Question

Company 1 is a trucking (logistics) business and has been offered a proposal by Company 2 who is their largest client. Company 2's proposal is

Company 1 is a trucking (logistics) business and has been offered a proposal by Company 2 who is their largest client. Company 2's proposal is considering adding two van loads per week. Each would require 1,5000 round-trip kilometres. They are offering $2.15 per kilometre including all FSC and miscellaneous fees. Required:

Company 1's management is considering the proposal from Company 2. There are many issues involving strategy, cost, risk, and capacity. Prepare a formal written report to management that analyses this case and makes recommendations to management. Ensure that you provide appropriate and relevant quantitative and qualitative analysis to support your assessments and recommendations. Use the following questions to guide your analysis:

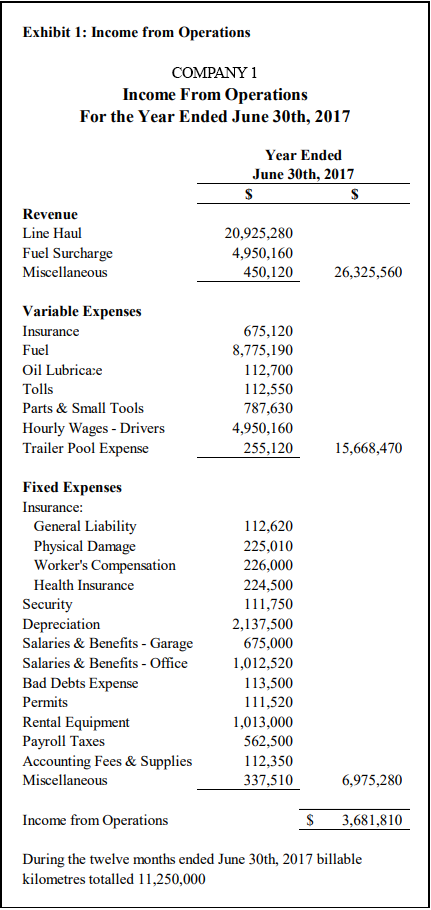

1. Assume Company 1 could service the contract with existing equipment. Use the attached image to identify the relevant costs concerning the acceptance of Company 2's request to add two additional loads per week. Which costs are not relevant? Why?

2. Calculate the contribution per kilometre and total annual contribution associated with accepting Company 2's proposal. What do you recommend? (Use 52 weeks per year in your calculations.)

3. Consider the strategic implications (including risks) associated with expanding (or choosing not to expand) operations to meet the demands of Company 2. Analyse this question from a conceptual point of view. Calculations are not necessary.

Exhibit 1: Income from Operations COMPANY1 Income rom operations For the Year Ended June 30th, 2017 Year Ended June 30th, 2017 Kevenue Line Haul Fuel Surcharge Miscellaneous 20,925,280 4,950,160 450,120 26,325,560 Variable Expenses 675,120 8,775,190 112,700 112,550 787,630 4,950,160 255,120 Insurance ue Oil Lubrica:e Tolls Parts & Small Tools Hourly Wages Drivers Trailer Pool Expense 15,668,470 Fixed Expenses Insurance: 112,620 225,010 226,000 224,500 111,750 2,137,500 675,000 1,012,520 113,500 111,520 1,013,000 562,500 112,350 337,510 General Liability Physical Damage Worker's Compensation Health Insurance Security Depreciation Salaries & Benefits - Garage Salaries & Benefits - Office Bad Debts Expense Permits Rental Equipment Payroll Taxes Accounting Fees & Supplies Miscellaneous 6,975,280 Income from Operations S 3,681,810 During the twelve months ended June 30th, 2017 billable kilometres totalled 11,250,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started