Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Companies use different sources for financing their assets-internal resources as well as external resources. Company A uses long-term debt to finance its assets, and company

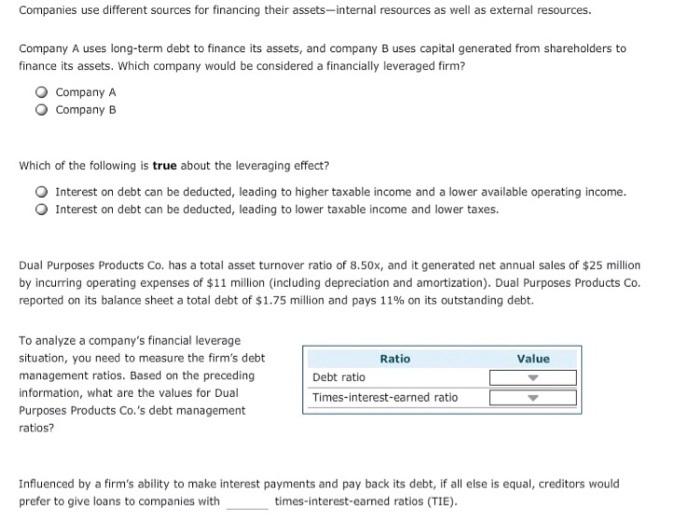

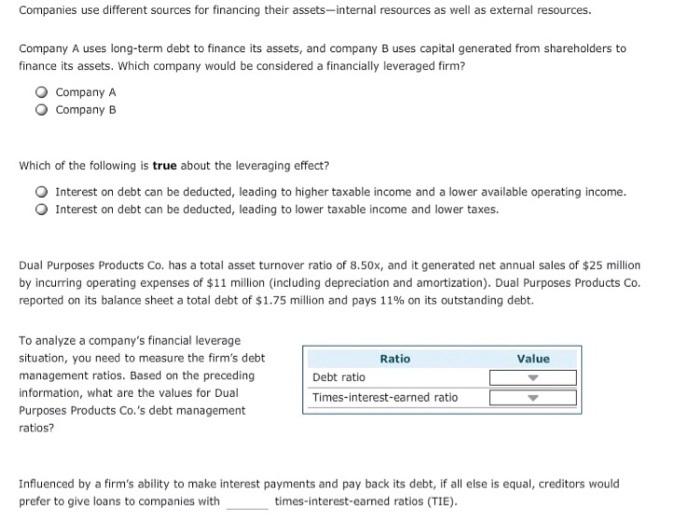

Companies use different sources for financing their assets-internal resources as well as external resources. Company A uses long-term debt to finance its assets, and company B uses capital generated from shareholders to finance its assets. Which company would be considered a financially leveraged firm? O Company A Company B Which of the following is true about the leveraging effect? Interest on debt can be deducted, leading to higher taxable income and a lower available operating income. O Interest on debt can be deducted, leading to lower taxable income and lower taxes. Dual Purposes Products Co. has a total asset turnover ratio of 8.50x, and it generated net annual sales of $25 million by incurring operating expenses of $11 millon (including depreciation and amortization). Dual Purposes Products Co. reported on its balance sheet a total debt of $1.75 million and pays 11% on its outstanding debt. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Dual Purposes Products Co.'s debt management ratios? Ratio Value Debt ratio Trimes-interest-earned ratio 7 Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with times-interest-earned ratios (TIE)

Companies use different sources for financing their assets-internal resources as well as external resources. Company A uses long-term debt to finance its assets, and company B uses capital generated from shareholders to finance its assets. Which company would be considered a financially leveraged firm? O Company A Company B Which of the following is true about the leveraging effect? Interest on debt can be deducted, leading to higher taxable income and a lower available operating income. O Interest on debt can be deducted, leading to lower taxable income and lower taxes. Dual Purposes Products Co. has a total asset turnover ratio of 8.50x, and it generated net annual sales of $25 million by incurring operating expenses of $11 millon (including depreciation and amortization). Dual Purposes Products Co. reported on its balance sheet a total debt of $1.75 million and pays 11% on its outstanding debt. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Dual Purposes Products Co.'s debt management ratios? Ratio Value Debt ratio Trimes-interest-earned ratio 7 Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with times-interest-earned ratios (TIE)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started