Answered step by step

Verified Expert Solution

Question

1 Approved Answer

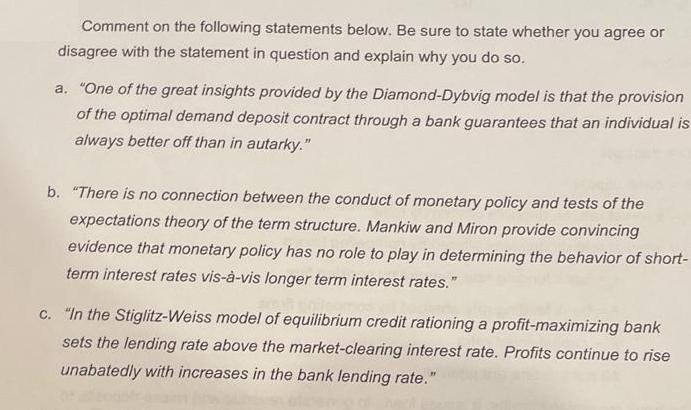

Comment on the following statements below. Be sure to state whether you agree or disagree with the statement in question and explain why you

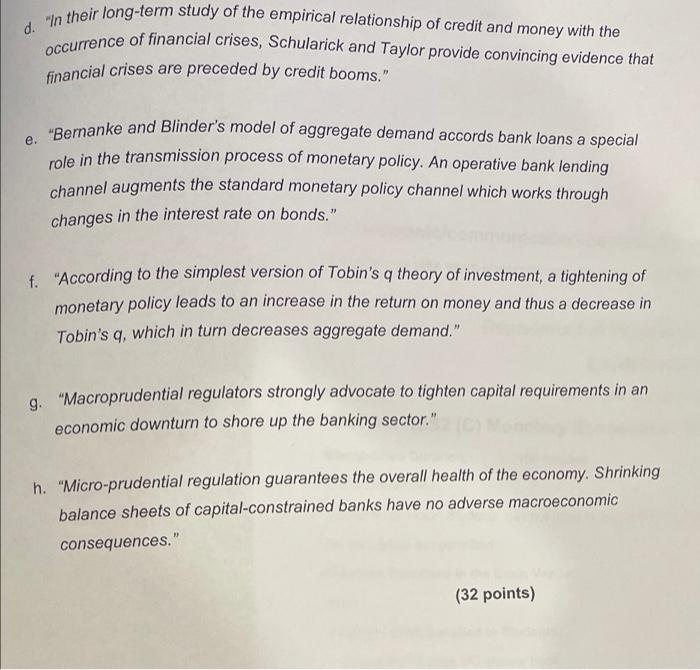

Comment on the following statements below. Be sure to state whether you agree or disagree with the statement in question and explain why you do so. a. "One of the great insights provided by the Diamond-Dybvig model is that the provision of the optimal demand deposit contract through a bank guarantees that an individual is always better off than in autarky." b. "There is no connection between the conduct of monetary policy and tests of the expectations theory of the term structure. Mankiw and Miron provide convincing evidence that monetary policy has no role to play in determining the behavior of short- term interest rates vis--vis longer term interest rates." c. "In the Stiglitz-Weiss model of equilibrium credit rationing a profit-maximizing bank sets the lending rate above the market-clearing interest rate. Profits continue to rise unabatedly with increases in the bank lending rate." financial crises are preceded by credit booms." d. "In their long-term study of the empirical relationship of credit and money with the Occurrence of financial crises, Schularick and Taylor provide convincing evidence that "Rernanke and Blinder's model of aggregate demand accords bank loans a special role in the transmission process of monetary policy. An operative bank lending . channel augments the standard monetary policy channel which works through changes in the interest rate on bonds." f "According to the simplest version of Tobin's q theory of investment, a tightening of monetary policy leads to an increase in the return on money and thus a decrease in Tobin's q, which in turn decreases aggregate demand." g. "Macroprudential regulators strongly advocate to tighten capital requirements in an economic downturn to shore up the banking sector." h. "Micro-prudential regulation guarantees the overall health of the economy. Shrinking balance sheets of capital-constrained banks have no adverse macroeconomic consequences." (32 points)

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

A Agreed One of the greatest implications from the Diamond Dybvig model is that provision of demand ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started