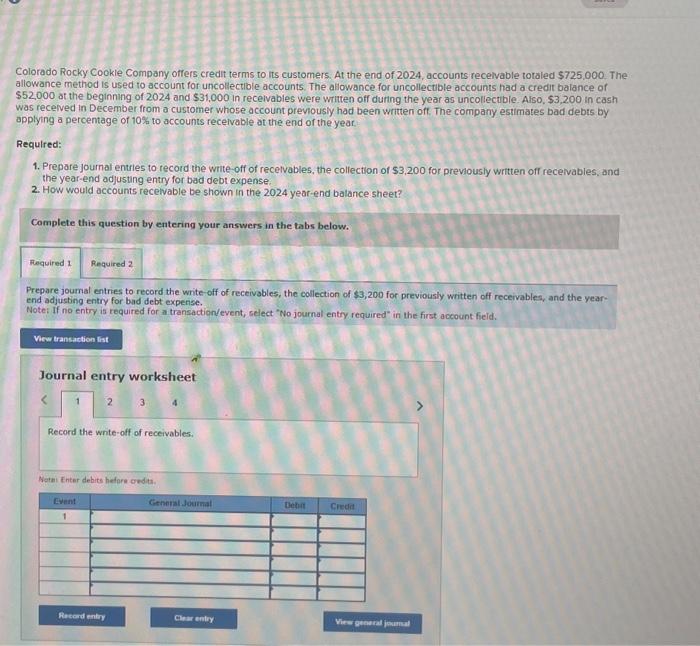

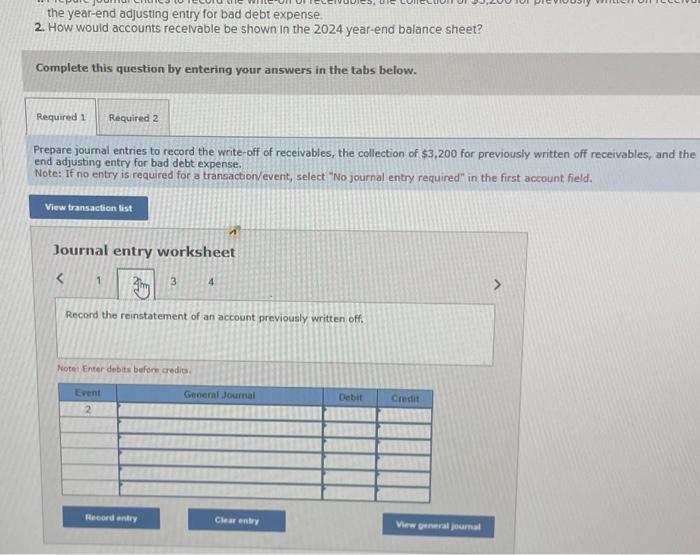

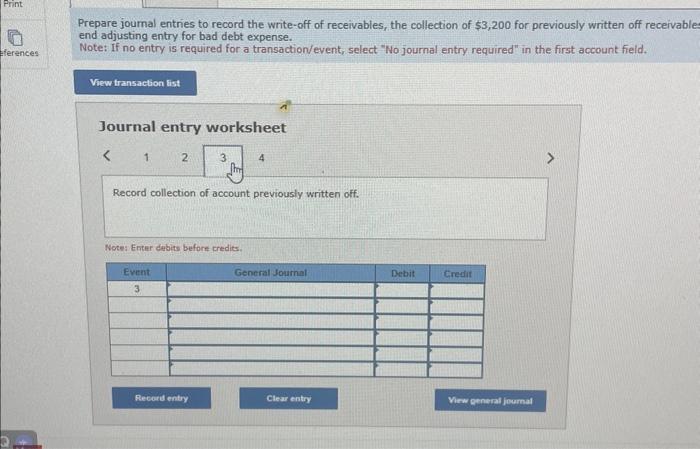

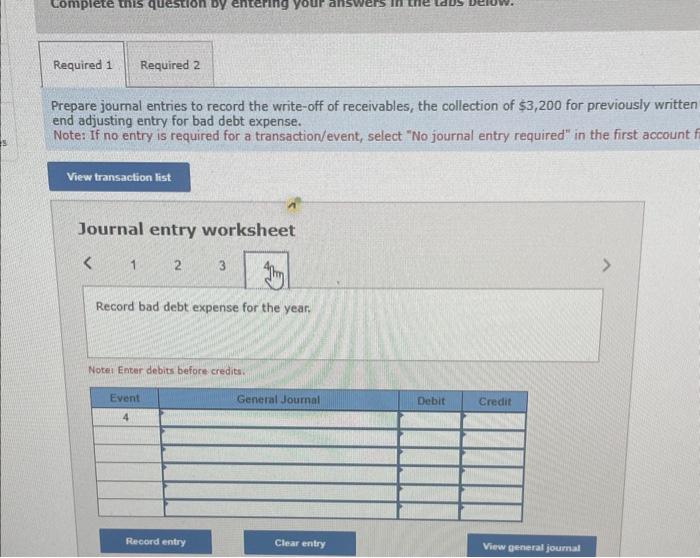

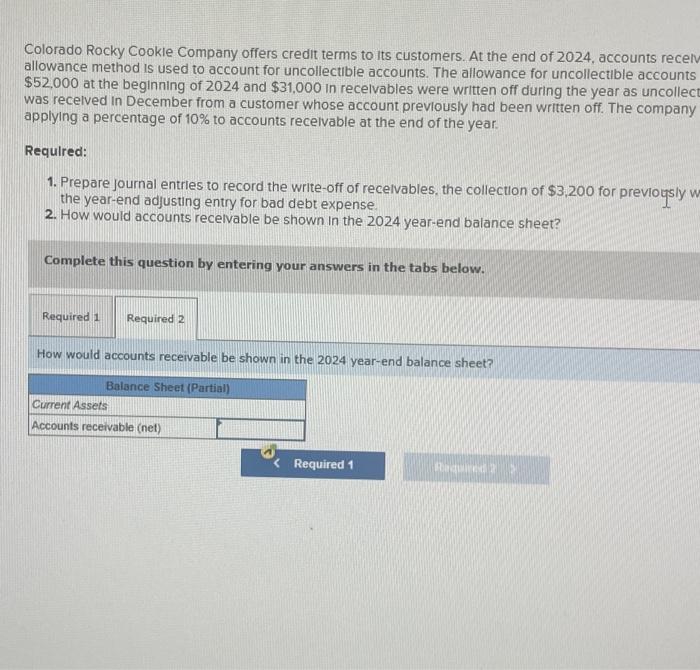

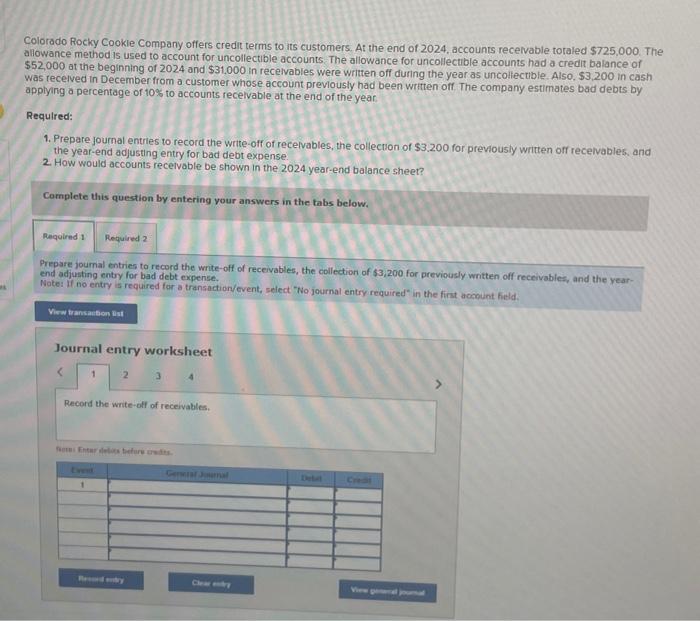

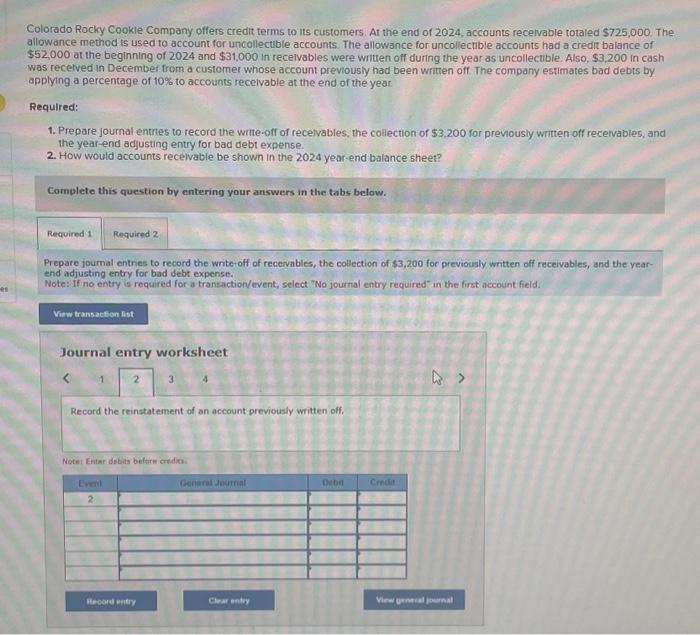

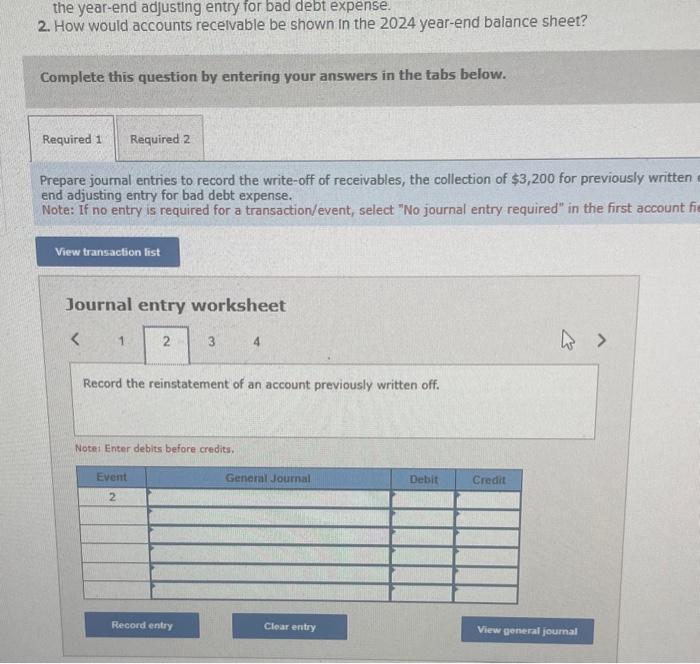

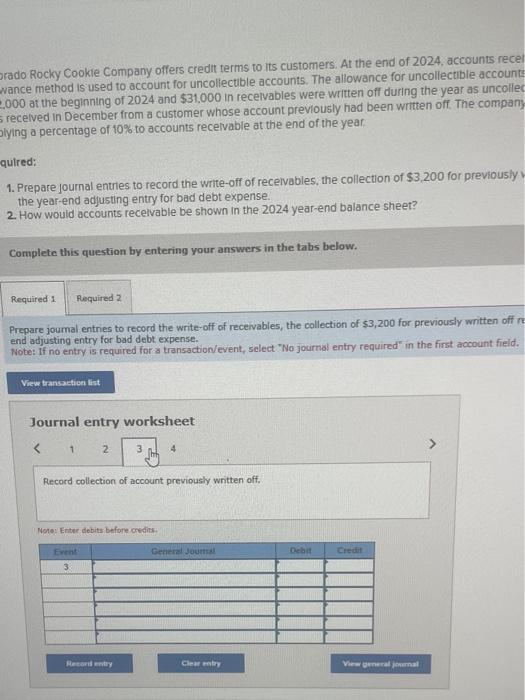

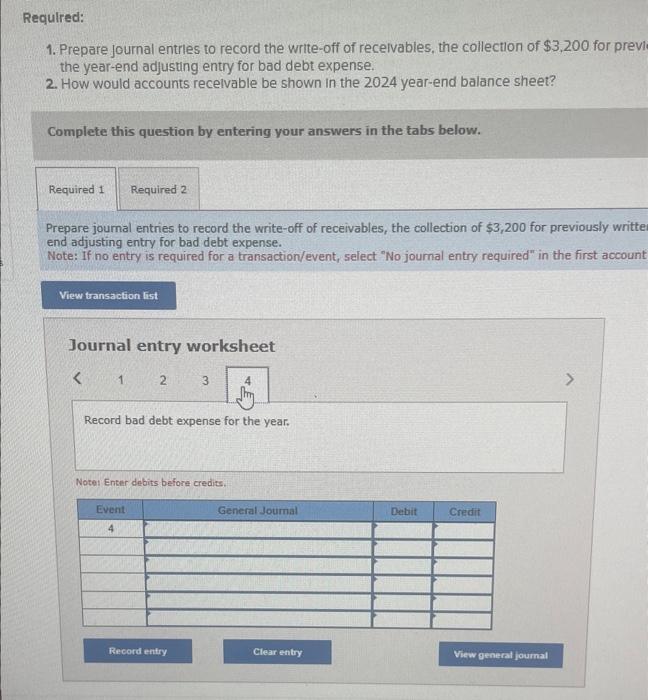

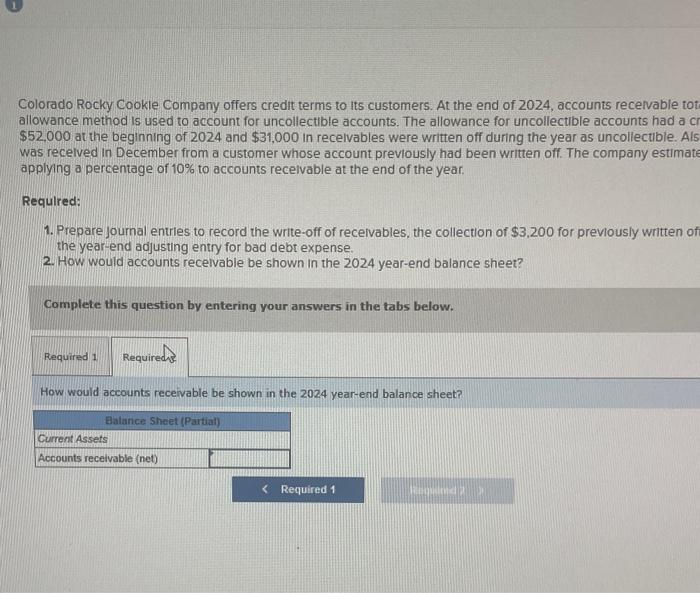

Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024 , accounts recen allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollec was recelved in December from a customer whose account previously had been written off. The company applying a percentage of 10% to accounts recelvable at the end of the year. Required: 1. Prepare journal entries to record the write-off of recelvables, the collection of $3,200 for previoysly the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. How would accounts receivable be shown in the 2024 year-end balance sheet? Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024 , accounts recelvable toraled $725,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollectible. Also, $3,200 in cash was recelved in December from a customer whose account previously had been written oft. The company estimates bad debts by applying a percentage of 10% to accounts recelvable at the end of the year: Required: 1. Prepare journal entries to record the write-off of recelvables, the collection of $3,200 for previously written off recelvables, and the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare joumal entries to record the write- off of receivables, the collection of $3,200 for previously written off receivables, and the yearend adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously written end adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account Journal entry worksheet Record the reinstatement of an account previously written off. Note: Enter debits before credits. Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024 , accounts recervable to allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncoliectible. Als was recelved in December from a customer whose account previously had been written off. The company estimat applying a percentage of 10% to accounts recelvable at the end of the year. Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously written of the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. How would accounts receivable be shown in the 2024 year-end balance sheet? the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare joumal entries to record the write-off of receivables, the collection of $3,200 for previously written off receivables, and the end adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the reinstatement of an account previously written off. Notei Enter dobes before credits. Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024 , accounts recelvable toraled $725,000. The alowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollectible. Also, $3,200 in cash was recelved in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts recelvable at the end of the year. Required: 1. Prepare journal entries to record the wrtte-off of recelvables, the collection of $3.200 for previously written off recelvables. and the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entries to record the wnite-off of receivables, the collection of $3,200 for previously wntten off receivabies, and the yearend adjusting entry for bad debt expense. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first acoouint field. Journal entry worksheet Record the write-off of receivables. Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024, accounts recelvable totaled $725,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollectible. Also, $3,200 in cash was recelved in December from a customer whose account previously had been written off. The company estimates bad debis by applying a percentage of 10% to accounts recelvable at the end of the year. Required: 1. Prepare journal entres to record the write-off of recelvables, the collection of $3,200 for prevously written off recelvables, and the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entines to record the write- off of receivables, the collection of $3,200 for previously written off receivables, and the vearend adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. orado Rocky Cookle Company offers credit terms to its customers. At the end of 2024, accounts recel wance method is used to account for uncollectible accounts. The allowance for uncollectble accounts 2000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollec 5 recelved in December from a customer whose account previously had been written off. The company blying a percentage of 10% to accounts recelvable at the end of the year: qutred: 1. Prepare journal entries to record the write-off of recelvables, the collection of $3,200 for previously the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare joumal entries to record the write-off of receivables, the collection of $3,200 for previously written off end adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Noter Enter debits before credits: Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously written end adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account Journal entry worksheet repare joumal entries to record the write-off of receivables, the collection of $3,200 for previously written off receivable and adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required: 1. Prepare journal entries to record the write-off of recelvables, the collection of $3,200 for previ the year-end adjusting entry for bad debt expense. 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously writte end adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account Journal entry worksheet Notel Enter debits before credits