Answered step by step

Verified Expert Solution

Question

1 Approved Answer

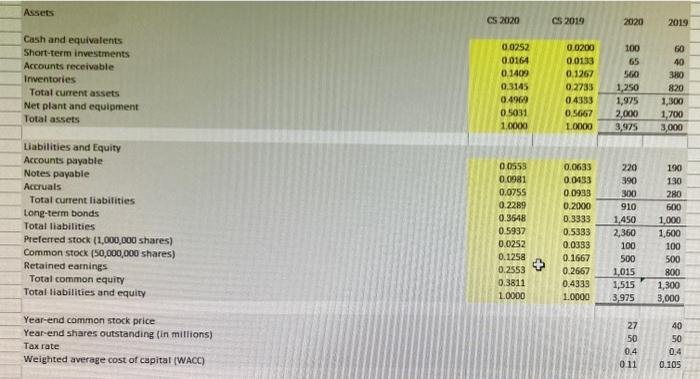

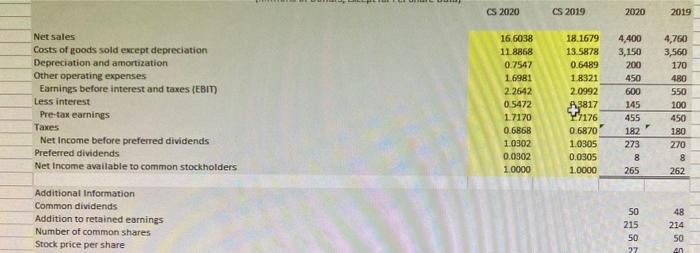

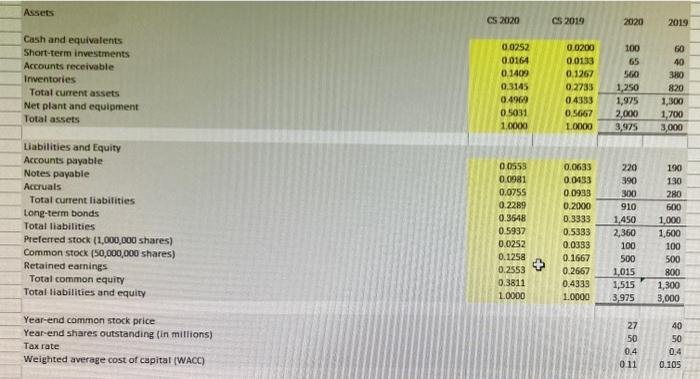

comment on 5 interest area and how they will be deen in the dtatement of cash flow Assets CS 2020 CS 2019 2020 2019 Cash

comment on 5 interest area and how they will be deen in the dtatement of cash flow

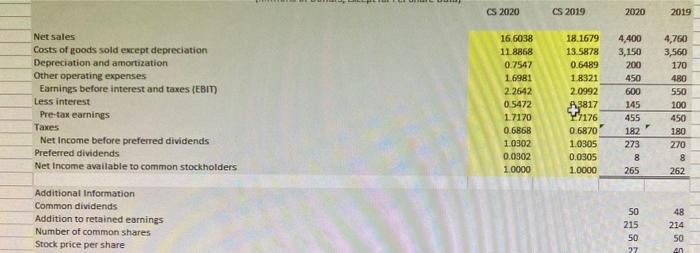

Assets CS 2020 CS 2019 2020 2019 Cash and equivalents Short-term investments Accounts receivable Inventories Total current assets Net plant and equipment Total assets 0.0252 0.0164 0.1409 0.3145 0.4969 05031 1.0000 0.0200 0.0133 0.1267 0.2733 0.4335 0.5667 10000 100 65 560 1,250 1,975 2,000 3,975 60 40 380 820 1,300 1,700 3,000 220 190 390 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total liabilities Preferred stock (1,000,000 shares) Common stock (50,000,000 shares) Retained earnings Total common equity Total liabilities and equity 0.0553 0.0981 0.0755 0.2289 0.3648 0.5937 0.0252 0.1258 0.2553 0.3811 10000 0.0633 0.0433 0.0933 0.2000 0.3333 0.5333 0.0333 0.1667 0.2667 0.4333 1.0000 300 910 1.450 2,360 100 130 280 600 1,000 1,600 100 500 800 1,300 3,000 + 500 1,015 1,515 3,975 Year-end common stock price Year-end shares outstanding (in millions) Tax rate Weighted average cost of capital (WACC) 27 50 0.4 0.11 40 50 0.4 0.105 CS 2020 CS 2019 2020 2019 Net sales Costs of goods sold except depreciation Depreciation and amortization Other operating expenses Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes Net Income before preferred dividends Preferred dividends Net Income available to common stockholders 16,6038 11.8868 0.7547 16981 2.2642 0.5472 17170 0.6868 1.0302 0.0302 10000 18.1679 13.5878 0.6489 1.8321 2.0992 A3817 17176 0.6870 1.0305 0.0305 1.0000 4,400 3,150 200 450 600 145 455 182 273 8 265 4,760 3,560 170 480 550 100 450 180 270 8 262 Additional Information Common dividends Addition to retained earnings Number of common shares Stock price per share 50 215 50 27 48 214 50 an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started