Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete Income Statement and a balance sheet for Belmond. i Data Table - (Click on the icon in order to copy its contents into a

Complete Income Statement and a balance sheet for Belmond.

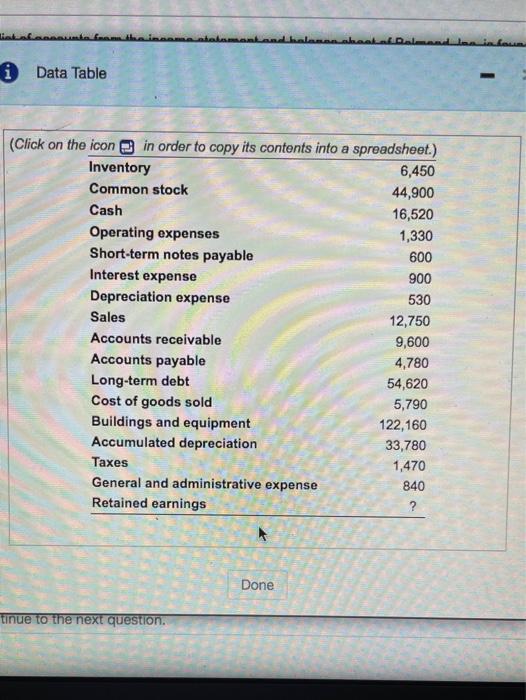

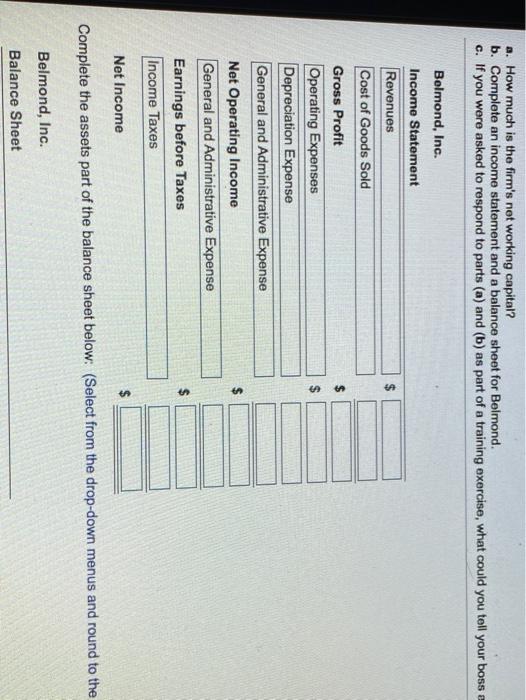

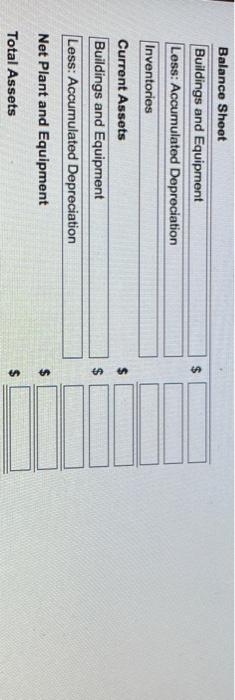

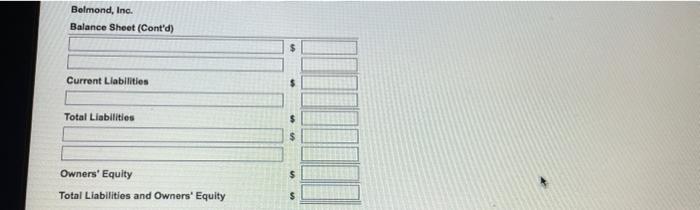

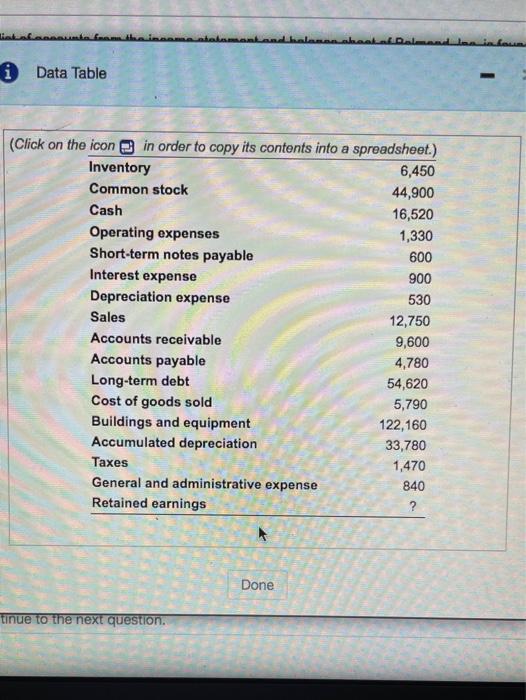

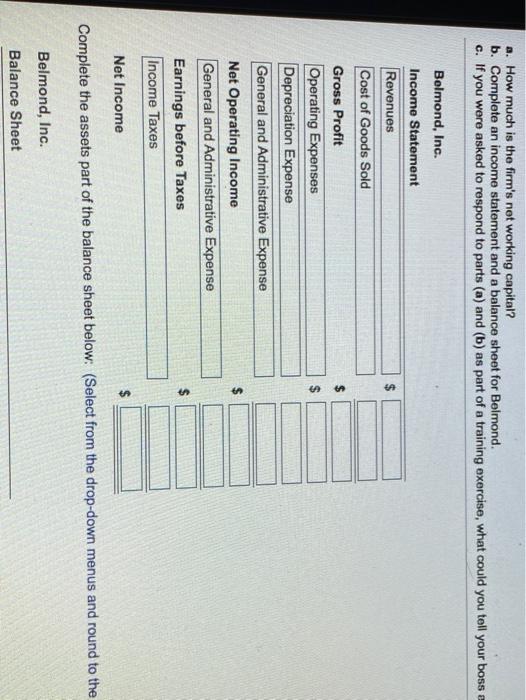

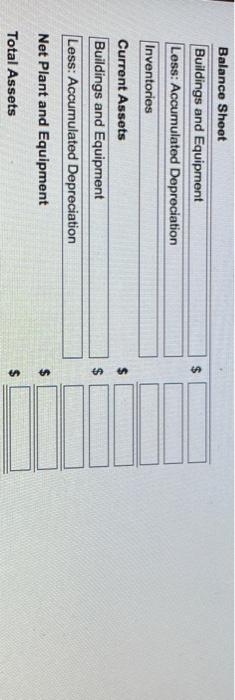

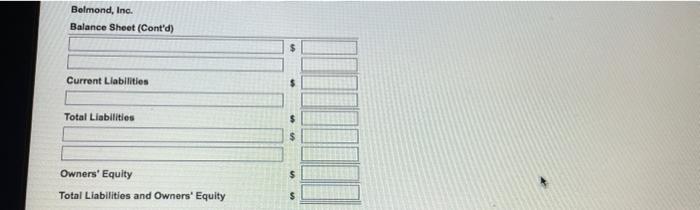

i Data Table - (Click on the icon in order to copy its contents into a spreadsheet.) Inventory 6,450 Common stock 44,900 Cash 16,520 Operating expenses 1,330 Short-term notes payable 600 Interest expense 900 Depreciation expense 530 Sales 12,750 Accounts receivable 9,600 Accounts payable 4,780 Long-term debt 54,620 Cost of goods sold 5,790 Buildings and equipment 122,160 Accumulated depreciation 33,780 Taxes 1,470 General and administrative expense 840 Retained earnings ? Done tinue to the next question. A. How much is the firm's not working capital? b. Complete an income statement and a balance sheet for Belmond. c. If you were asked to respond to parts (a) and (b) as part of a training exercise, what could you tell your boss Belmond, Inc. Income Statement Revenues $ Cost of Goods Sold $ $ Gross Profit Operating Expenses Depreciation Expense General and Administrative Expense $ Net Operating Income General and Administrative Expense Earnings before Taxes Income Taxes $ Net Income $ Complete the assets part of the balance sheet below: (Select from the drop-down menus and round to the Belmond, Inc. Balance Sheet Balance Sheet $ Buildings and Equipment Less: Accumulated Depreciation Inventories Current Assets Buildings and Equipment Less: Accumulated Depreciation $ Net Plant and Equipment Total Assets Belmond, Inc. Balance Sheet (Cont'd) Current Liabilities Total Liabilities Owners' Equity $ Total Liabilities and Owners' Equity

i Data Table - (Click on the icon in order to copy its contents into a spreadsheet.) Inventory 6,450 Common stock 44,900 Cash 16,520 Operating expenses 1,330 Short-term notes payable 600 Interest expense 900 Depreciation expense 530 Sales 12,750 Accounts receivable 9,600 Accounts payable 4,780 Long-term debt 54,620 Cost of goods sold 5,790 Buildings and equipment 122,160 Accumulated depreciation 33,780 Taxes 1,470 General and administrative expense 840 Retained earnings ? Done tinue to the next question. A. How much is the firm's not working capital? b. Complete an income statement and a balance sheet for Belmond. c. If you were asked to respond to parts (a) and (b) as part of a training exercise, what could you tell your boss Belmond, Inc. Income Statement Revenues $ Cost of Goods Sold $ $ Gross Profit Operating Expenses Depreciation Expense General and Administrative Expense $ Net Operating Income General and Administrative Expense Earnings before Taxes Income Taxes $ Net Income $ Complete the assets part of the balance sheet below: (Select from the drop-down menus and round to the Belmond, Inc. Balance Sheet Balance Sheet $ Buildings and Equipment Less: Accumulated Depreciation Inventories Current Assets Buildings and Equipment Less: Accumulated Depreciation $ Net Plant and Equipment Total Assets Belmond, Inc. Balance Sheet (Cont'd) Current Liabilities Total Liabilities Owners' Equity $ Total Liabilities and Owners' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started