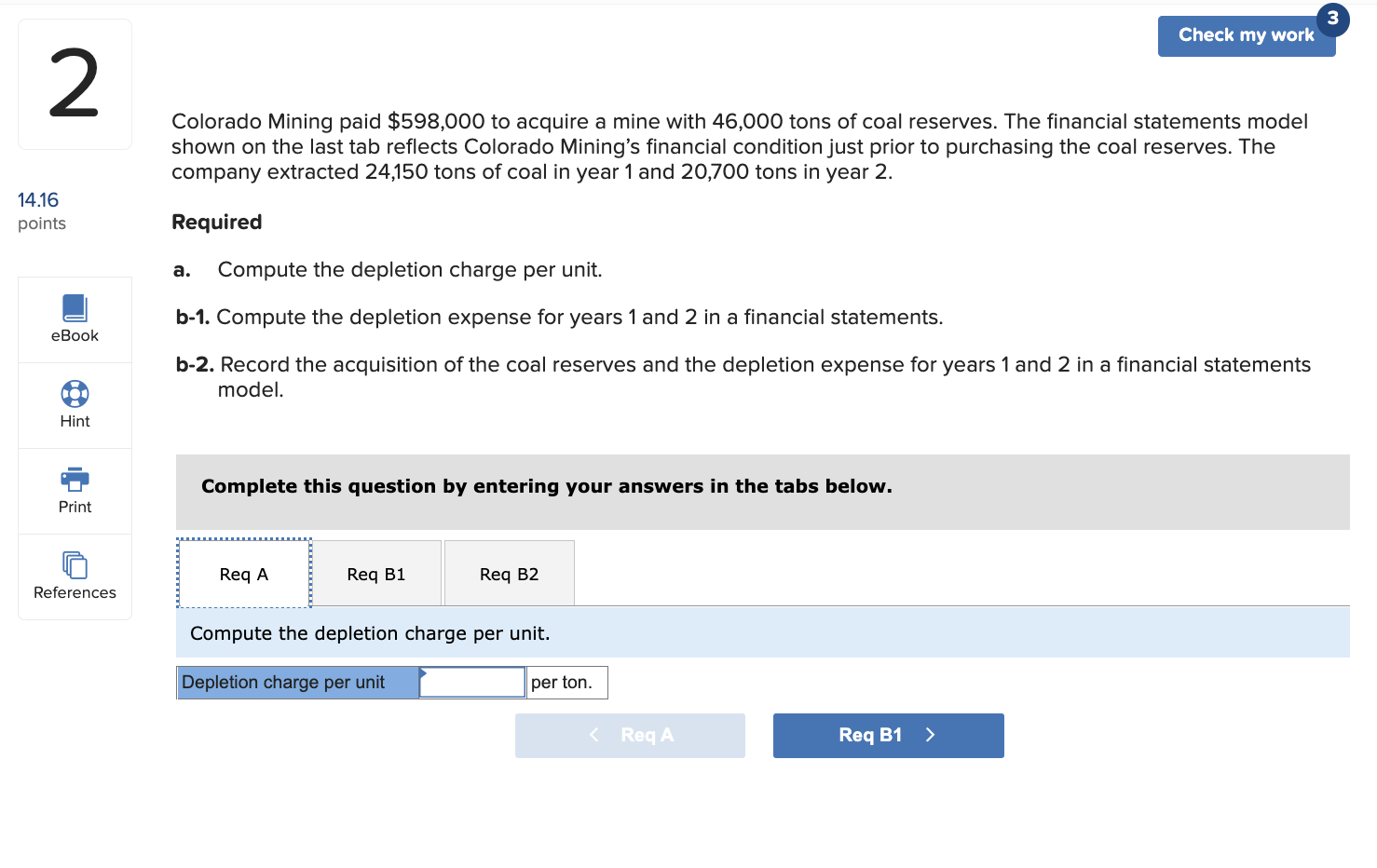

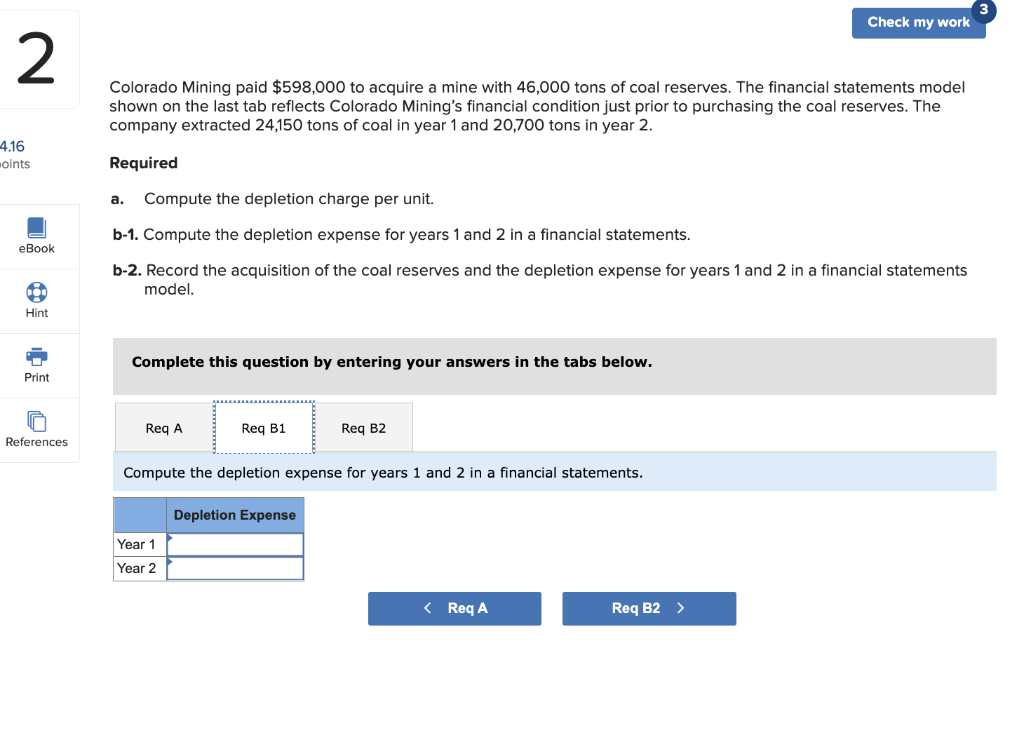

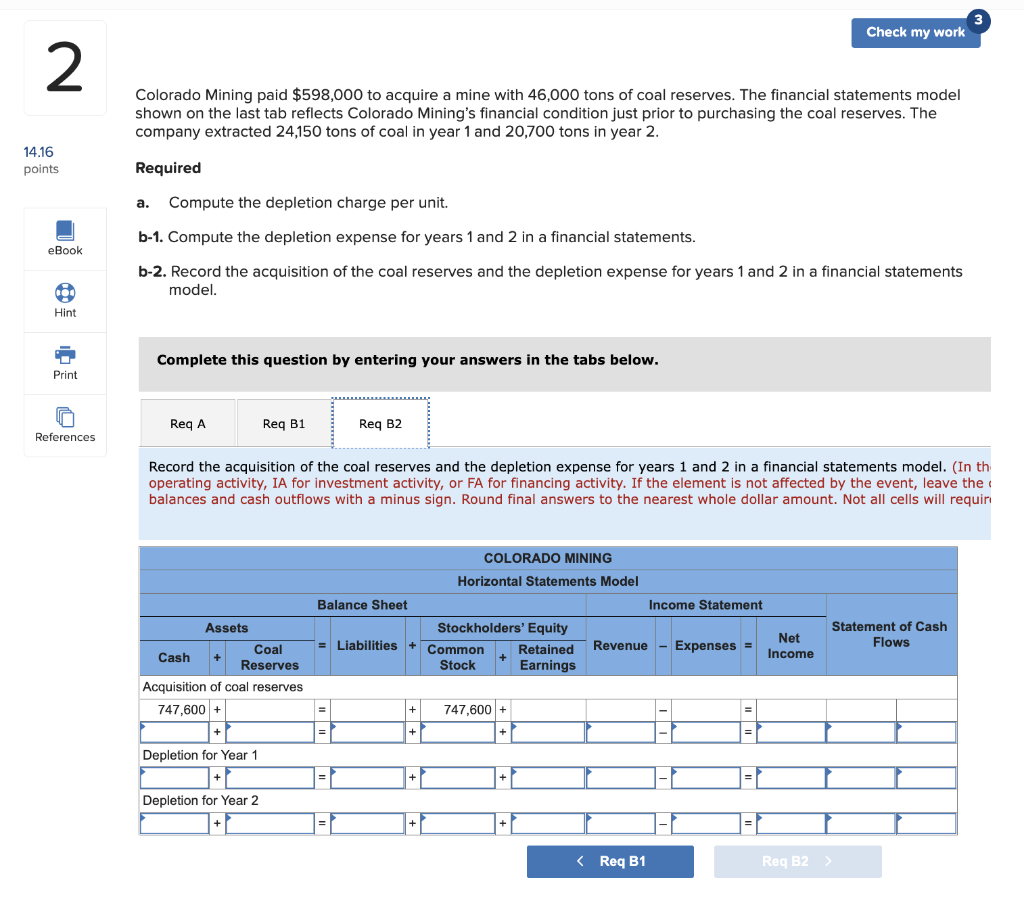

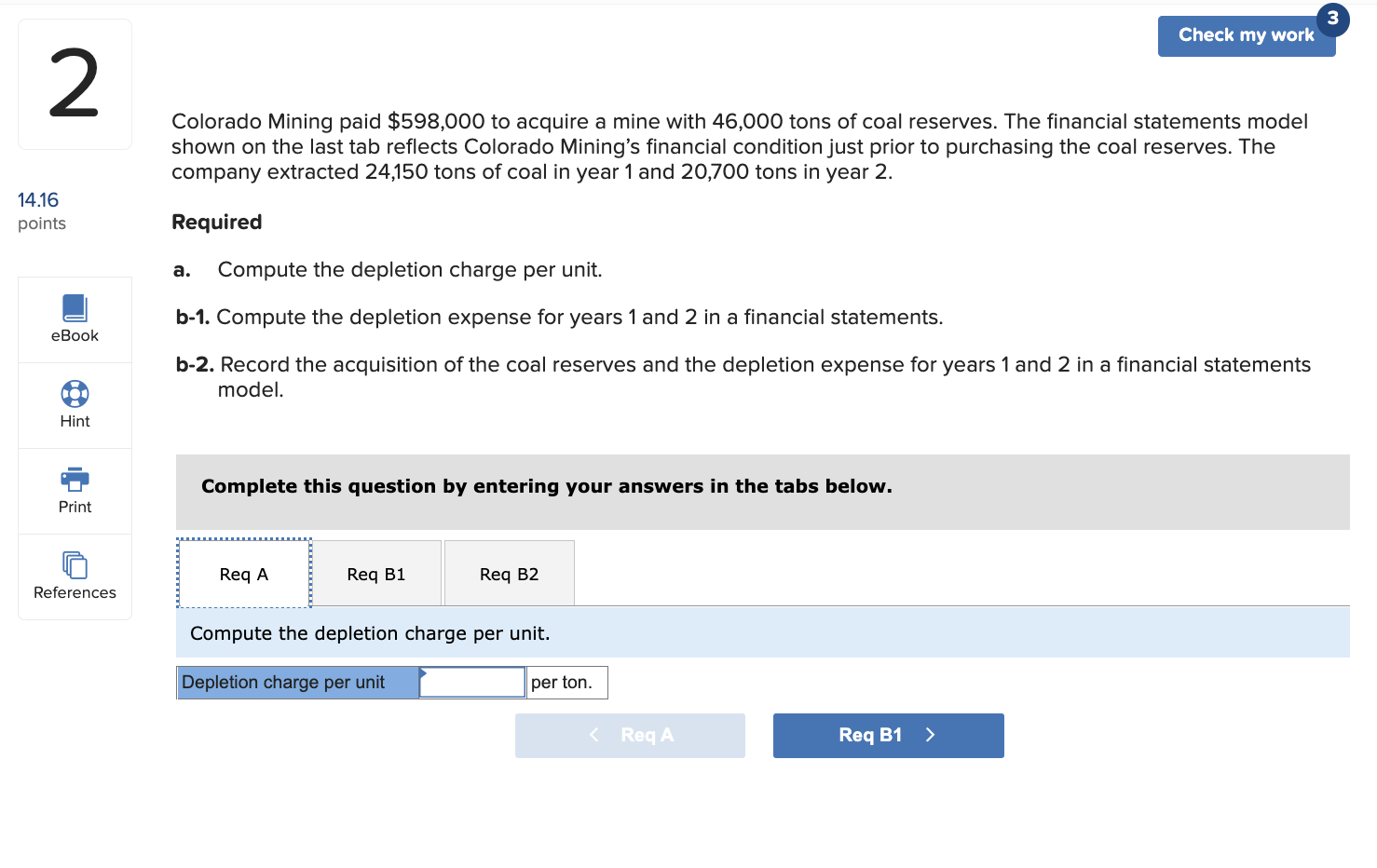

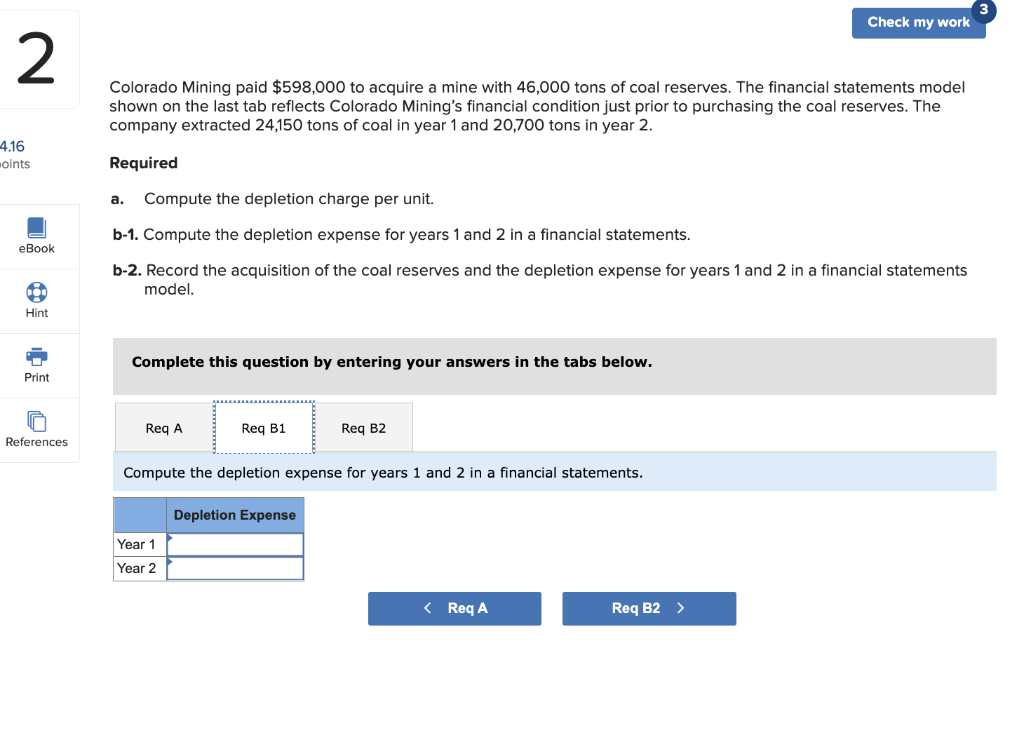

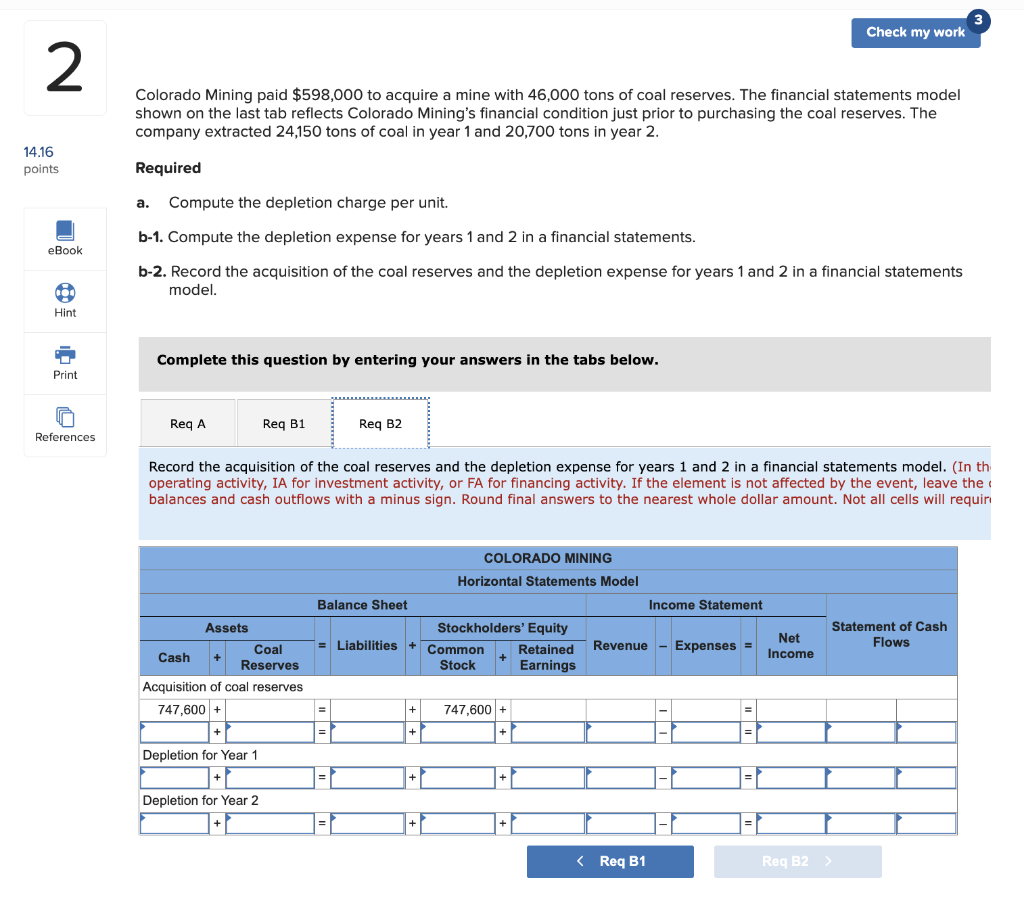

Colorado Mining paid $598,000 to acquire a mine with 46,000 tons of coal reserves. The financial statements model shown on the last tab reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,150 tons of coal in year 1 and 20,700 tons in year 2. Required a. Compute the depletion charge per unit. b-1. Compute the depletion expense for years 1 and 2 in a financial statements. b-2. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Compute the depletion charge per unit. Colorado Mining paid $598,000 to acquire a mine with 46,000 tons of coal reserves. The financial statements model shown on the last tab reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,150 tons of coal in year 1 and 20,700 tons in year 2. Required a. Compute the depletion charge per unit. b-1. Compute the depletion expense for years 1 and 2 in a financial statements. b-2. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Compute the depletion expense for years 1 and 2 in a financial statements. Colorado Mining paid $598,000 to acquire a mine with 46,000 tons of coal reserves. The financial statements model shown on the last tab reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,150 tons of coal in year 1 and 20,700 tons in year 2. Required a. Compute the depletion charge per unit. b-1. Compute the depletion expense for years 1 and 2 in a financial statements. b-2. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model. (In operating activity, IA for investment activity, or FA for financing activity. If the element is not affected by the event, leave the balances and cash outflows with a minus sign. Round final answers to the nearest whole dollar amount. Not all cells will requ