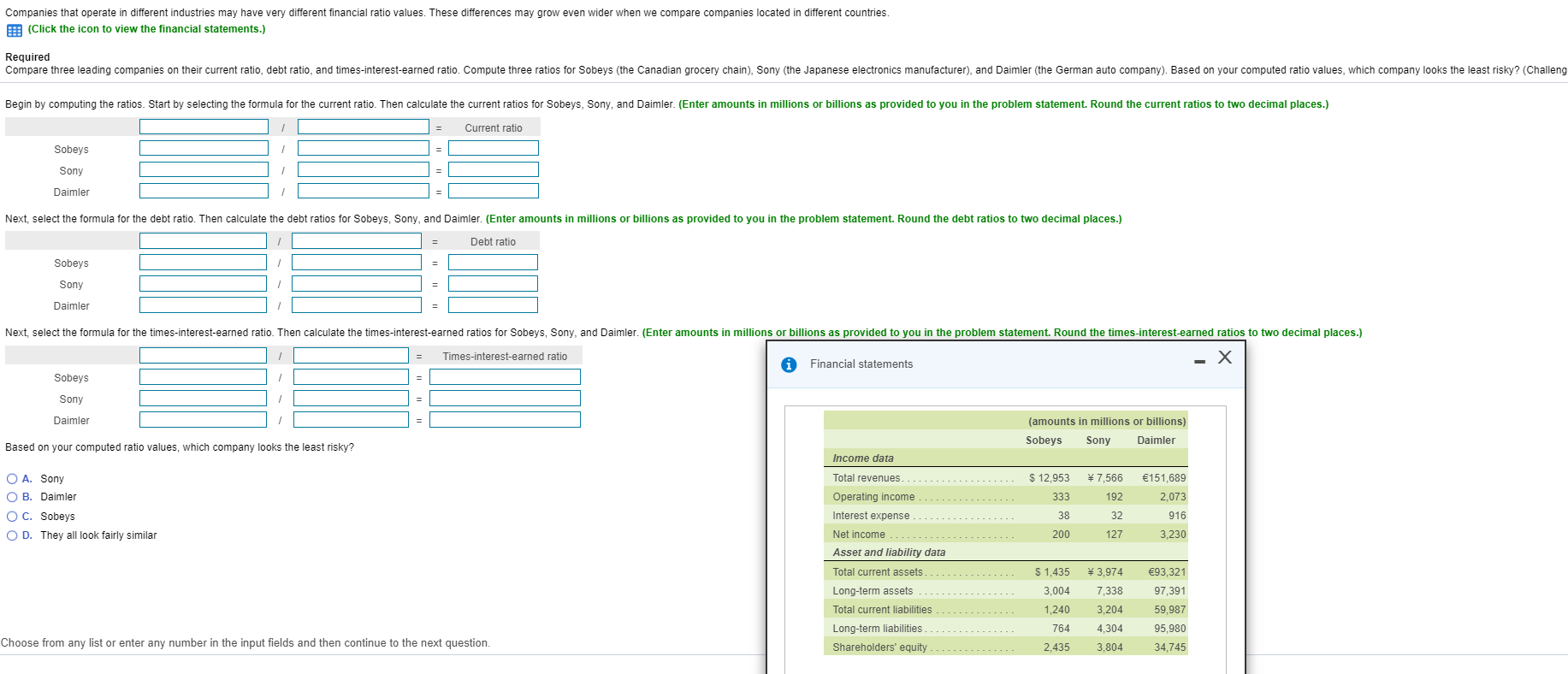

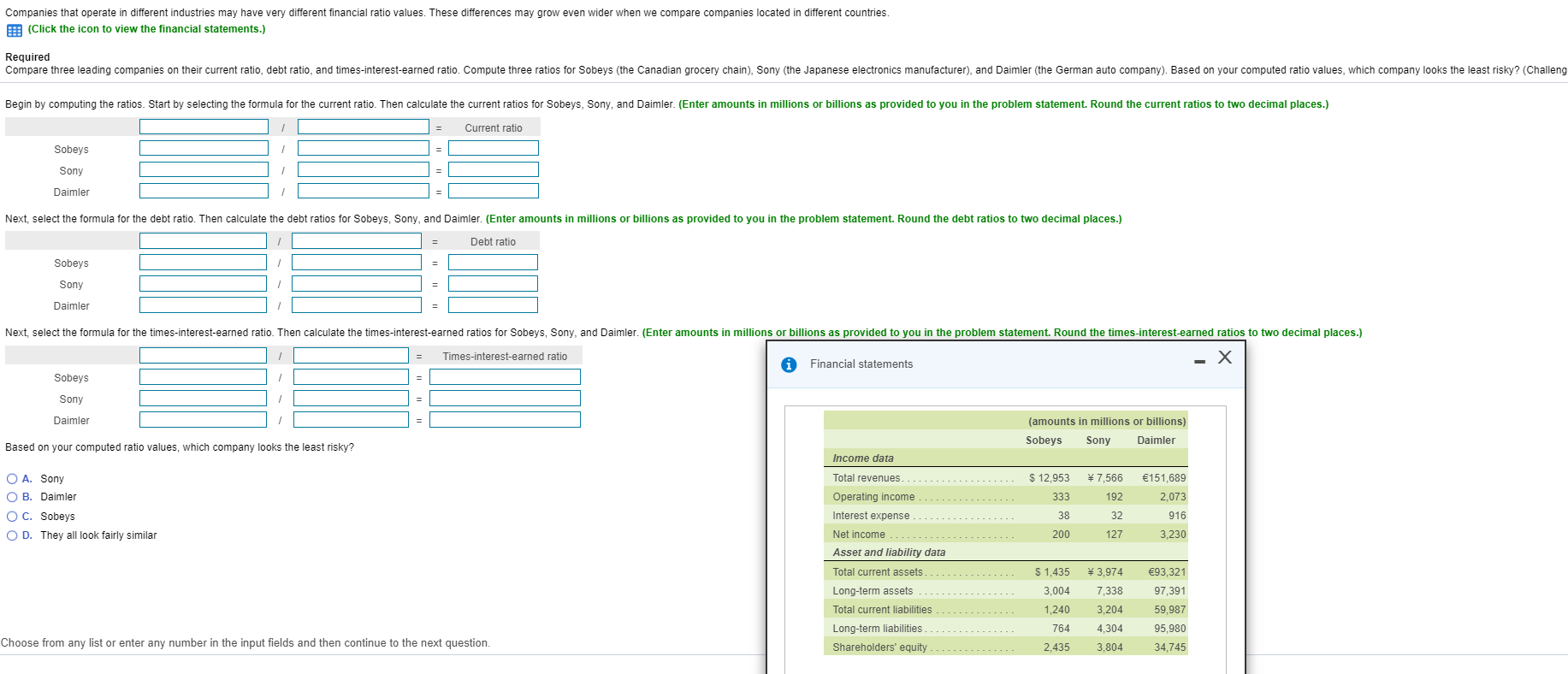

Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. E(Click the icon to view the financial statements.) Required Compare three leading companies on their current ratio, debt ratio, and times-interest-earned ratio. Compute three ratios for Sobeys (the Canadian grocery chain), Sony (the Japanese electronics manufacturer), and Daimler (the German auto company). Based on your computed ratio values, which company looks the least risky? (Challeng Begin by computing the ratios. Start by selecting the formula for the current ratio. Then calculate the current ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the current ratios to two decimal places.) Current ratio Sobeys Sony Daimler Next, select the formula for the debt ratio. Then calculate the debt ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the debt ratios to two decimal places.) Debt ratio Sobeys Sony Daimler Next, select the formula for the times-interest-earned ratio. Then calculate the times-interest-earned ratios for Sobeys, Sony, and Daimler. (Enter amounts in millions or billions as provided to you in the problem statement. Round the times-interest-earned ratios to two decimal places.) Times-interest-earned ratio Financial statements Sobeys Sony Daimler (amounts in millions or billions) Sobeys Sony Daimler Based on your computed ratio values, which company looks the least risky? Income data O A. Sony Total revenues. 7,566 151,689 $ 12,953 O B. Daimler 2,073 Operating income 333 192 O C. Sobeys Interest expense 38 32 916 O D. They all look fairly similar Net income - 200 127 3,230 . Asset and liability data 1,435 93,321 Total current assets 3,974 Long-term assets 3,004 7,338 97,391 Total current liabilities 1,240 3,204 59,987 Long-term liabilities 764 4,304 95,980 Choose from any list or enter any number in the input fields and then continue to the next question. Shareholders' equity 2,435 3,804 34,745