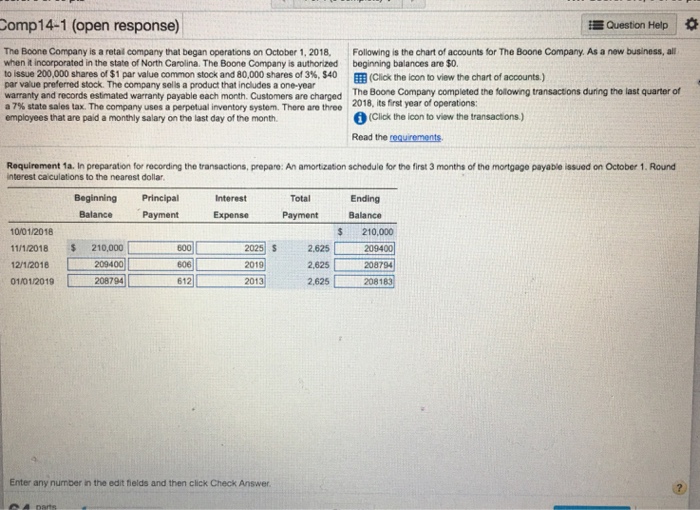

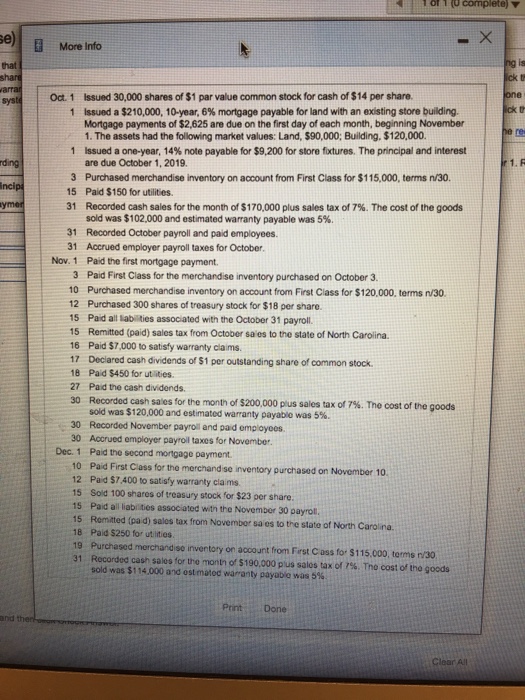

Comp14-1 (open response) EQuestion Help The Boone Company is a retail company that began operations on October 1, 2018,Following is the chart of accounts for The Boone Company. As a new business, all when it incorporated in the state of North Carolina. The Boone Company is authorized beginning balances are $0. to issue 200,000 shares of $1 par value common stock and 80,000 shares of 3%, $40 par value preferred stock. The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 7% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary on the last day of the month (Click the icon to view the chart of accounts.) The Boone Company completed the following transactions during the last quarter of 2018, its first year of operations: (Click the lcon to view the transactions) Read the requirements Requirement 1a. In preparation for recording the transactions, prepare: An amortization schodule for the first 3 months of the mortgage payable issued on October 1. Round interest caiculations to the nearest dollar Beginning Principal Balance Payment Ending Balance $210,000 Interest Total Payment Expense 10/01/2018 1/1/2018 210,000 12/120182094006062019 2.625 01/01/2019208794 s 2.625 2,625 2,625 600 2025 2094 208794 2081 612 2013 Enter any number in the edit fields and then click Check Answer a parts Comp14-1 (open response) EQuestion Help The Boone Company is a retail company that began operations on October 1, 2018,Following is the chart of accounts for The Boone Company. As a new business, all when it incorporated in the state of North Carolina. The Boone Company is authorized beginning balances are $0. to issue 200,000 shares of $1 par value common stock and 80,000 shares of 3%, $40 par value preferred stock. The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 7% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary on the last day of the month (Click the icon to view the chart of accounts.) The Boone Company completed the following transactions during the last quarter of 2018, its first year of operations: (Click the lcon to view the transactions) Read the requirements Requirement 1a. In preparation for recording the transactions, prepare: An amortization schodule for the first 3 months of the mortgage payable issued on October 1. Round interest caiculations to the nearest dollar Beginning Principal Balance Payment Ending Balance $210,000 Interest Total Payment Expense 10/01/2018 1/1/2018 210,000 12/120182094006062019 2.625 01/01/2019208794 s 2.625 2,625 2,625 600 2025 2094 208794 2081 612 2013 Enter any number in the edit fields and then click Check Answer a parts