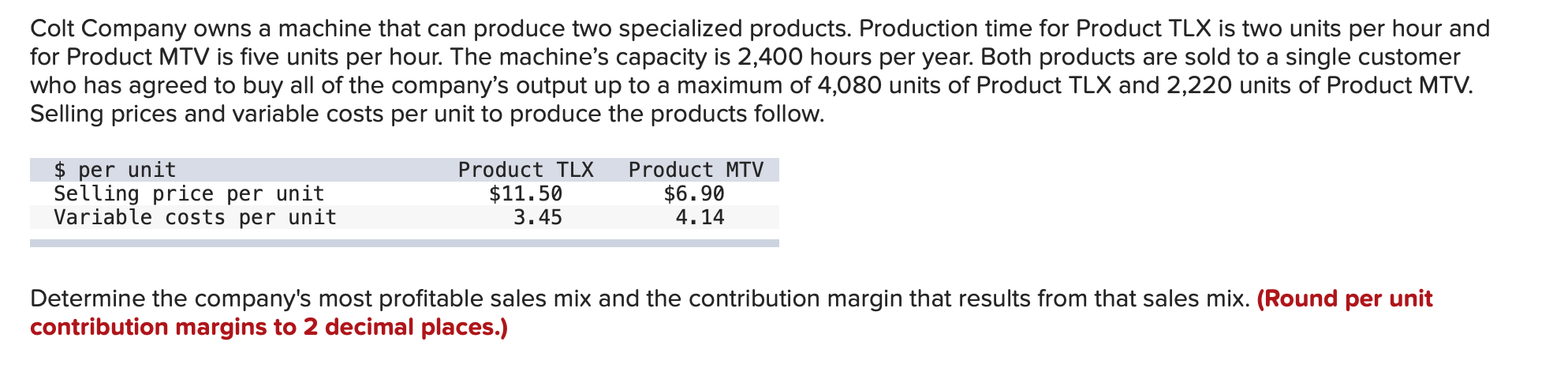

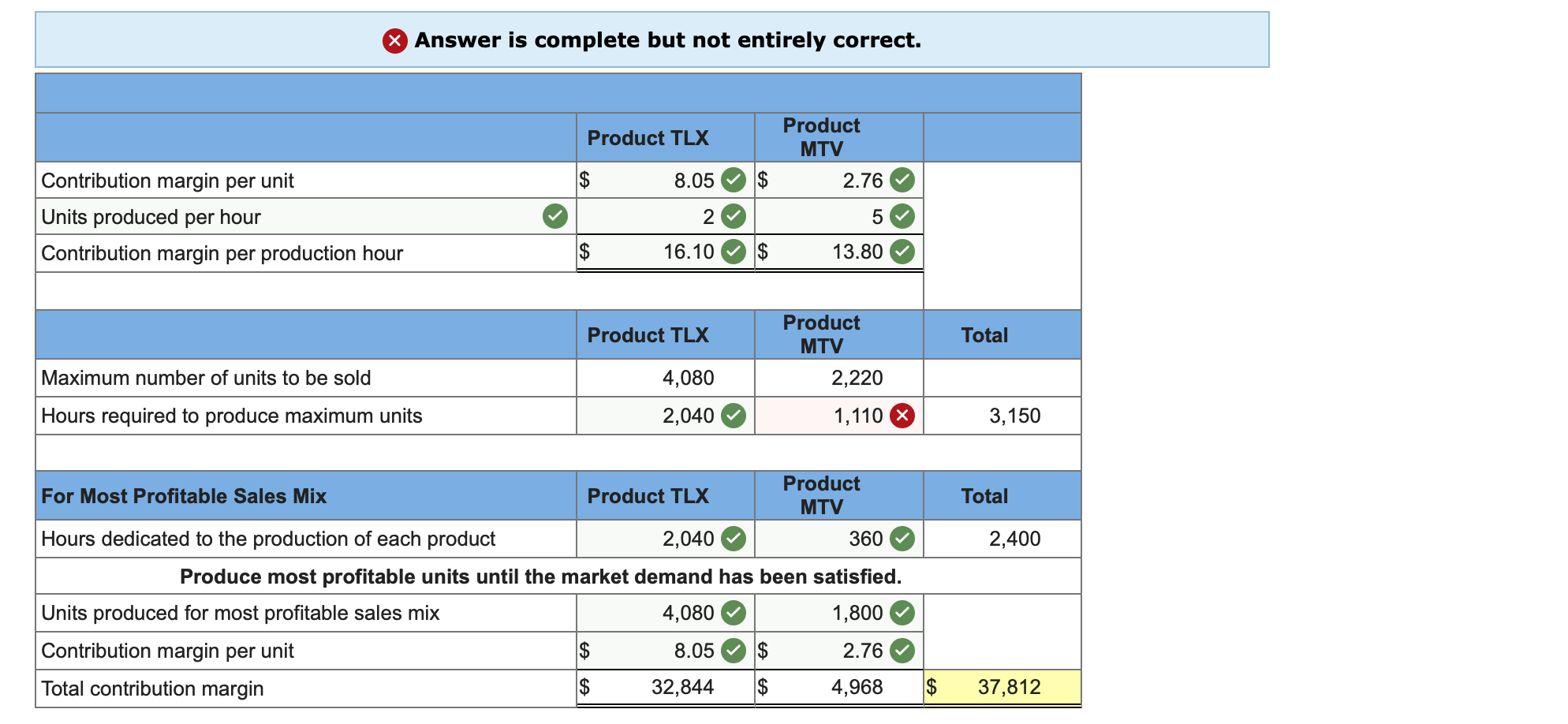

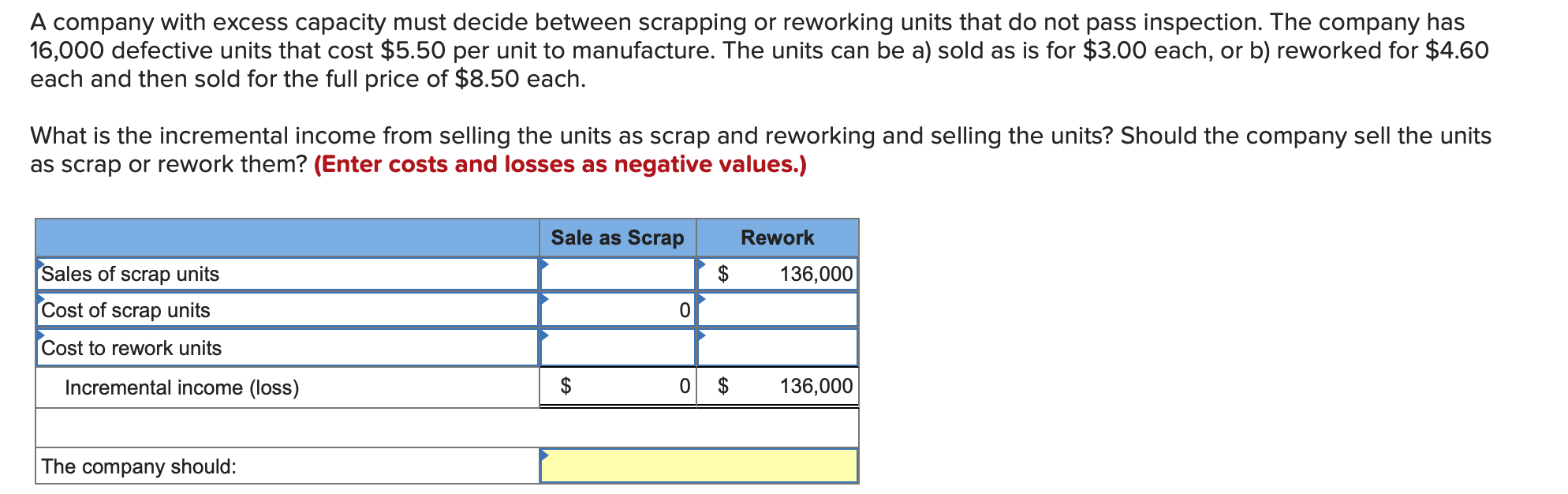

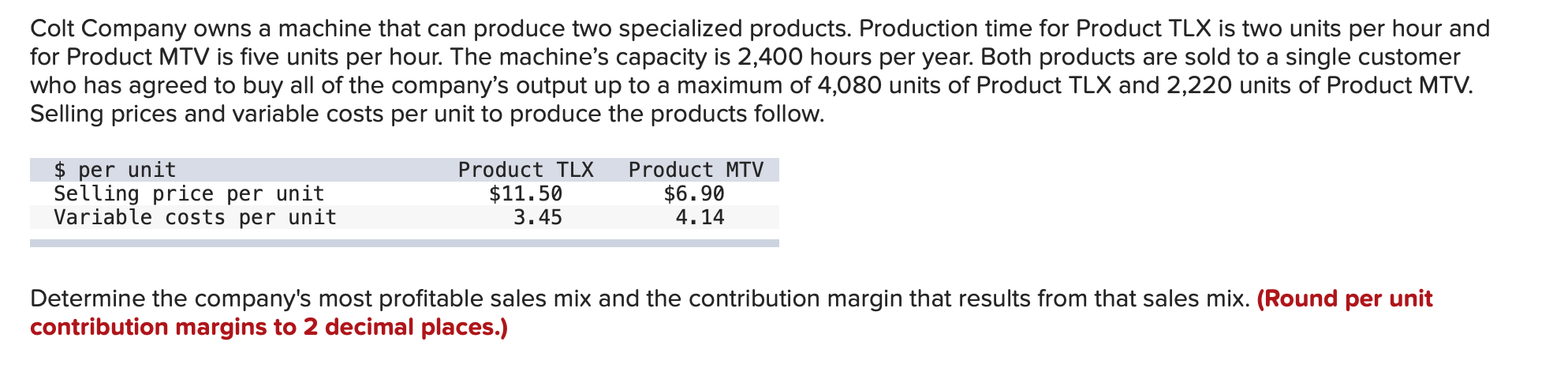

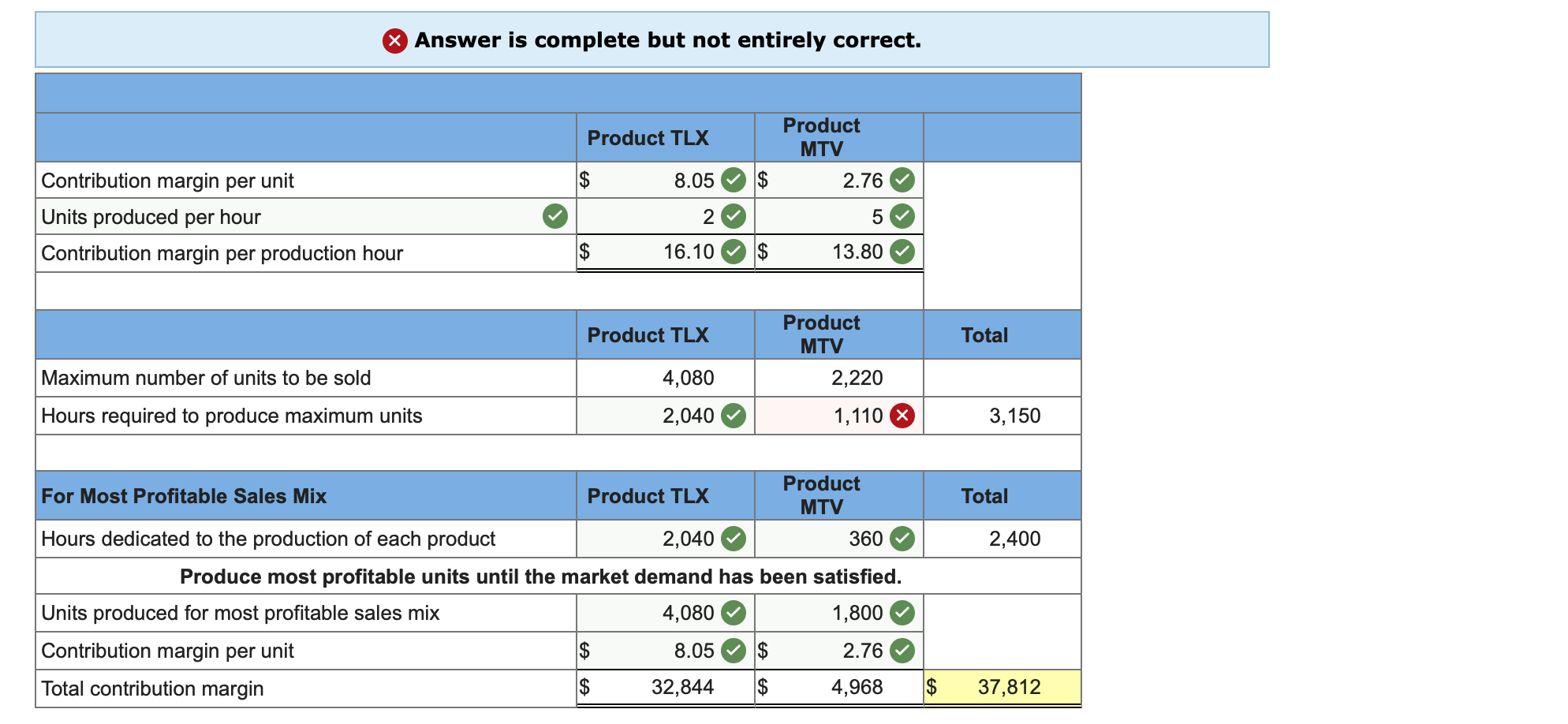

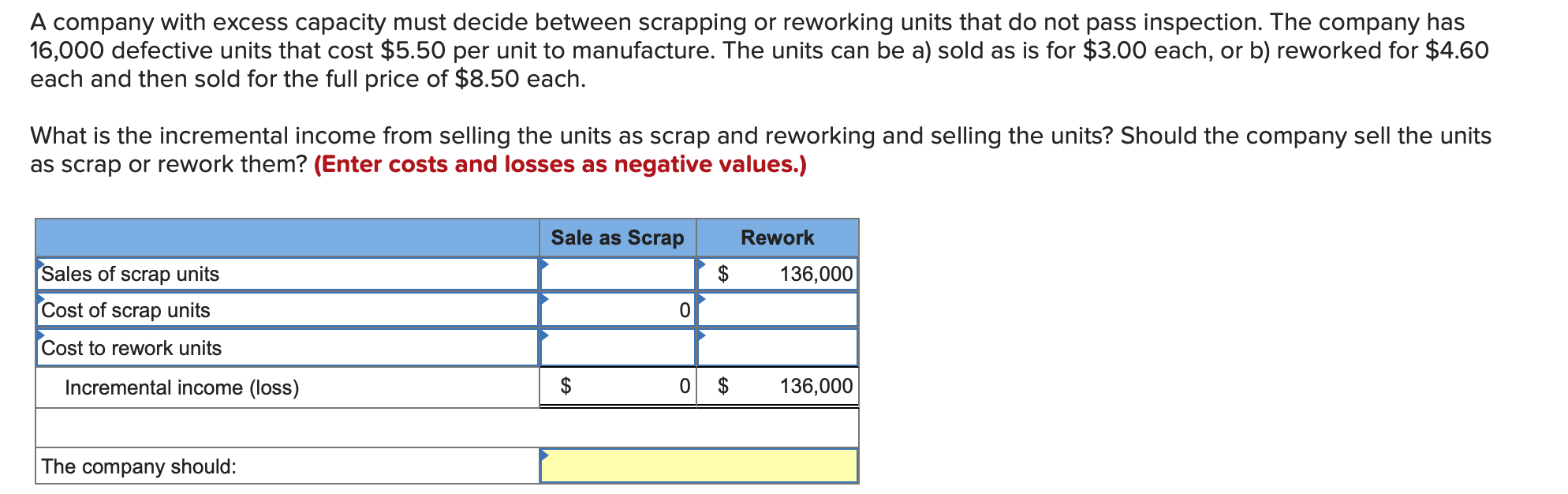

Colt Company owns a machine that can produce two specialized products. Production time for Product TLX is two units per hour and for Product MTV is five units per hour. The machine's capacity is 2,400 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 4,080 units of Product TLX and 2,220 units of Product MTV. Selling prices and variable costs per unit to produce the products follow. $ per unit Selling price per unit Variable costs per unit Product TLX $11.50 3.45 Product MTV $6.90 4.14 Determine the company's most profitable sales mix and the contribution margin that results from that sales mix. (Round per unit contribution margins to 2 decimal places.) X Answer is complete but not entirely correct. Product TLX Product MTV 8.05 $ 2.76 Contribution margin per unit Units produced per hour Contribution margin per production hour 2 5 16.10 $ 13.80 Product TLX Product MTV Total 4,080 2,220 Maximum number of units to be sold Hours required to produce maximum units 2,040 1,110 3,150 Total 2,400 For Most Profitable Sales Mix Product Product TLX MTV Hours dedicated to the production of each product 2,040 360 Produce most profitable units until the market demand has been satisfied. Units produced for most profitable sales mix 4,080 1,800 Contribution margin per unit $ 8.05 $ 2.76 Total contribution margin $ 32,844 $ 4,968 $ 37,812 A company with excess capacity must decide between scrapping or reworking units that do not pass inspection. The company has 16,000 defective units that cost $5.50 per unit to manufacture. The units can be a) sold as is for $3.00 each, or b) reworked for $4.60 each and then sold for the full price of $8.50 each. What is the incremental income from selling the units as scrap and reworking and selling the units? Should the company sell the units as scrap or rework them? (Enter costs and losses as negative values.) Sale as Scrap Rework $ 136,000 Sales of scrap units Cost of scrap units 0 Cost to rework units Incremental income (loss) $ 0 $ 136,000 The company should