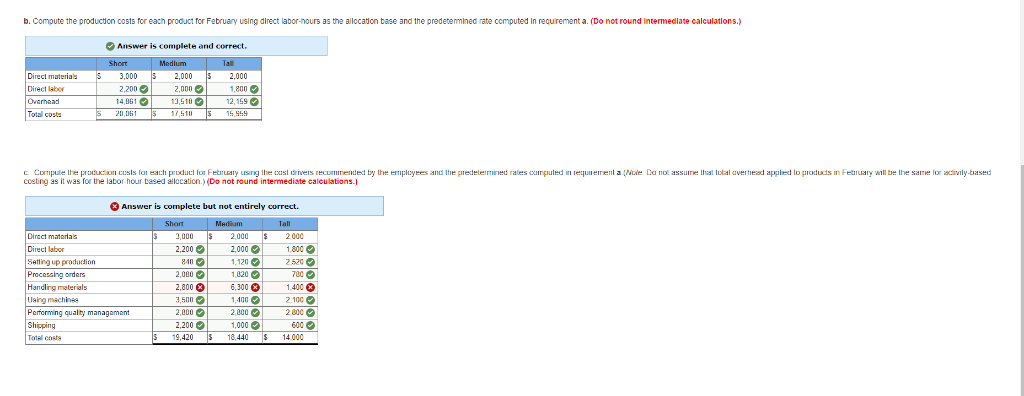

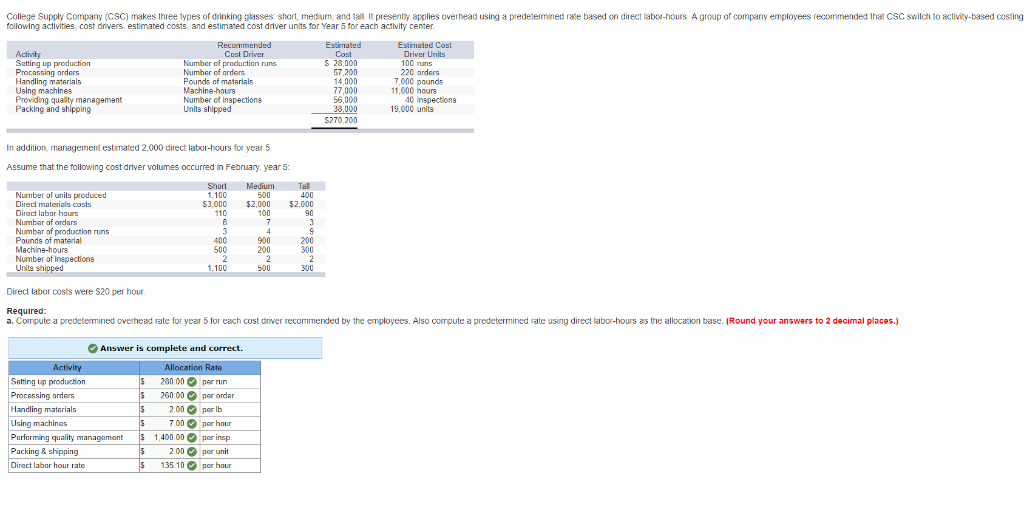

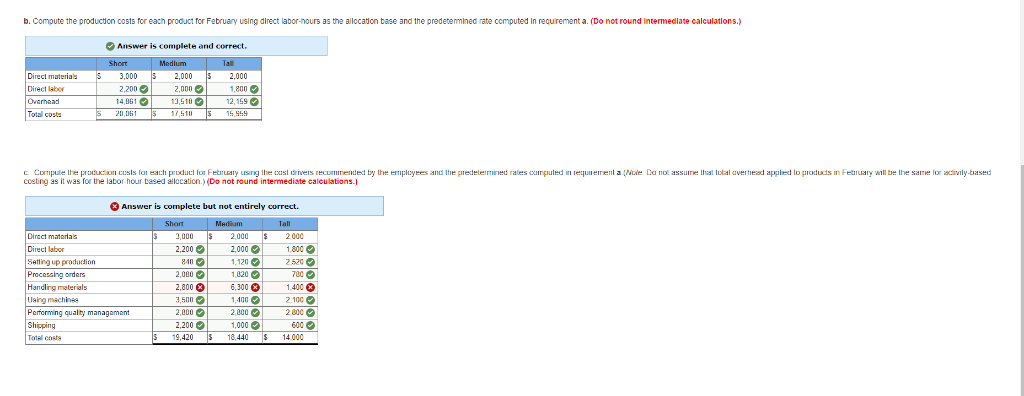

College Supply Company (CSC) makes three types of drinking glasses short, medium, and tall It presently applies overhead using a predetemined rate based on direct labor-hours A group of company employees recommended that CSC switch to activity-based costing following activities, cost drivers, estimated cosis, and estimated cost driver units for Year 5 for each acivity center Estimated Cost Cost Driver Driver Units 100 runs 220 arders Setting up production Procassing arders Handling materials Using machines Providing quality management Packing and shipping S 28,000 7.200 14,000 77,000 56,000 Number of production runs Number of orders Pounds of matarials 7,000 pounds 11,000 hours Number of inspections Units shipped 40 inspections 19,000 units 27020D In addition, management estimated 2,000 direct labor-hours for year 5 Assume that the tollowing cost driver volumes occurred in February, year 5: Number of units produced Direct materials costs Direct labar haurs Numbar of ordars Numbar of production runs Pounds of material Mechine-hours Number of inspections Unite 500 400 53,000 $2,000 2,000 90 110 100 900 200 500 300 1.100 300 Direct labor costs were $20 per hour a. Compute a predetermined overhead rate for year 5 for each cost driver recommended by the employees. Also compute a predetermined rate using direct labor-hours as the allocation base. (Round your answers to 2 decimal places.) Answer is complete and correct. Sating up production Procassing orders andling matorials sing machines Performing quality Packing& shipping Direct labor hour rate Allocation Rate 8000per run 26000 per ordar 200per lb 00por hour 1,400.00 per insp 200por unit 35.10per hour b. Compute the producion costs for each proouct for February using direct labor-hours as the allocation base and the predetenmined rate computed In recuirement a. (Do not round Intermedlate caiculations.) Answer is complete and correct. 3,000 2,2002,000 Direct materials 2,000 2,000 Direct labor 0001,800 Total costs costing as it was for the labor hour based allocation ) (Do not round intermediate calculations.) Answer is complete but not entirely correct. Diract materlals Direct labor Satting up productiorn Processing orders Handlirg materials Uaing machinee Perfarming qualty m Shipping 2000 1.800 20520 2,000 2,2002000 2,0001020 700 2,8006,300 1400 2,0002000 2,200,000 18.440 2.800 200 9,420 14.000