Answered step by step

Verified Expert Solution

Question

1 Approved Answer

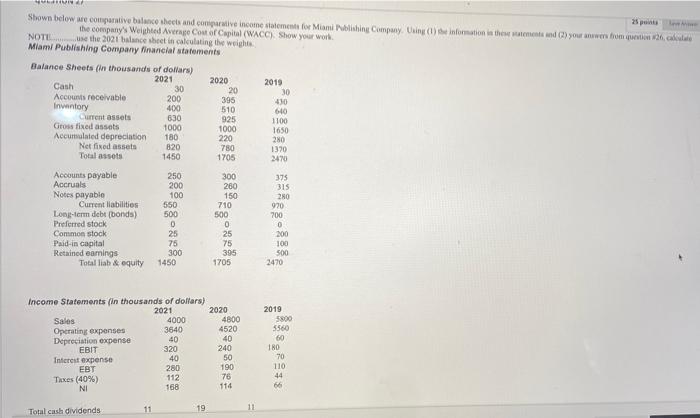

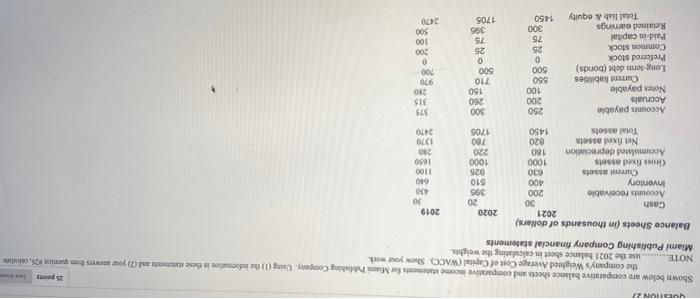

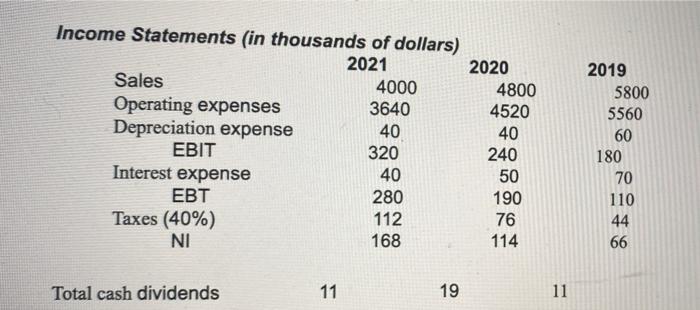

COM NOTE A Home Showcase of dollar 30 Acev 200 C 30 2006 w 20 30 250 200 00 00 MO 1000 220 10 300

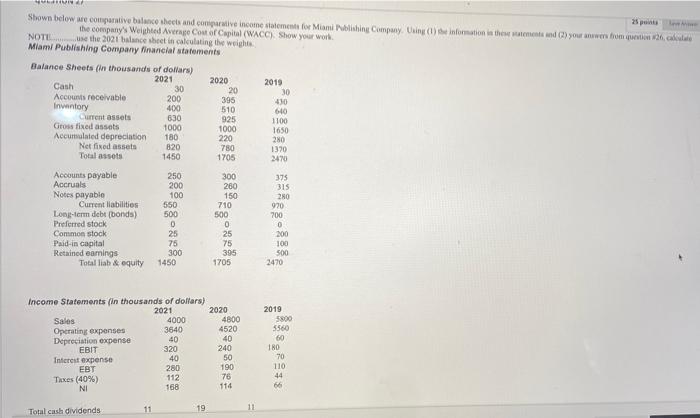

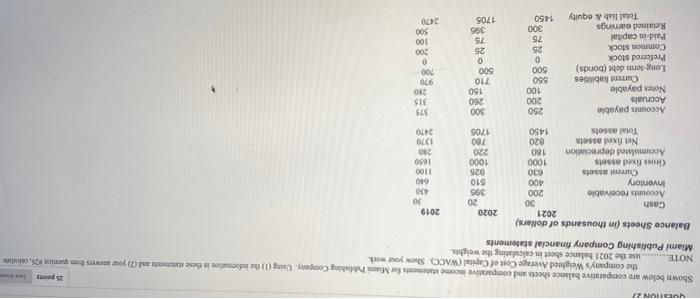

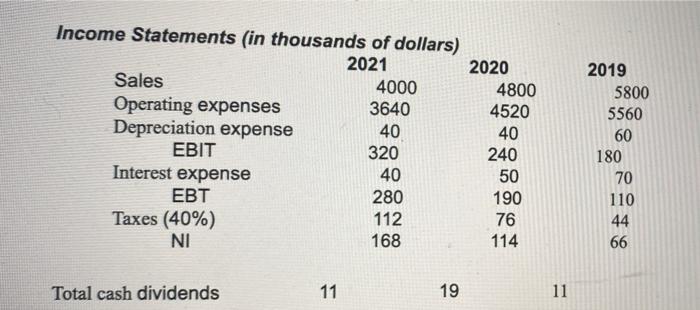

COM NOTE A Home Showcase of dollar 30 Acev 200 C 30 2006 w 20 30 250 200 00 00 MO 1000 220 10 300 290 350 TID 500 . 25 75 13 13 E Deport o O 25 C 20 50 40 100 450 40 50 190 7 11 200 T (40%) 160 395 Shown below are comparative balance sheets and compartive income statement for Miami Ning Company. Uning () Information is the wond) you wbrom 26, 25 the company Weighted Average cost of Capital (WACC). Show your work NOTE. the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 Cash 2019 30 20 30 Accounts receivable 200 430 Inventory 400 510 640 Current assets 630 925 1100 Gross fixed assets 1000 1000 1650 Accumulated depreciation 180 220 280 Net fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 375 Accruals 200 280 315 Notes payable 100 280 Current liabilities 710 920 Long-term debt (bonds) 500 500 200 Preferred stock 0 0 0 Common stock 25 25 200 Paid-in capital 75 75 100 Retained earings 300 395 500 Total liab & equity 1450 1705 300 150 550 2470 Income Statements in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 EBIT 320 Interest expense 40 EBT 280 Taxes (40%) 112 NI 168 pf8988883 2019 5800 5560 60 180 70 110 44 66 11 19 Total cash dividends YUSTUNZI NOTE.. Shown below are comparative balance sheets and comparative income tatements for Miami Publishing Compay. Using (l) the information in these statementsant () your answers from question 26, call the company's Weighted Average Cost of Capital (WACC). Show your work use the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 2019 Cash 30 20 30 Accounts receivable 200 395 430 Inventory 100 510 640 Current assets 630 025 1100 Crossfixed assets 1000 1000 1650 Accumulated depreciation 180 220 Nel fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 300 375 Accruals 200 260 315 Notes payable 100 150 250 Current liabilities 550 710 970 Long term debt (bonds) 500 500 Preferred stock 0 0 0 Common stock 25 25 200 75 Paid-in capital 75 100 Retained earings 300 500 395 Total liab & equity 1450 1705 2470 700 Income Statements (in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 40 EBIT 320 240 Interest expense 40 EBT 280 190 Taxes (40%) 112 76 NI 168 114 2019 5800 5560 60 180 70 110 44 66 50 Total cash dividends 11 19 11 COM NOTE A Home Showcase of dollar 30 Acev 200 C 30 2006 w 20 30 250 200 00 00 MO 1000 220 10 300 290 350 TID 500 . 25 75 13 13 E Deport o O 25 C 20 50 40 100 450 40 50 190 7 11 200 T (40%) 160 395 Shown below are comparative balance sheets and compartive income statement for Miami Ning Company. Uning () Information is the wond) you wbrom 26, 25 the company Weighted Average cost of Capital (WACC). Show your work NOTE. the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 Cash 2019 30 20 30 Accounts receivable 200 430 Inventory 400 510 640 Current assets 630 925 1100 Gross fixed assets 1000 1000 1650 Accumulated depreciation 180 220 280 Net fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 375 Accruals 200 280 315 Notes payable 100 280 Current liabilities 710 920 Long-term debt (bonds) 500 500 200 Preferred stock 0 0 0 Common stock 25 25 200 Paid-in capital 75 75 100 Retained earings 300 395 500 Total liab & equity 1450 1705 300 150 550 2470 Income Statements in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 EBIT 320 Interest expense 40 EBT 280 Taxes (40%) 112 NI 168 pf8988883 2019 5800 5560 60 180 70 110 44 66 11 19 Total cash dividends YUSTUNZI NOTE.. Shown below are comparative balance sheets and comparative income tatements for Miami Publishing Compay. Using (l) the information in these statementsant () your answers from question 26, call the company's Weighted Average Cost of Capital (WACC). Show your work use the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 2019 Cash 30 20 30 Accounts receivable 200 395 430 Inventory 100 510 640 Current assets 630 025 1100 Crossfixed assets 1000 1000 1650 Accumulated depreciation 180 220 Nel fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 300 375 Accruals 200 260 315 Notes payable 100 150 250 Current liabilities 550 710 970 Long term debt (bonds) 500 500 Preferred stock 0 0 0 Common stock 25 25 200 75 Paid-in capital 75 100 Retained earings 300 500 395 Total liab & equity 1450 1705 2470 700 Income Statements (in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 40 EBIT 320 240 Interest expense 40 EBT 280 190 Taxes (40%) 112 76 NI 168 114 2019 5800 5560 60 180 70 110 44 66 50 Total cash dividends 11 19 11

COM NOTE A Home Showcase of dollar 30 Acev 200 C 30 2006 w 20 30 250 200 00 00 MO 1000 220 10 300 290 350 TID 500 . 25 75 13 13 E Deport o O 25 C 20 50 40 100 450 40 50 190 7 11 200 T (40%) 160 395 Shown below are comparative balance sheets and compartive income statement for Miami Ning Company. Uning () Information is the wond) you wbrom 26, 25 the company Weighted Average cost of Capital (WACC). Show your work NOTE. the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 Cash 2019 30 20 30 Accounts receivable 200 430 Inventory 400 510 640 Current assets 630 925 1100 Gross fixed assets 1000 1000 1650 Accumulated depreciation 180 220 280 Net fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 375 Accruals 200 280 315 Notes payable 100 280 Current liabilities 710 920 Long-term debt (bonds) 500 500 200 Preferred stock 0 0 0 Common stock 25 25 200 Paid-in capital 75 75 100 Retained earings 300 395 500 Total liab & equity 1450 1705 300 150 550 2470 Income Statements in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 EBIT 320 Interest expense 40 EBT 280 Taxes (40%) 112 NI 168 pf8988883 2019 5800 5560 60 180 70 110 44 66 11 19 Total cash dividends YUSTUNZI NOTE.. Shown below are comparative balance sheets and comparative income tatements for Miami Publishing Compay. Using (l) the information in these statementsant () your answers from question 26, call the company's Weighted Average Cost of Capital (WACC). Show your work use the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 2019 Cash 30 20 30 Accounts receivable 200 395 430 Inventory 100 510 640 Current assets 630 025 1100 Crossfixed assets 1000 1000 1650 Accumulated depreciation 180 220 Nel fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 300 375 Accruals 200 260 315 Notes payable 100 150 250 Current liabilities 550 710 970 Long term debt (bonds) 500 500 Preferred stock 0 0 0 Common stock 25 25 200 75 Paid-in capital 75 100 Retained earings 300 500 395 Total liab & equity 1450 1705 2470 700 Income Statements (in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 40 EBIT 320 240 Interest expense 40 EBT 280 190 Taxes (40%) 112 76 NI 168 114 2019 5800 5560 60 180 70 110 44 66 50 Total cash dividends 11 19 11 COM NOTE A Home Showcase of dollar 30 Acev 200 C 30 2006 w 20 30 250 200 00 00 MO 1000 220 10 300 290 350 TID 500 . 25 75 13 13 E Deport o O 25 C 20 50 40 100 450 40 50 190 7 11 200 T (40%) 160 395 Shown below are comparative balance sheets and compartive income statement for Miami Ning Company. Uning () Information is the wond) you wbrom 26, 25 the company Weighted Average cost of Capital (WACC). Show your work NOTE. the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 Cash 2019 30 20 30 Accounts receivable 200 430 Inventory 400 510 640 Current assets 630 925 1100 Gross fixed assets 1000 1000 1650 Accumulated depreciation 180 220 280 Net fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 375 Accruals 200 280 315 Notes payable 100 280 Current liabilities 710 920 Long-term debt (bonds) 500 500 200 Preferred stock 0 0 0 Common stock 25 25 200 Paid-in capital 75 75 100 Retained earings 300 395 500 Total liab & equity 1450 1705 300 150 550 2470 Income Statements in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 EBIT 320 Interest expense 40 EBT 280 Taxes (40%) 112 NI 168 pf8988883 2019 5800 5560 60 180 70 110 44 66 11 19 Total cash dividends YUSTUNZI NOTE.. Shown below are comparative balance sheets and comparative income tatements for Miami Publishing Compay. Using (l) the information in these statementsant () your answers from question 26, call the company's Weighted Average Cost of Capital (WACC). Show your work use the 2021 balance sheet in calculating the weight Miami Publishing Company financial statements Balance Sheets (in thousands of dollars) 2021 2020 2019 Cash 30 20 30 Accounts receivable 200 395 430 Inventory 100 510 640 Current assets 630 025 1100 Crossfixed assets 1000 1000 1650 Accumulated depreciation 180 220 Nel fixed assets 820 780 1370 Total assets 1450 1705 2470 Accounts payable 250 300 375 Accruals 200 260 315 Notes payable 100 150 250 Current liabilities 550 710 970 Long term debt (bonds) 500 500 Preferred stock 0 0 0 Common stock 25 25 200 75 Paid-in capital 75 100 Retained earings 300 500 395 Total liab & equity 1450 1705 2470 700 Income Statements (in thousands of dollars) 2021 2020 Sales 4000 4800 Operating expenses 3640 4520 Depreciation expense 40 40 EBIT 320 240 Interest expense 40 EBT 280 190 Taxes (40%) 112 76 NI 168 114 2019 5800 5560 60 180 70 110 44 66 50 Total cash dividends 11 19 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started