Question

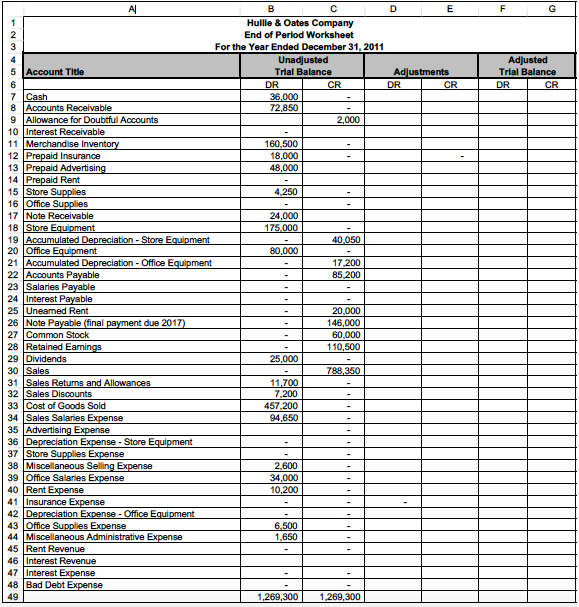

(In excel) Your required tasks are as follows: 1. On the designated worksheet, prepare in journal entry form the adjusting journal entries for the following

(In excel) Your required tasks are as follows:

1. On the designated worksheet, prepare in journal entry form the adjusting journal entries for the following items. (Round all numbers to the nearest dollar)

a. On April 1, 2011 a 12-month insurance policy was purchased for $18,000.

b. On January 1, 2011 Hullie & Oates paid Gretsky Advertising $48,000 for two years of advertising services. Equal services are provided in year 1 and year 2.

c. Hullie & Oates needed some additional storage space so on November 1, 2011 they rented a unit for an annual rate of $10,200. The entire amount was expensed when paid.

d. $4,250 of store supplies were purchased during the year and the asset store supplies was increased. $3,850 of these supplies were used during the year.

e. $6,500 of office supplies were purchased during the year and were immediately expensed. $1,500 of these supplies remained at the end of 2011.

f. On July 1, 2011, Hullie & Oates issued a 9-month note receivable to Shanahan & Co. at an annual interest rate of 7%. Principle and interest will be paid at the end of the 9-months. The note was recorded in Notes Receivable and is the only note outstanding.

g. Depreciation for the year is based on the following:

- Straight line depreciation

- Store equipment Assets were held for the entire year; Residual Value = $7,000; Service life is estimated to be 10 years.

- Office equipment Assets were held for the entire year; Residual Value = $5,000; Service life is estimated to be 5 years.

h. Sales salaries of $6,200 and office salaries of $4,800 remained unpaid at 12/31/11.

i. On October 1, 2011, Hullie & Oates rented a portion of one store to Twist & Chase Co. The contract was for 10 months and Hullie & Oates required the 10 months of cash upfront on October 1st. The rent is being earned equally over the next 10 months. When cash was received, unearned rent was appropriately recorded.

j. The note payable was outstanding the entire year and a 5.5% interest rate exists on the note. No interest has been recorded for the year.

k. Based on past experience, Hullie & Oates calculates bad debt expense at 1% of net sales for the year.

2. After the above adjusting entries are entered on the adjustment worksheet, the amounts should be linked to the adjustments column of the worksheet. Your adjustment amounts should be a formula so if you change the debit/credit amount on the adjustments worksheet, the column amount will automatically change.

3. Complete the adjusted columns by the use of the formula. Think about the best way to do this. Your last two columns should never contain constant numbers but will include formulas only. (Maximum points are given for using an if statement, but the majority of the points are just given for having a proper formula).

4. Prepare a multiple-step income statement on the proper worksheet. Your Income Statement should be in good form (proper titles, etc., use examples from your book) and well formatted. Do your best designating between selling and administrative expenses. You should use formulas in all cells, not constant numbers. (That means, your income statement should be linked to the adjusted numbers on your worksheet.)

5. Prepare a Statement of Stockholders Equity on the proper worksheet. Your Statement should be formatted. You should use formulas in all cells, not constant numbers

6. On the designated worksheet, prepare in journal entry form the closing entries for Hullie & Oates at the end of 12/31/11.

7. Prepare a Classified Balance Sheet on the proper worksheet as of 12/31/11. Your Statement should be formatted. You should use formulas in all cells, not constant numbers.

8. Complete the Ratio Tab.

Hullie & Oates Company End of Period Worksheet For the Year Ended December 31, 2011 Accouns Receivable 22,890 Allowance for Doubtul Accounts 2000 10 Merchandise Inventory 160,500 11 Prepaid Insurance 118.000 12 13 Prepaid Advertising 48,000 14 Prepaid Rent store supplies 15 supplies 16 Note Receivable 21.000 17 18 Store 19 Accumulated Depreciation-store Eguipment 40.050 20 Office Equip 21 22 Accounts Payable 23 Salaries Payable 24 Interest Payable Unearned Rent 200,000 26 Note 27 Common Stock 60.000 28 Retained Earnings 110,500 29 Dividends Sales 350 30 31 Sales Returns and Allowances 1 32 Sales Discounts 7.2001 33 Cost of Goods Sold 34 Sales Salaries Expense 94,650 Advertising Expense 36 Depreciation Expense Store Equipment Store Supplies Expense 37 38 Miscellaneous Selling Ex 2600 39 Office Salaries Expense 3.000 Rent Expense 10.2200 41 Depreciation Expense-Office Equipment 42 43 Office 44 Miscellaneous Administrative 45 Rent Revenue 46 Interest Revenue 47 Interest 48 Bad Debt Expense 49 Adjusted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started