Question

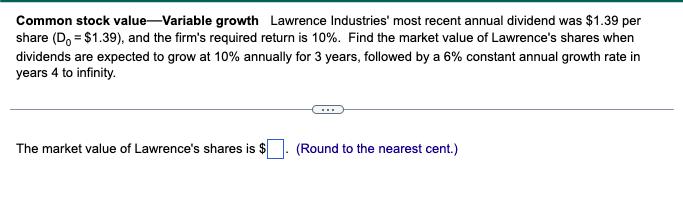

Common stock value-Variable growth Lawrence Industries' most recent annual dividend was $1.39 per share (Do $1.39), and the firm's required return is 10%. Find

Common stock value-Variable growth Lawrence Industries' most recent annual dividend was $1.39 per share (Do $1.39), and the firm's required return is 10%. Find the market value of Lawrence's shares when dividends are expected to grow at 10% annually for 3 years, followed by a 6% constant annual growth rate in years 4 to infinity. The market value of Lawrence's shares is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given D0 139 current annual dividend per share k 10 required rate of return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance Brief

Authors: Chad J. Zutter, Scott B. Smart

8th Global Edition

1292267143, 978-1292267142

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App