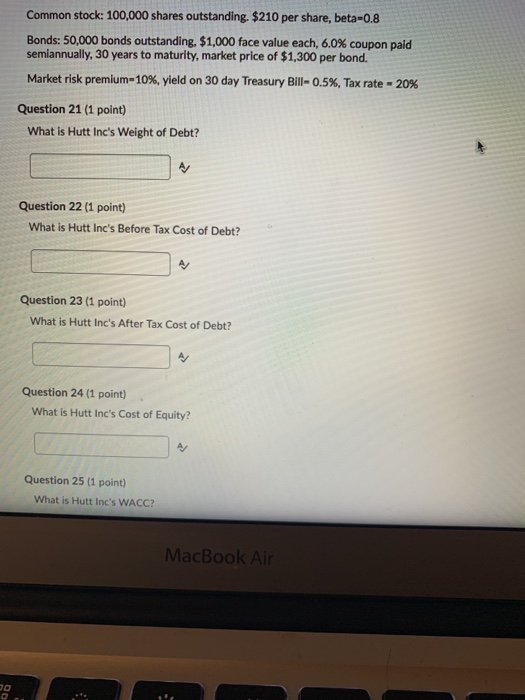

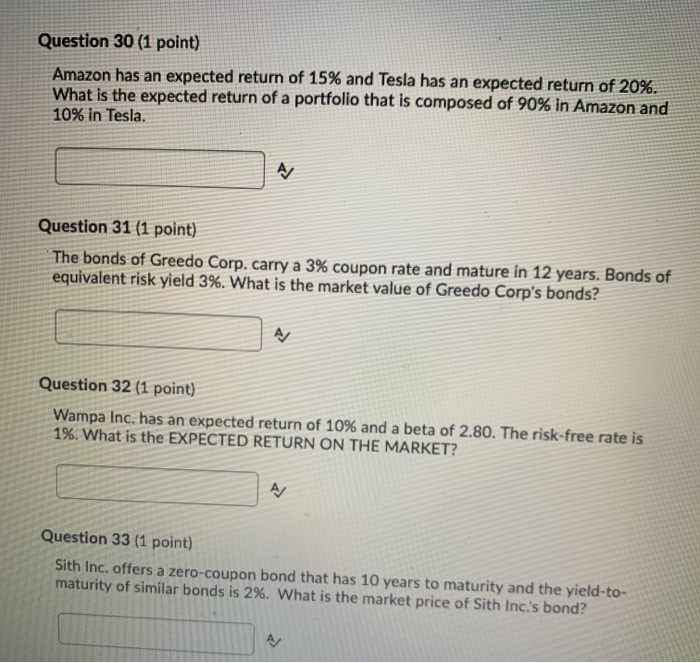

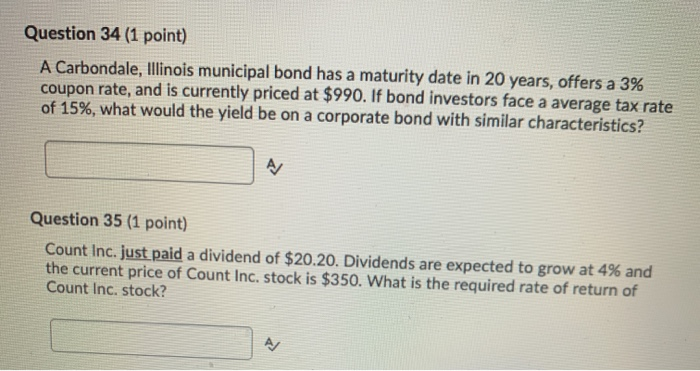

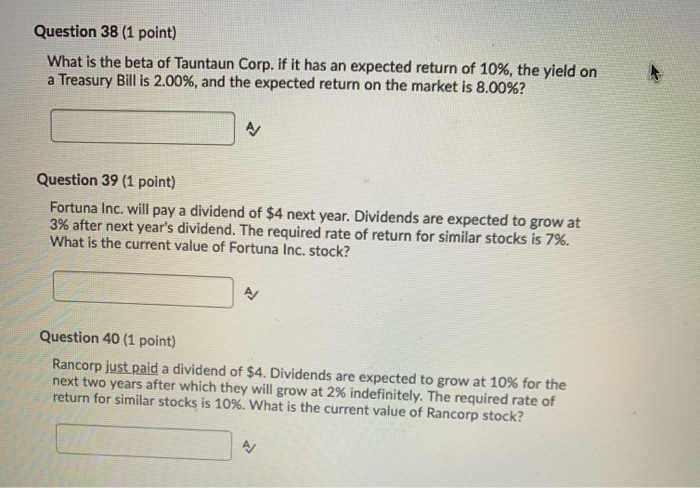

Common stock: 100,000 shares outstanding. $210 per share, beta-0.8 Bonds: 50,000 bonds outstanding. $1,000 face value each, 6.0% coupon paid semiannually, 30 years to maturity, market price of $1,300 per bond. Market risk premium-10%, yield on 30 day Treasury Bill-0.5%, Tax rate - 20% Question 21 (1 point) What is Hutt Inc's Weight of Debt? Question 22 (1 point) What is Hutt Inc's Before Tax Cost of Debt? Question 23 (1 point) What is Hutt Inc's After Tax Cost of Debt? Question 24 (1 point) What is Hutt Inc's Cost of Equity? Question 25 (1 point) What is Hutt Inc's WACC? MacBook Air si Question 30 (1 point) Amazon has an expected return of 15% and Tesla has an expected return of 20%. What is the expected return of a portfolio that is composed of 90% in Amazon and 10% in Tesla. The bonds of Greedo Corp. carry a 3% coupon rate and mature in 12 years. Bonds of equivalent risk yield 3%. What is the market value of Greedo Corp's bonds? Question 32 (1 point) Wampa Inc. has an expected return of 10% and a beta of 2.80. The risk-free rate is 1%. What is the EXPECTED RETURN ON THE MARKET? Question 33 (1 point) Sith Inc. offers a zero-coupon bond that has 10 years to maturity and the yield-to- maturity of similar bonds is 2%. What is the market price of Sith Inc.'s bond? Question 34 (1 point) A Carbondale, Illinois municipal bond has a maturity date in 20 years, offers a 3% coupon rate, and is currently priced at $990. If bond investors face a average tax rate of 15%, what would the yield be on a corporate bond with similar characteristics? Question 35 (1 point) Count Inc. just paid a dividend of $20.20. Dividends are expected to grow at 4% and the current price of Count Inc. stock is $350. What is the required rate of return of Count Inc. stock? Question 38 (1 point) What is the beta of Tauntaun Corp. if it has an expected return of 10%, the yield on a Treasury Bill is 2.00%, and the expected return on the market is 8.00%? Question 39 (1 point) Fortuna Inc. will pay a dividend of $4 next year. Dividends are expected to grow at 3% after next year's dividend. The required rate of return for similar stocks is 7%. What is the current value of Fortuna Inc. stock? Question 40 (1 point) Rancorp just paid a dividend of $4. Dividends are expected to grow at 10% for the next two years after which they will grow at 2% indefinitely. The required rate of return for similar stocks is 10%. What is the current value of Rancorp stock