Question

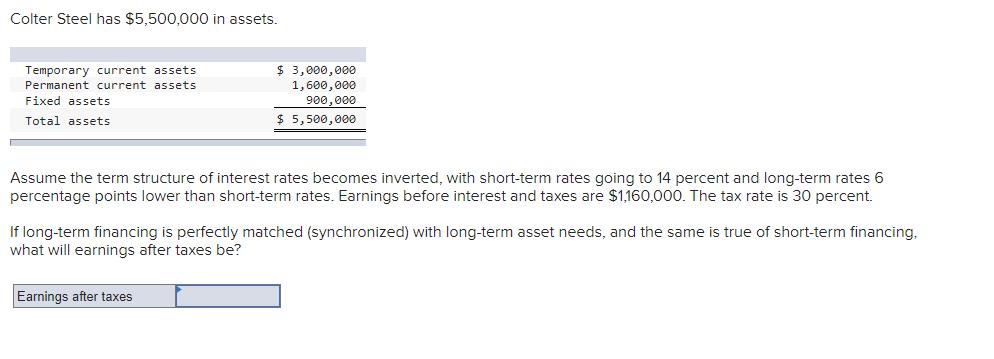

Colter Steel has $5,500,000 in assets. Temporary current assets Permanent current assets Fixed assets Total assets $ 3,000,000 1,600,000 900,000 $5,500,000 Assume the term

Colter Steel has $5,500,000 in assets. Temporary current assets Permanent current assets Fixed assets Total assets $ 3,000,000 1,600,000 900,000 $5,500,000 Assume the term structure of interest rates becomes inverted, with short-term rates going to 14 percent and long-term rates 6 percentage points lower than short-term rates. Earnings before interest and taxes are $1,160,000. The tax rate is 30 percent. If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing. what will earnings after taxes be? Earnings after taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided scenario the company Colter Steel has assets totaling 5500000 an earnings befo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

16th edition

125927716X, 978-1259687969, 1259687961, 978-1259277160

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App