Answered step by step

Verified Expert Solution

Question

1 Approved Answer

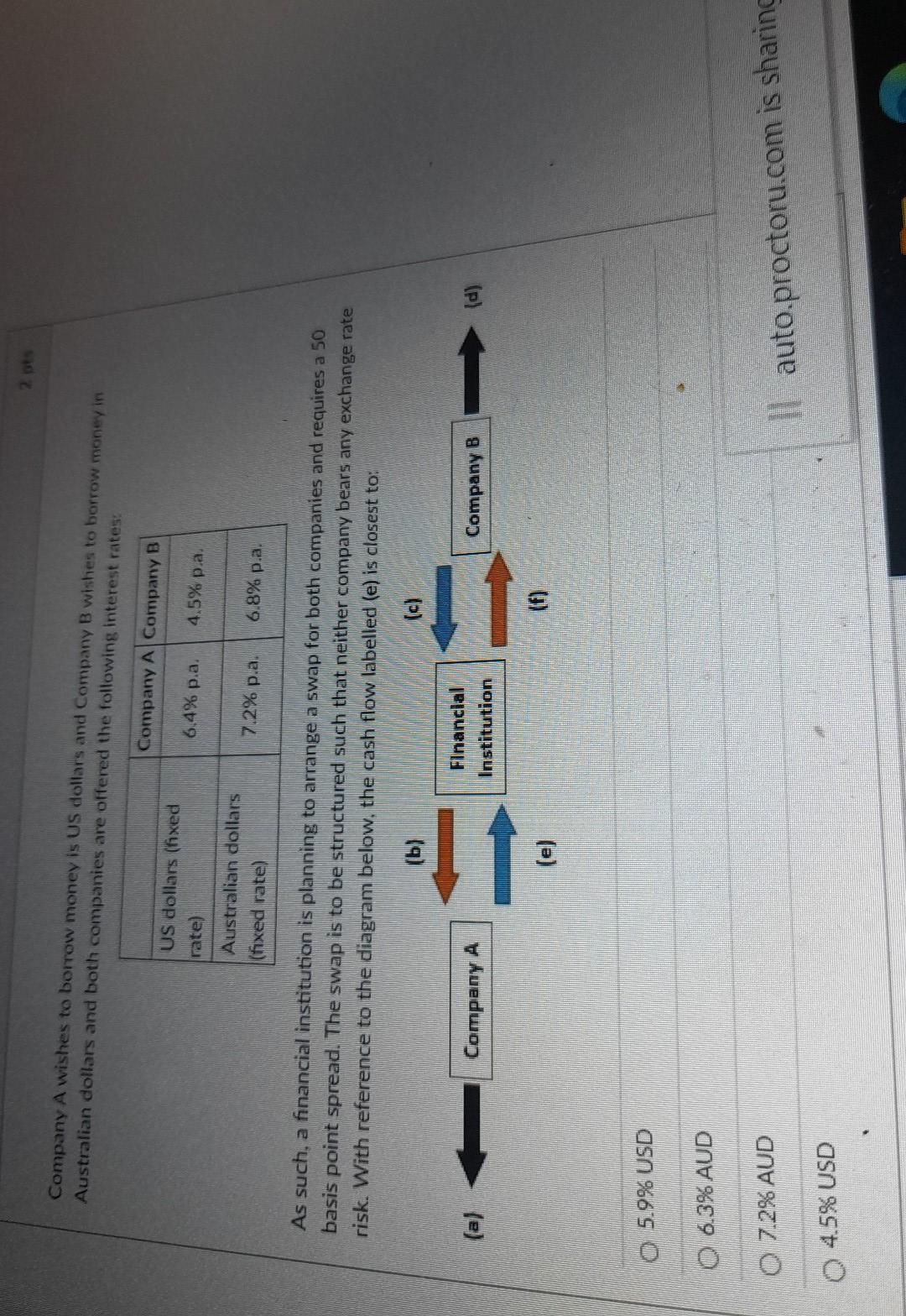

Company A wishes to borrow money is US dollars and Company B wishes to borrow money in Australian dollars and both companies are offered the

Company A wishes to borrow money is US dollars and Company B wishes to borrow money in Australian dollars and both companies are offered the following interest rates As such, a financial institution is planning to arrange a swap for both companies and requires a 50 basis point spread. The swap is to be structured such that neither company bears any exchange rate risk. With reference to the diagram below, the cash flow labelled (e) is closest to: 5.9% USD 6.3% AUD 7.2% AUD 4.5% USD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started