Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comments References Mailings Review View Help Share X Calibri 12 o LA BIU - ab X, X A 19 Styles Editing Dictate Sensitivity A-DA A

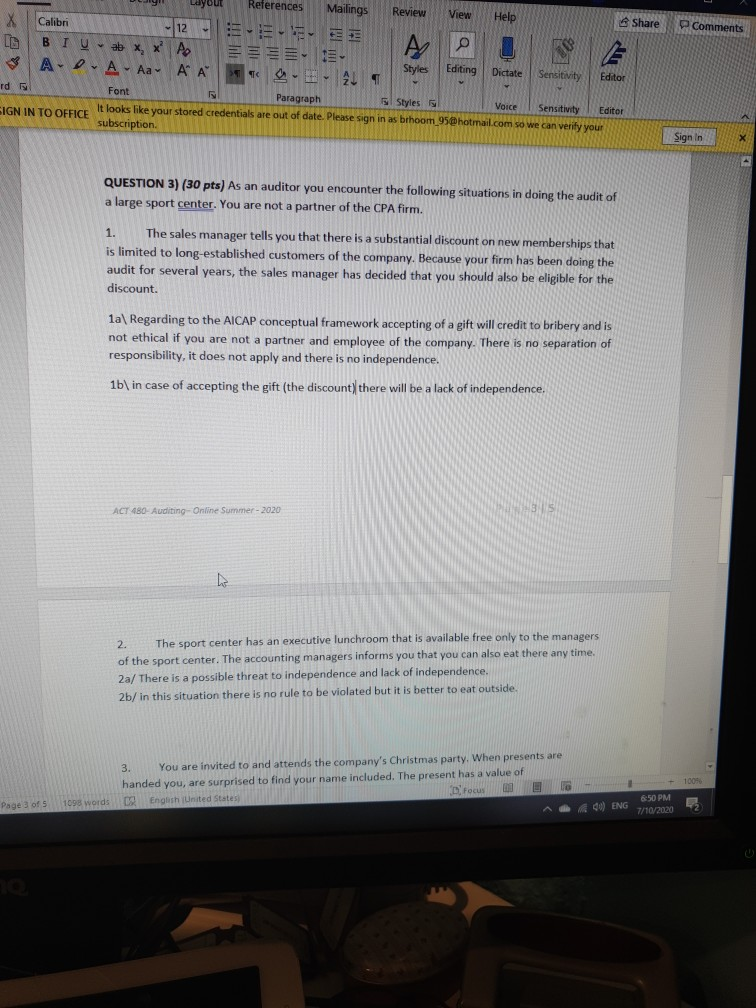

Comments References Mailings Review View Help Share X Calibri 12 o LA BIU - ab X, X A 19 Styles Editing Dictate Sensitivity A-DA A A A Editor - AL Td Font Paragraph 5 Styles Voice Sensitivity Editor SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as broom_95@hotmail.com so we can verify your subscription Sign In X QUESTION 3) (30 pts) As an auditor you encounter the following situations in doing the audit of a large sport center. You are not a partner of the CPA firm. 1. The sales manager tells you that there is a substantial discount on new memberships that is limited to long-established customers of the company. Because your firm has been doing the audit for several years, the sales manager has decided that you should also be eligible for the discount. 1a\ Regarding to the AICAP conceptual framework accepting of a gift will credit to bribery and is not ethical you are not a partner and employee of the company. There is no separation of responsibility, it does not apply and there is no independence. 1b\ in case of accepting the gift (the discount) there will be a lack of independence, ACT 480- Auditing - Online Summer - 2020 2. The sport center has an executive lunchroom that is available free only to the managers of the sport center. The accounting managers informs you that you can also eat there any time. 2a/ There is a possible threat to independence and lack of independence. 2b/ in this situation there is no rule to be violated but it is better to eat outside, 3. You are invited to and attends the company's Christmas party. When presents are handed you, are surprised to find your name included. The present has a value of English (United States) D Focus + 1007 6:50 PM 7/10/2020 Page 3 of 5 1098 words 00) ENG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started