Company A has recently patented a design for a new product and is considering the best method to generate a return on its investment. You are asked to assess the following options and determine with reasons which of the following three options should be pursued by the company.

1. Direct sale of the patent for an immediate one-off payment of 1.3 million.

2. Sale of the patent for an immediate one-off payment of 500,000 plus royalties on sales for 10 years estimated at 100,000 per year.

3.Manufacture and sell the product themselves. Manufacturing set up costs are estimated at 200,000. Other set up costs are estimated at 100,000 Expected profit on sales in the first year are estimated at 200,000 and rising by 10% per annum. Expected life of the product is 10 years.

The investment costs to date are 300,000

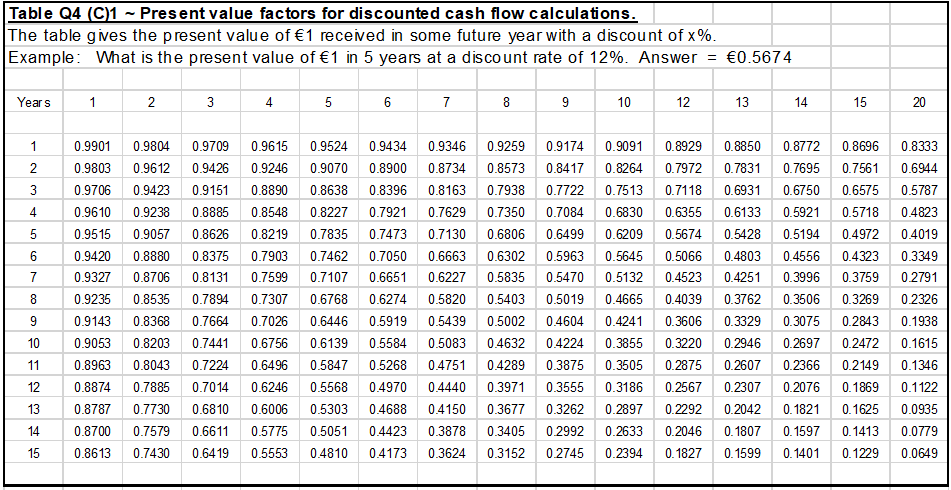

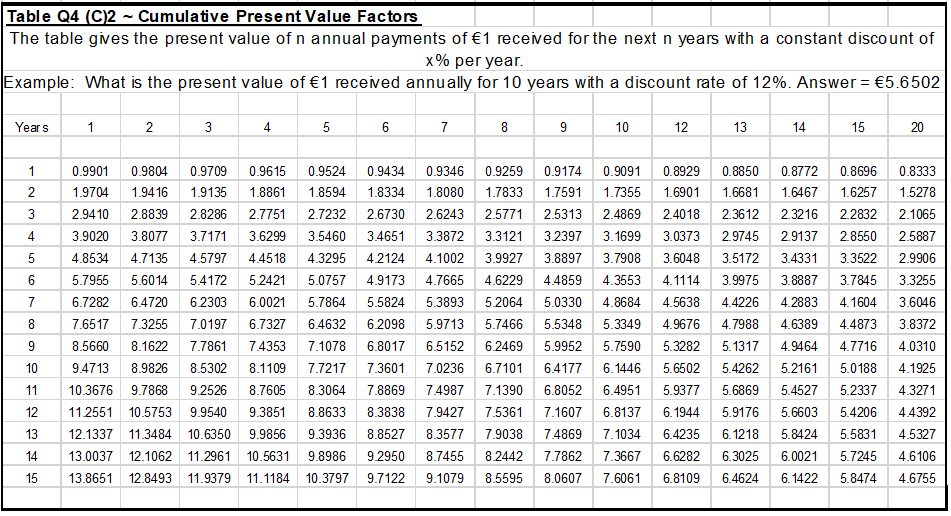

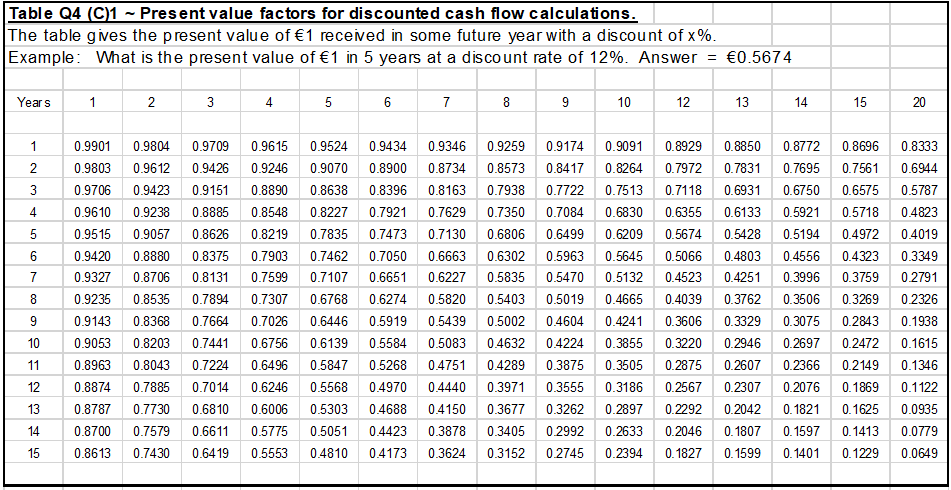

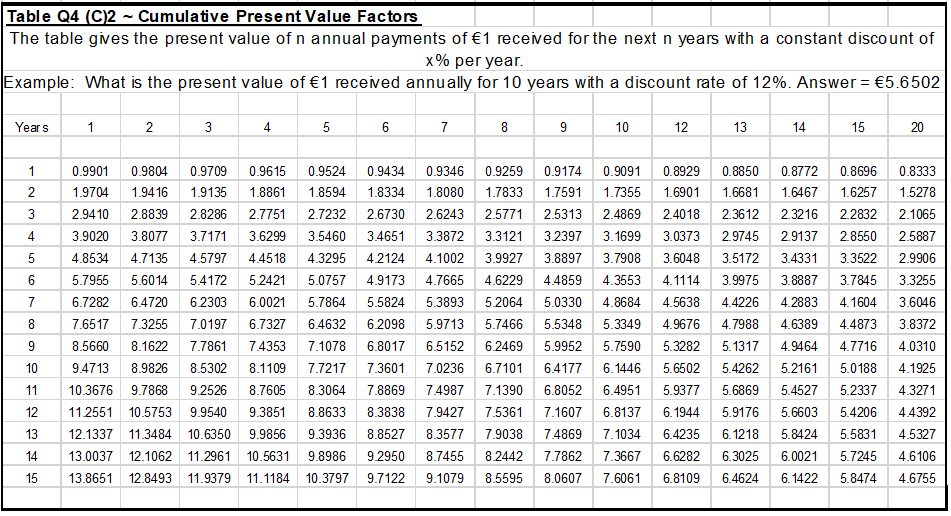

Use tables Q4 (C)1 and Q4 (C)2 and a discount factor of 8% where necessary.

Table Q4 (C)1 - Present value factors for discounted cash flow calculations. The table gives the present value of 1 received in some future year with a discount of x%. Example: What is the present value of 1 in 5 years at a discount rate of 12%. Answer = 0.5674 Years 1 2 3 4 5 6 7 8 9 10 12 13 14 15 20 2 3 0 5 0.9901 0.9804 0.9803 0.9612 .9706 0.9423 0.9610 0.9238 0.95150.9057 0.9420 0.8880 0.9327 0.8706 0.9235 0.8535 0.9143 0.8368 0.9053 0.8203 0.8963 0.8043 0.8874 0.7885 0.8787 0.7730 0.8700 0.7579 0.8613 0.7430 0.9709 0.9615 0.9426 0.9246 0.9151 0.8890 0.8885 0.8548 0.8626 0.8219 0.8375 0.7903 0.8131 0.7599 0.7894 0.7307 0.7664 0.7026 0.7441 0.6756 0.7224 0.6496 0.7014 0.6246 0.6810 0.6006 0.6611 0.5775 0.64190.5553 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.4810 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5268 0.4970 0.4688 0.4423 0.4173 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 0.3624 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 02745 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.2307 0.2042 0.1807 0.1599 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.2366 0.2076 0.1821 0.1597 0.1401 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 02791 0.2326 0.1938 0.1615 0.1346 0.1122 0.0935 0.0779 0.0649 12 13 Table Q4 (C2 - Cumulative Present Value Factors The table gives the present value of n annual payments of 1 received for the next n years with a constant discount of x % per year. Example: What is the present value of 1 received annually for 10 years with a discount rate of 12%. Answer = 5.6502 Years 2 3 4 5 6 7 8 9 10 12 13 14 15 20 1 0 .9901 1.9704 2.9410 3.9020 4.8534 5.7955 6.7282 7.6517 .5660 9.4713 10.3676 11 2551 12.1337 13.0037 13.8651 0.9804 0.9709 0.9615 1.94161.9135 1.8861 2.8839 2.8286 2.7751 3.8077 3.71713.6299 4.7135 4.5797 4.4518 5.60 14 5.4172 52421 6.4720 6.2303 6.0021 7.32557.0197 6.7327 8.1622 7.7861 7.4353 8.9826 8.5302 8.1109 9.78689 2526 8.7605 10.5753 9.9540 9.3851 11.3484 10.6350 9.9856 12.1062 11.2961 10.5631 12.8493 11.9379 11.1184 0.9524 0.9434 1.8594 1.8334 2.7232 2.6730 3.5460 3.4651 4.3295 42124 5.0757 4.9173 5.78645.5824 6.4632 62098 7.1078 6.8017 7.7217 7.3601 8.3064 7.8869 8.8633 8.3838 9.3936 8.8527 9.8986 92950 10.3797 9.7122 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 8.3577 8.7455 9.1079 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 52064 5.7466 6 2469 6.7101 7.1390 7.5361 7.9038 82442 8.5595 0.9174 0.9091 1.7591 1.7355 2.5313 2.4869 32397 3.1699 3.88973.7908 4.4859 4.3553 5.0330 4.8684 5.5348 5.3349 5.9952 5.7590 6.4177 6.1446 6.8052 6.4951 7.1607 6.8137 7.4869 7.1034 7.7862 7.3667 8.0607 7.6061 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 5.9377 6.1944 6.4235 6.6282 6.8109 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6. 1218 6.3025 6.4624 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 5.4527 5.6603 5.8424 6.0021 6.1422 0.8696 1.6257 22832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 57245 5.8474 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.3271 4.4392 4.5327 4.6106 4.6755 9 8 13 14 15