Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Wolverine Corporation is working at full production capacity producing 9,000 units of a unique product, Everlast. Manufacturing cost per unit for Everlast is

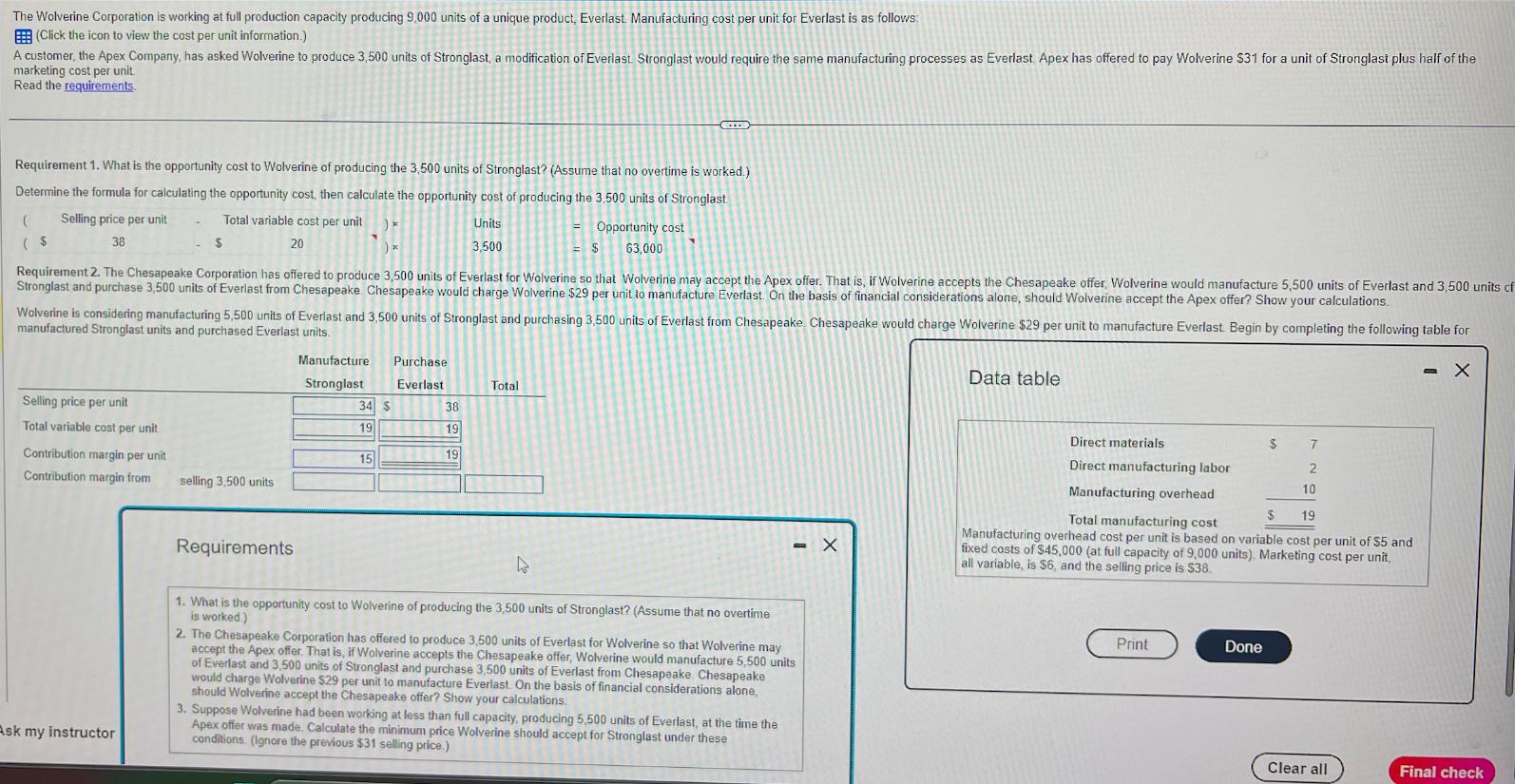

The Wolverine Corporation is working at full production capacity producing 9,000 units of a unique product, Everlast. Manufacturing cost per unit for Everlast is as follows: (Click the icon to view the cost per unit information.) A customer, the Apex Company, has asked Wolverine to produce 3,500 units of Stronglast, a modification of Everlast. Stronglast would require the same manufacturing processes as Everlast. Apex has offered to pay Wolverine $31 for a unit of Stronglast plus half of the marketing cost per unit. Read the requirements. Requirement 1. What is the opportunity cost to Wolverine of producing the 3,500 units of Stronglast? (Assume that no overtime is worked.) ( Total variable cost p per unit )* Determine the formula for calculating the opportunity cost, then calculate the opportunity cost of producing the 3,500 units of Stronglast Selling price per unit ( $ 38 $ 20 Units 3,500 = $ Opportunity cost 63,000 Requirement 2. The Chesapeake Corporation has offered to produce 3,500 units of Everlast for Wolverine so that Wolverine may accept the Apex offer. That is, if Wolverine accepts the Chesapeake offer, Wolverine would manufacture 5,500 units of Everlast and 3,500 units cf Stronglast and purchase 3,500 units of Everlast from Chesapeake Chesapeake would charge Wolverine $29 per unit to manufacture Everlast. On the basis of financial considerations alone, should Wolverine accept the Apex offer? Show your calculations. Wolverine is considering manufacturing 5,500 units of Everlast and 3,500 units of Stronglast and purchasing 3,500 units of Everlast from Chesapeake. Chesapeake would charge Wolverine $29 per unit to manufacture Everlast. Begin by completing the following table for manufactured Stronglast units and purchased Everlast units. Manufacture Purchase Stronglast Everlast Total Selling price per unit 34 $ 38 Total variable cost per unit Contribution margin per unit Contribution margin from 19 19 15 19 selling 3,500 units Ask my instructor Requirements 1. What is the opportunity cost to Wolverine of producing the 3,500 units of Stronglast? (Assume that no overtime is worked.) 2. The Chesapeake Corporation has offered to produce 3,500 units of Everlast for Wolverine so that Wolverine may accept the Apex offer. That is, if Wolverine accepts the Chesapeake offer, Wolverine would manufacture 5,500 units of Everlast and 3,500 units of Stronglast and purchase 3,500 units of Everlast from Chesapeake Chesapeake would charge Wolverine $29 per unit to manufacture Everlast. On the basis of financial considerations alone, should Wolverine accept the Chesapeake offer? Show your calculations. 3. Suppose Wolverine had been working at less than full capacity, producing 5,500 units of Everlast, at the time the Apex offer was made. Calculate the minimum price Wolverine should accept for Stronglast under these conditions. (Ignore the previous $31 selling price.) - X Data table Direct materials $ 7 Direct manufacturing labor 2 10 Manufacturing overhead $ 19 Total manufacturing cost Manufacturing overhead cost per unit is based on variable cost per unit of $5 and fixed costs of $45,000 (at full capacity of 9,000 units). Marketing cost per unit, all variable, is $6, and the selling price is $38. Print Done Clear all Final check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started