Prepare a statement of cash flows for Wu using the indirect method. Sales Cost of goods sold Wu Company Income Statement For the Year

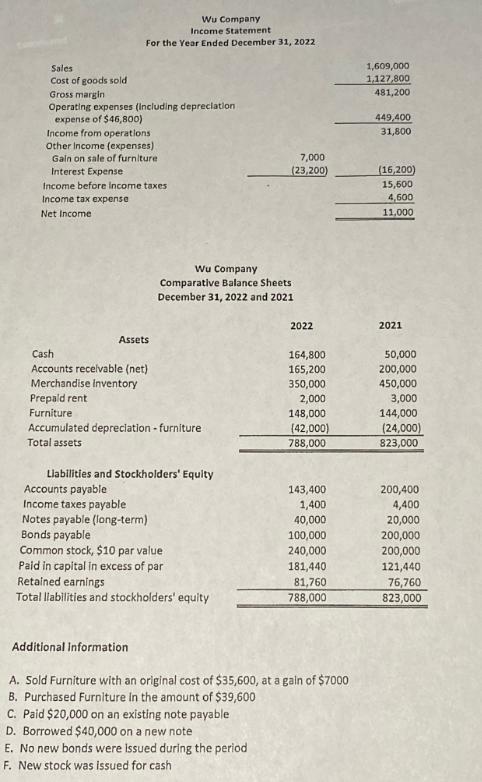

Prepare a statement of cash flows for Wu using the indirect method. Sales Cost of goods sold Wu Company Income Statement For the Year Ended December 31, 2022 Gross margin Operating expenses (Including depreciation. expense of $46,800) Income from operations Other Income (expenses) Gain on sale of furniture Interest Expense Income before income taxes Income tax expense Net Income Wu Company Comparative Balance Sheets December 31, 2022 and 2021 1,609,000 1,127,800 481,200 449,400 31,800 7,000 (23,200) (16,200) 15,600 4,600 11,000 2022 2021 Assets Cash 164,800 50,000 Accounts receivable (net) 165,200 200,000 Merchandise Inventory 350,000 450,000 Prepaid rent 2,000 3,000 Furniture 148,000 144,000 Accumulated depreciation - furniture (42,000) (24,000) Total assets 788,000 823,000 Liabilities and Stockholders' Equity Accounts payable 143,400 200,400 Income taxes payable 1,400 4,400 Notes payable (long-term) 40,000 20,000 Bonds payable 100,000 200,000 Common stock, $10 par value 240,000 200,000 Paid in capital in excess of par 181,440 121,440 Retained earnings 81,760 76,760 Total liabilities and stockholders' equity 788,000 823,000 Additional Information A. Sold Furniture with an original cost of $35,600, at a gain of $7000 B. Purchased Furniture in the amount of $39,600 C. Paid $20,000 on an existing note payable D. Borrowed $40,000 on a new note E. No new bonds were issued during the period F. New stock was issued for cash

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Absolutely I can help you prepare the statement of cash flows using the indirect method based on the information provided in the Wu Companys income statement and comparative balance sheets for the yea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started