Question

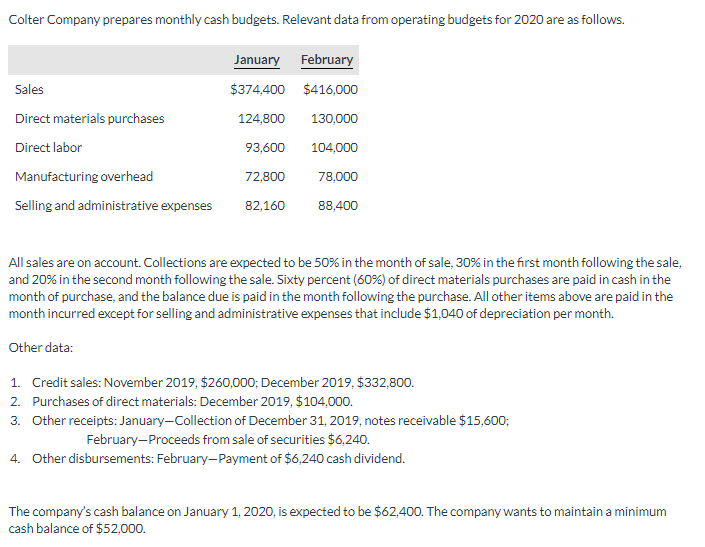

Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. January February Sales $374,400 $416,000 Direct materials purchases 124,800

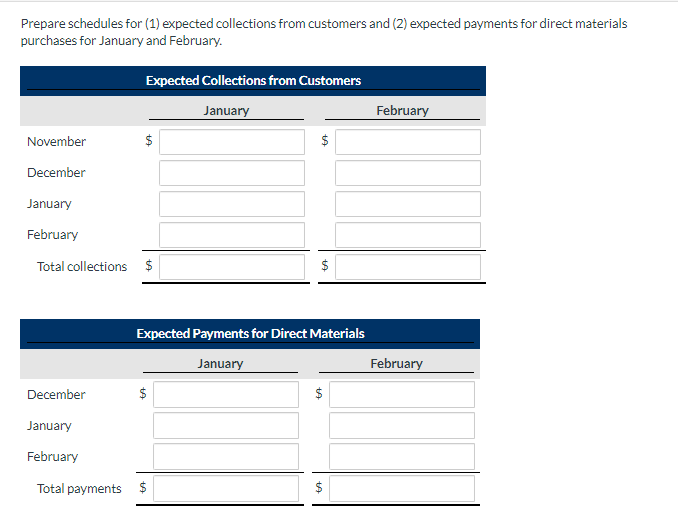

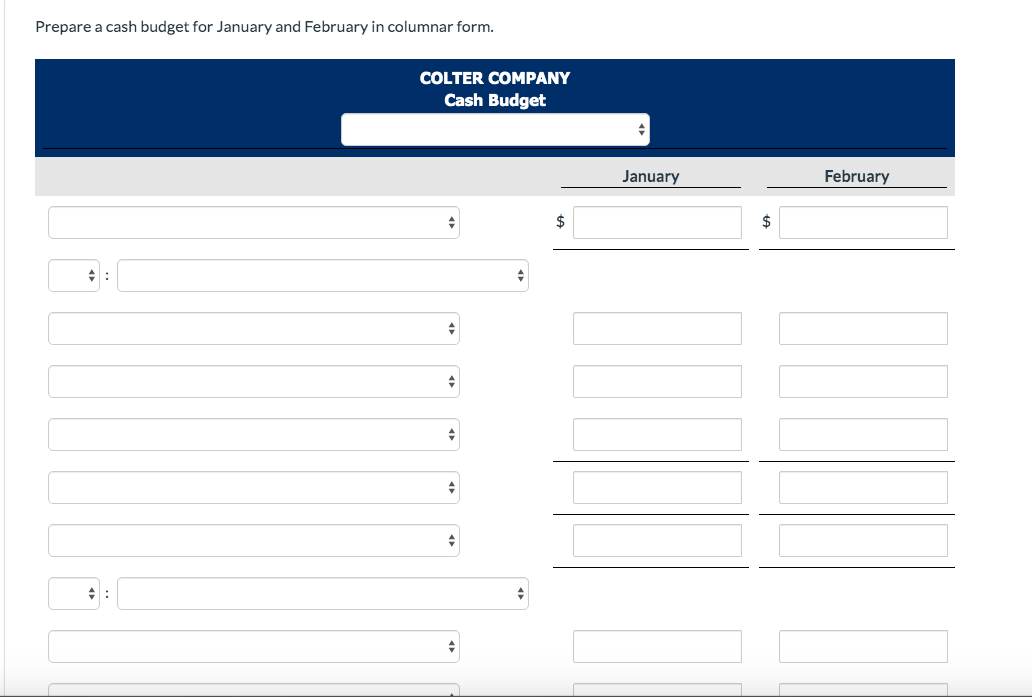

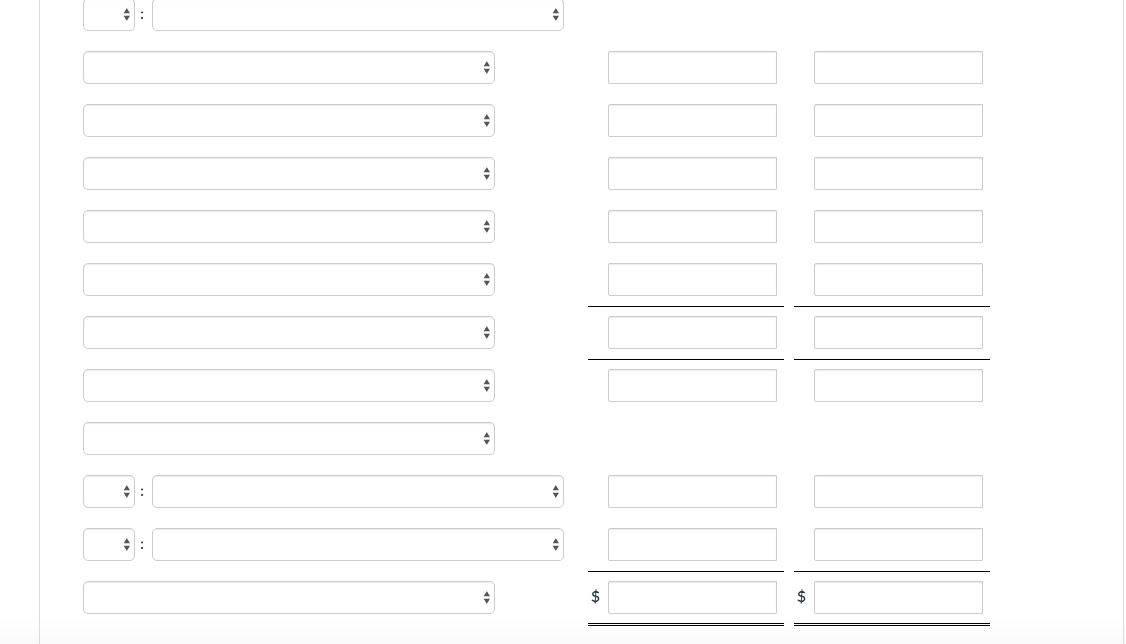

Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. January February Sales $374,400 $416,000 Direct materials purchases 124,800 130,000 Direct labor 93,600 104,000 Manufacturing overhead 72,800 78,000 Selling and administrative expenses 82,160 88,400 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,040 of depreciation per month. Other data: 1. Credit sales: November 2019, $260,000; December 2019, $332,800. 2. Purchases of direct materials: December 2019, $104,000. 3. Other receipts: JanuaryCollection of December 31, 2019, notes receivable $15,600; FebruaryProceeds from sale of securities $6,240. 4. Other disbursements: FebruaryPayment of $6,240 cash dividend. The companys cash balance on January 1, 2020, is expected to be $62,400. The company wants to maintain a minimum cash balance of $52,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started