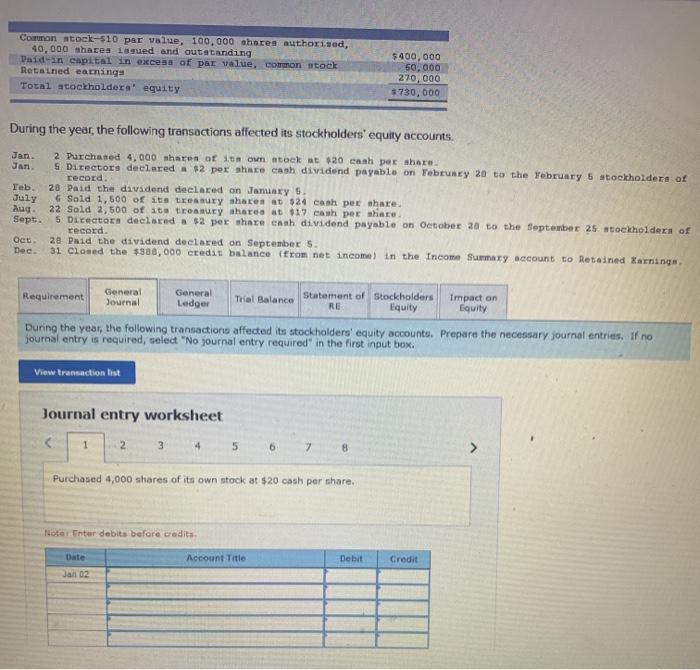

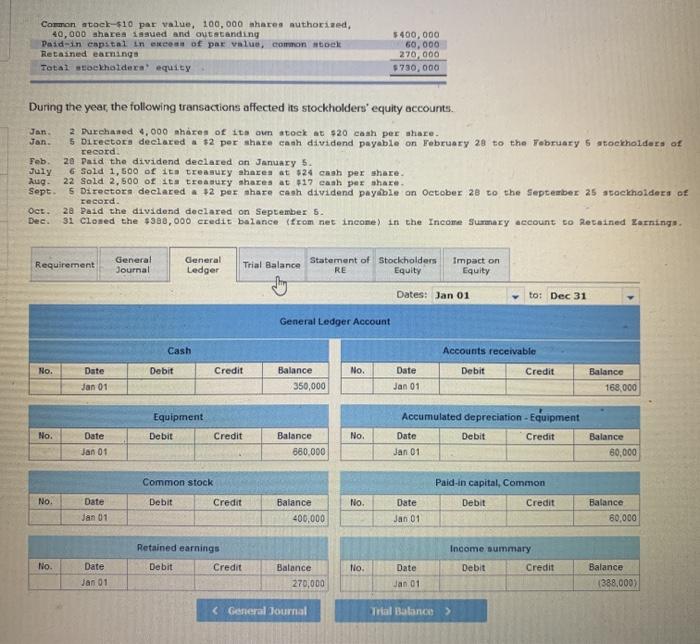

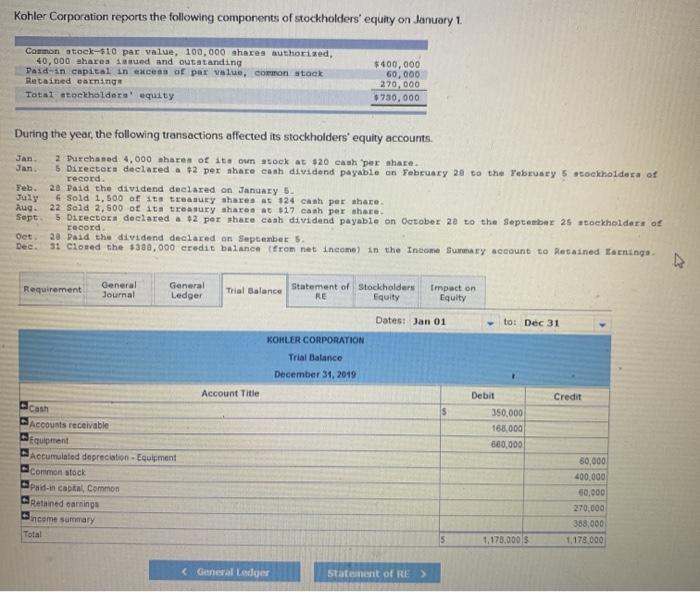

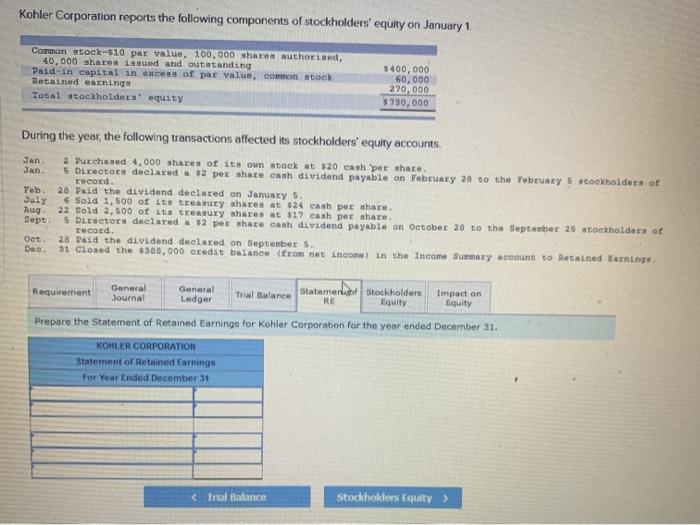

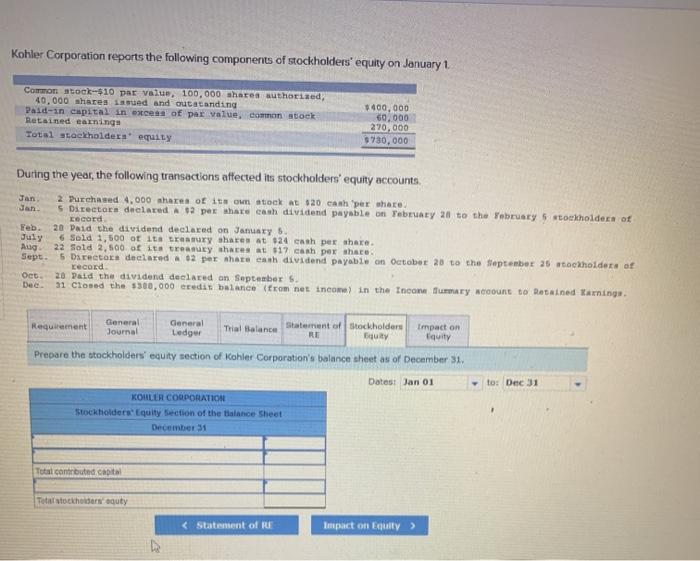

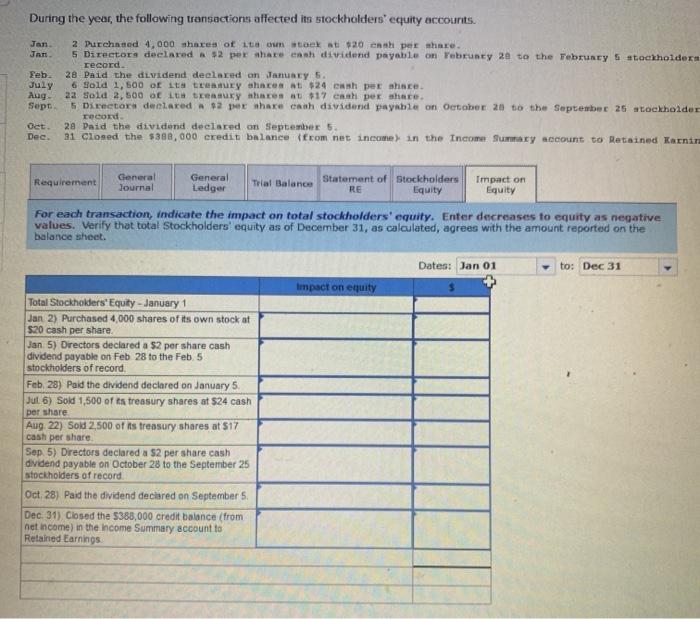

Common stock-510 par value, 100,000 shares authorised, 40,000 shares issued and outstanding Daid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $400,000 50,000 270,000 $ 730,000 During the year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,000 shares of its own atokat 20 cash per share. Jan S Directors declared a $2 per shace cash dividend payable on February 20 to the Yebruary 6 stockholders of record Teb 28 Paid the dividend declared on January 5. July 6 Sold 1,500 of its treasury shares at $24 cash per share. Aug. 22 Sold 2,500 of its treasury shares at 17 cash per share. Sept. 5 Directors declared a $2 per share cash dividend payable on October 20 to the September 25 stockholders of record Oct 2a Daid the dividend declared on September 5. Dee 31 Closed the $300,000 credit balance from net income) in the Income Summary account to Retained Earnings Requirement General Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity During the year, the following transactions affected its stockholders' equity accounts. Prepare the necessary journal entries. If no journal entry is required, select "No journal entry required" in the first input box. View transaction tist Journal entry worksheet 1 2 3 5 7 8 Purchased 4,000 shares of its own stock at $20 cash per share, Note Entor debits before credits Account Title Debit Credit Date Jan 02 Common stock-$10 par value, 100,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value, common boek Retained earnings Total stockholders' equity $400,000 60,000 270,000 $ 730,000 During the year, the following transactions affected its stockholders' equity accounts. Jan. 3 Purchased 4,000 shares of its own stock at $20 cash per share. Jan. 5 Directors declared a $2 per share canh dividend payable on February 28 to the February S stockholders of record Feb 20 Paid the dividend declared on January 5. July G Sold 1,500 of its treasury shares at 524 cash per share. Aug 22 Sold 2.500 of its treasury shares at 517 cash per share. Sept 5 Directora declared 12 per share cash dividend payable on October 28 to the September 25 stockholders of record Oct. 28 Paid the dividend declared on September 5. Dec. 31 Cloned the $300,000 credit balance (from net income) in the Income Summary account to Retained Larnings Requirement General Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity Dates: Jan 01 to: Dec 31 General Ledger Account Cash Accounts receivable Debit Credit No. Debit Credit No. Date Jan 01 Balance 350,000 Date Jan 01 Balance 168,000 Equipment No. Debit Credit No. Date Jan 01 Date Accumulated depreciation - Equipment Debit Credit Jan 01 Balance 660.000 Balance 80,000 Common stock Paid-in capital, Common No. Debit Credit No. Date Debit Credit Date Jan 01 Balance 400,000 Balance 60,000 Jan 01 Retained earnings Debit Credit Income summary Debit Credit NO. No. Date Jan 01 Balance 270,000 Date Jan 01 Balance (388,000) Kohler Corporation reports the following components of stockholders' equity on January Common stock-$10 par value. 100,000 shares authorised, 40,000 shares sued and outstanding Dasdan capital in excess of par value, common stock Retained earnings Total stockholders' equity $400,000 60,000 270,000 $750,000 During the year, the following transactions affected its stockholders' equity accounts. Jan Jan Feb. July Aug Sept 2. Durchased 4,000 shares of its own cock at $20 cash per share 5 Directora declared a 62 per abate cash dividend payable on February 20 to the February 5 stockholders of record 20 Daid the dividend declared on January 5. 6 Sold 1,500 of its treasury shares as 924 cash per share 22 Sold 2.500 of its treasury shares at 817 cash per share. 5 Director declared a 92 per share cash dividend payable on October 20 to the September 25 stockholders of record 20 Paid the dividend declared on September 5. 31 closed the $300,000 credit balance from net income in the Income Smary account to Retained Earnings. Oet Dee. Requirement General Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity Datest Jan 01 to: Dec 31 KOHLER CORPORATION Trial Balance December 31, 2019 Account Title Credit Debit 350,000 168,000 660,000 Accounts receivable Equipment Accumulated depreciation - Equipment Common stock Paid-in capital, Common Retained earnings income summary Total 50,000 400.000 50.000 270.000 388,000 1.178.000 5 1,178,000 $ Kohler Corporation reports the following components of stockholders' equity on January 1 Common stock-$10 par value, 100,000 shares authorised: 40,000 shares inued and outstanding Paid-in capital in excess of par value. common stock Retained earnings Total stockholders' equity $400,000 60.000 270,000 $780,000 Jan During the year, the following transactions affected its stockholders' equity accounts. Jan 2 Purchased 4,000 shares of its own stock at $20 cash per share 5 Directora declared 62 per share cash dividend payable on February 21 to the February 5 Coelholders of Ocord 20 Paid the dividend declared on January 5. July 6 Sold 1,500 ot its tresury shares at 924 cash per share Aug 22 Sold 2.500 of its truey shares at $17 cash per share Sept 5 Directors declared a 12 per share canh dividend payable on October 28 to the September 25 tockholders of Kecord OCE 20 Dald the dividend declared on September S. Dee 31 closed the $300,000 credit balance from net income in the Incon fummary account to Retained Taming Teb Requirement General Journal General Ledger Trial Balance Statement of stockholders RE Equity Impact on Equity Prepare the stockholders' equity section of Kohler Corporation's balance sheet as of December 31. Datest Jan 01 KOHLER CORPORATION Stockholders' Equity Section of the Balance Sheet to: Dec 31 December 31 Total contbuted capital Total stockholders guty During the year, the following transactions affected its stockholders' equity accounts. Jan Jan Feb. July Aug Sept 2 Purchased 4,000 shares of its own teksti 20 cash per share. 5 Directors declared $2 per share cash dividend payable on Yebruary 20 to the Teruey 5 stockholders record 28 Paid the dividend declared on January 5. 6 Sold 1,500 of its trury haces at $24 cash per share 22 Sold 2,500 of te treasury whares at $17 ens per shte. 5 Director declared $2 per share cash dividend payable on October 28 to the September 25 stockholder record 28 Paid the dividend declared on September 5. 31 closed the $380,000 credit balance from net income in the Income Summary account to Retained Karin Det Dec Requirement General Journal General Ledger Trial Balance Statement of Stockholders RE Equity Impact on Equity For each transaction, indicate the impact on total stockholders' equity. Enter decreases to equity as negative values. Verify that total Stockholders' equity as of December 31, as calculated, agrees with the amount reported on the balance sheet. Dates: Jan 01 to: Dec 31 Impact on equity Total Stockholders' Equity - January 1 Jan 2) Purchased 4,000 shares of its own stock at $20 cash per share. Jan 5) Directors declared a $2 per share cash dividend payable on Feb 28 to the Feb. 5 stockholders of record Feb 28) Paid the dividend declared on January 5. Jul 6) Sold 1,500 of ts treasury shares at $24 cash per share Aug 22) Sold 2,500 of its treasury shares at 517 cash per share Sep 5) Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record Oct. 28) Paid the dividend declared on September 5. Dec 31) Closed the $388,000 credit balance (from net income) in the income Summary account to Retained Earnings