Question

The founder of Frenza asks us to assist her in accounting and analysis of the corporations bonds, which have an annual contract rate of 8%.

The founder of Frenza asks us to assist her in accounting and analysis of the corporations bonds, which have an annual contract rate of 8%. She wants to know the business and accounting implications of further debt issuances as she looks for ways to finance the growth of Frenza. The following Tableau Dashboard is provided to help us address her questions and provide recommendations for her business decisions.

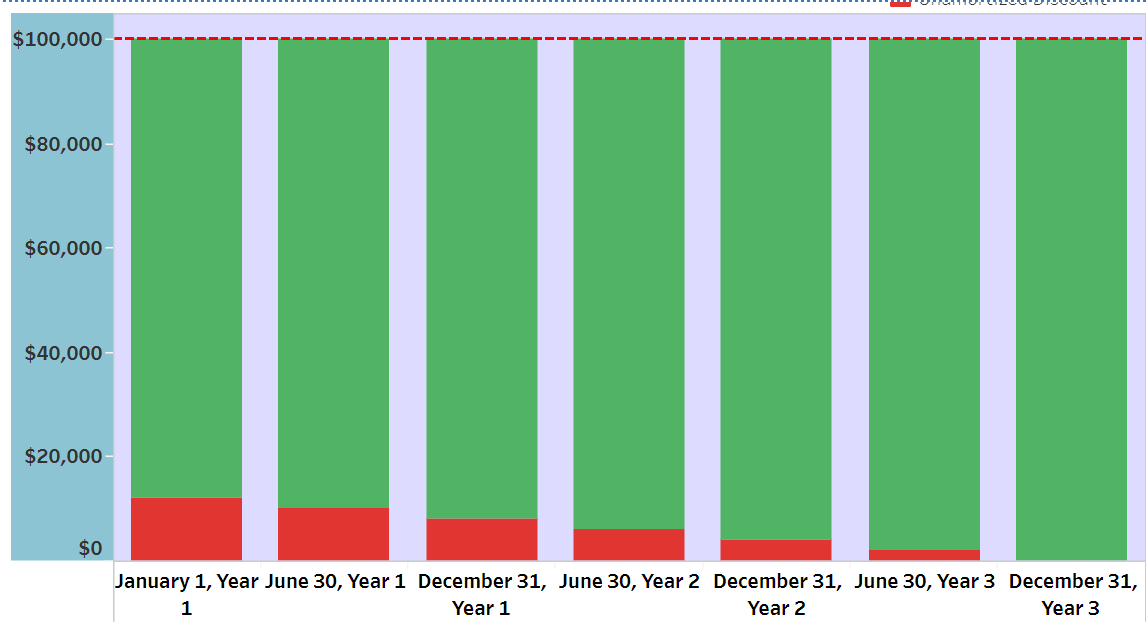

Frenza Bond Amortization (Carrying Value (Green)) (Unamortized Discount (red))

Frenza: January 1, Year 1 Carrying Value:$88,000 (green)

Frenza: January 1, Year 1 Carrying Value:$88,000 (green)

Frenza: June 30, Year 1 Carrying Value: $90,000 (green)

Frenza: December 31, Year 1 Carrying Value: $92,000 (green)

Frenza: June 30, Year 2 Carrying Value: $94,000 (green)

Frenza: December 31, Year 2 Carrying Value: $96,000 (green)

Frenza: June 30, Year 3 Carrying Value: $98,000 (green)

Frenza: December 31, Year 3 Carrying Value: $100,000 (green)

Frenza: January 1, Year 1 Unamortized Discount: $12,000 (red)

Frenza: June 30, Year 1 Unamortized Discount: $10,000 (red)

Frenza: December 31, Year 1 Unamortized: $8,000 (red)

Frenza: June 30, Year 2 Unamortized Discount: $6,000 (red)

Frenza: December 31, Year 2 Unamortized Discount: $4,000 (red)

Frenza: June 30, Year 3 Carrying: $98,000 (red)

Rest of the part of the both Graph

Rest of the part of the both Graph

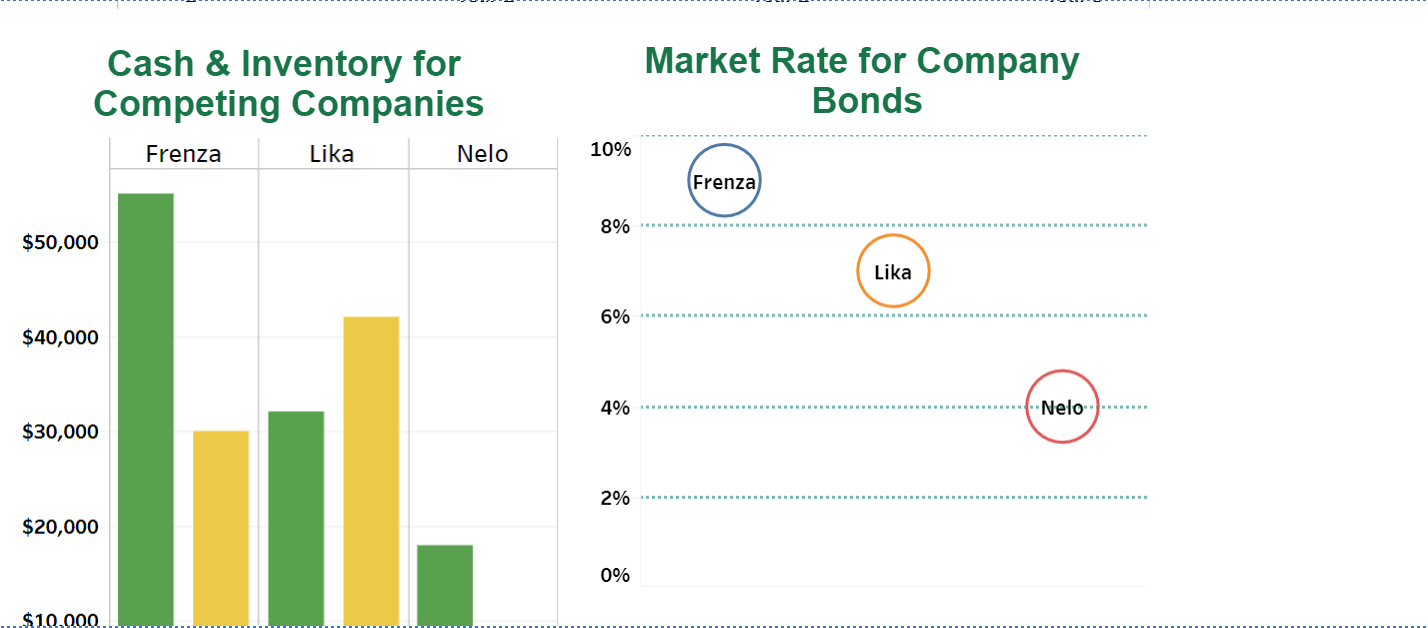

Frenza Cash: $55,000 (green)

Frenza Inventory: $30,000 (yellow)

Lika Cash: $32,000 (green)

Lika Inventory: $42,000 (yellow)

Nelo Cash: $18,000 (green)

Nelo Inventory; $7,000 (yellow)

Frenza Market Rate for Bonds: 9%

Lika Market Rate for Bonds: 7%

Nelo Market Rate for Bonds: 4%

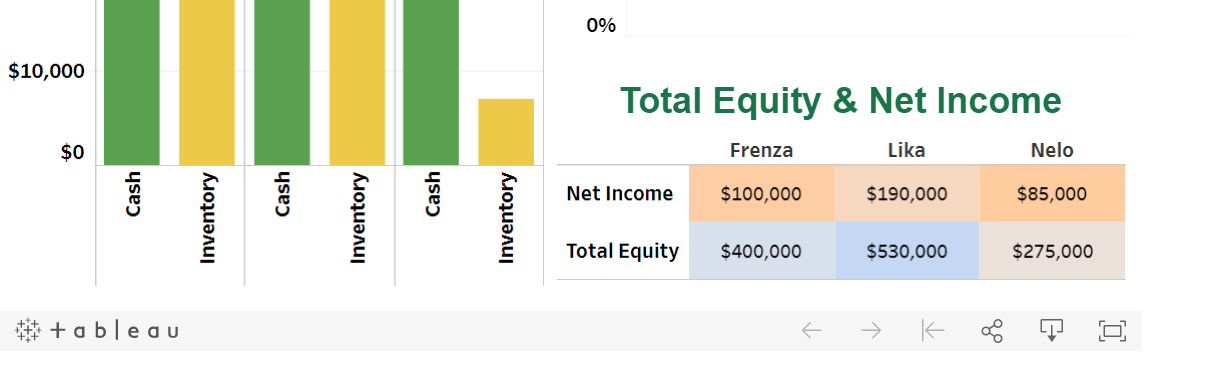

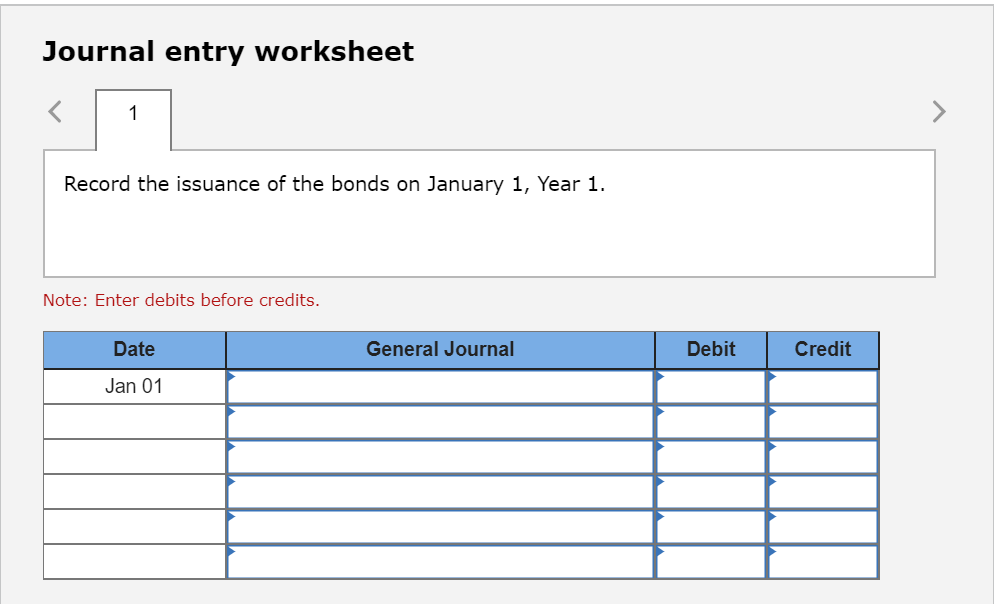

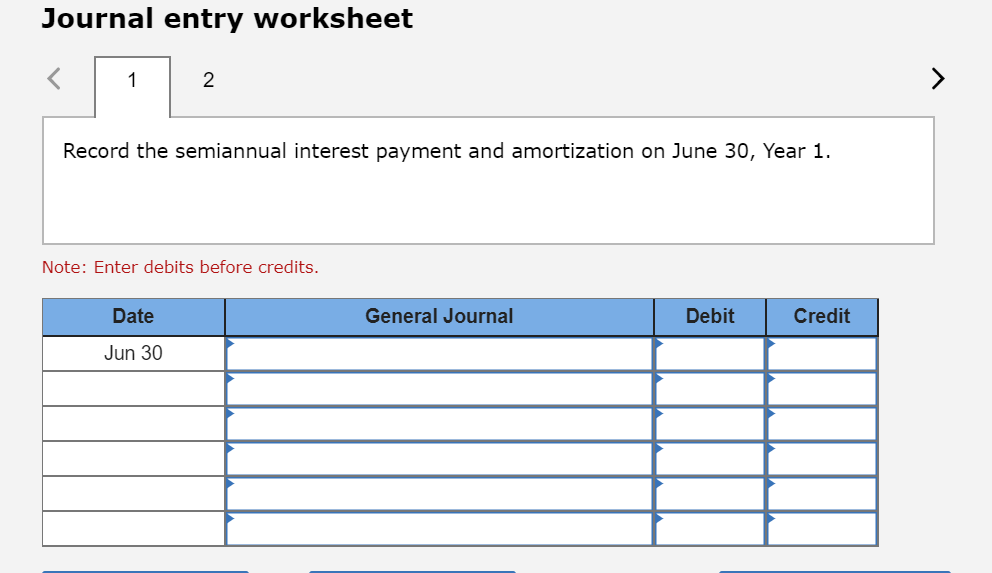

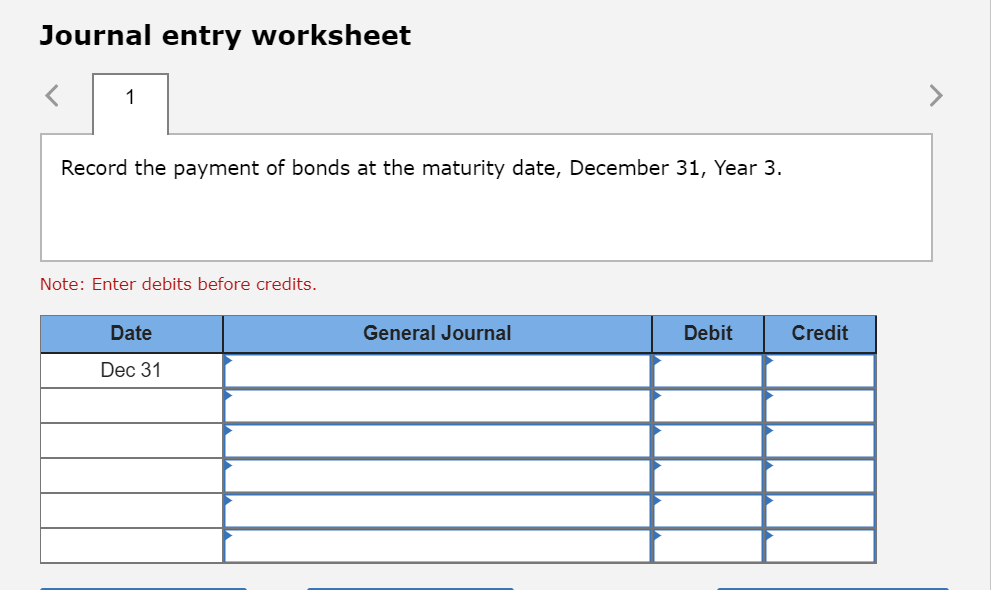

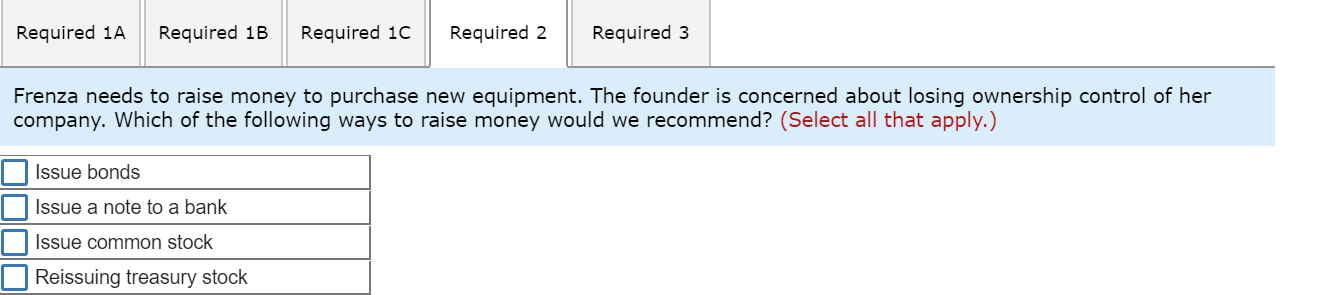

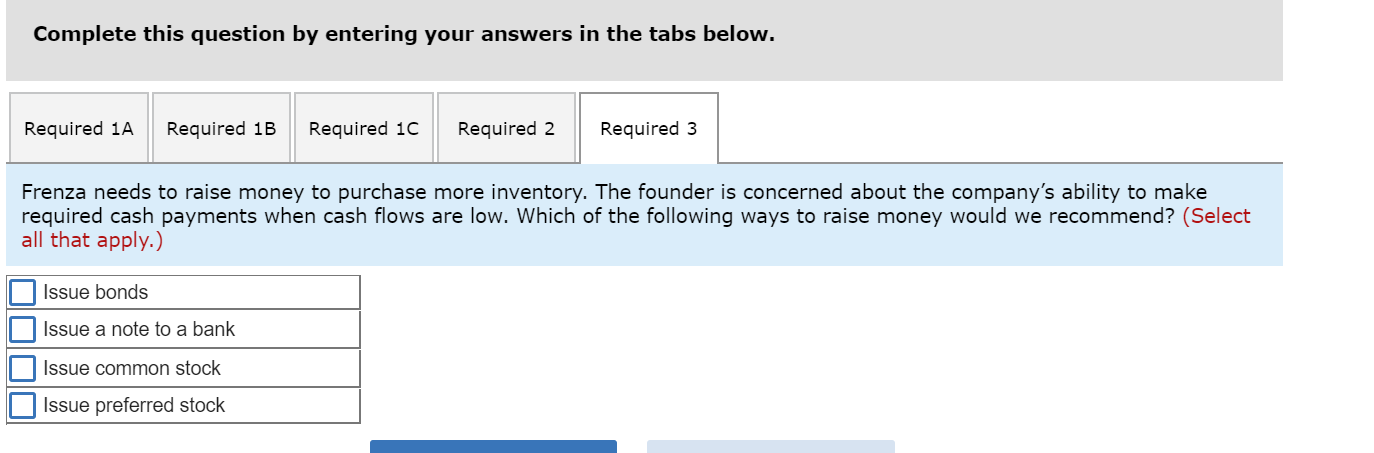

1(a). Prepare journal entries to record the issuance of Frenza bonds on January 1, Year 1. 1(b). Prepare journal entries to record the first and second interest payments on June 30, Year 1, and December 31, Year 1. 1(c). Prepare journal entries to record the maturity of the bonds on December 31, Year 3. 2. Frenza needs to raise money to purchase new equipment. The founder is concerned about losing ownership control of her company. Which of the following ways to raise money would we recommend? 3. Frenza needs to raise money to purchase more inventory. The founder is concerned about the companys ability to make required cash payments when cash flows are low. Which of the following ways to raise money would we recommend?

Options for General Journal

Options for General Journal

- Accounts payable

- Accounts receivable

- Accumulated depreciation

- Bond interest expense

- Bond interest payable

- Bonds payable

- Cash

- Common stock

- Contributed capital in excess of par value

- Depreciation expense

- Discount on bonds payable

- Gain on retirement of bonds payable

- Interest payable

- Lease liability

- Leased asset

- Loss on retirement of bonds payable

- Premium on bonds payable

- Rental expense

2) Record the semiannual interest payment and amortization on December 31, Year 1.

2) Record the semiannual interest payment and amortization on December 31, Year 1.

Options for General Journal

- Accounts payable

- Accounts receivable

- Accumulated depreciation

- Bond interest expense

- Bond interest payable

- Bonds payable

- Cash

- Common stock

- Contributed capital in excess of par value

- Depreciation expense

- Discount on bonds payable

- Gain on retirement of bonds payable

- Interest payable

- Lease liability

- Leased asset

- Loss on retirement of bonds payable

- Premium on bonds payable

- Rental expense

Options for General Journal

- Accounts payable

- Accounts receivable

- Accumulated depreciation

- Bond interest expense

- Bond interest payable

- Bonds payable

- Cash

- Common stock

- Contributed capital in excess of par value

- Depreciation expense

- Discount on bonds payable

- Gain on retirement of bonds payable

- Interest payable

- Lease liability

- Leased asset

- Loss on retirement of bonds payable

- Premium on bonds payable

- Rental expense

$100,000- $80,000 $60,000 $40,000 $20,000 $0 January 1, Year June 30, Year 1 December 31, June 30, Year 2 December 31, June 30, Year 3 December 31, Year 1 Year 3 Year 2 Market Rate for Company Cash & Inventory for Competing Companies Bonds 10% Lika Nelo Frenza Frenza $50,000 Lika 6% $40,000 Nelo 4% $30,000 2% $20,000 0% $10.000 0% $10,000 Total Equity & Net Income Nelo Lika $0 Frenza $85,000 Net Income $100,000 $190,000 Total Equity $400,000 $530,000 $275,000 * + a ble a u -> Cash Inventory Cash Inventory Cash Inventory Journal entry worksheet 1 Record the issuance of the bonds on January 1, Year 1. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Journal entry worksheet Record the semiannual interest payment and amortization on June 30, Year 1. Note: Enter debits before credits. Date General Journal Debit Credit Jun 30 Journal entry worksheet Record the payment of bonds at the maturity date, December 31, Year 3. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Required 1C Required 2 Required 1A Required 1B Required 3 Frenza needs to raise money to purchase new equipment. The founder is concerned about losing ownership control of her company. Which of the following ways to raise money would we recommend? (Select all that apply.) Issue bonds Issue a note to a bank Issue common stock Reissuing treasury stock Complete this question by entering your answers in the tabs below. Required 1A Required 1C Required 1B Required 2 Required 3 Frenza needs to raise money to purchase more inventory. The founder is concerned about the company's ability to make required cash payments when cash flows are low. Which of the following ways to raise money would we recommend? (Select all that apply.) Issue bonds Issue a note to a bank Issue common stock Issue preferred stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started