Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an audit manager for C.K. Chartered Accountants and are currently finalising your 30 June 2010 audits. Company A Company A is a

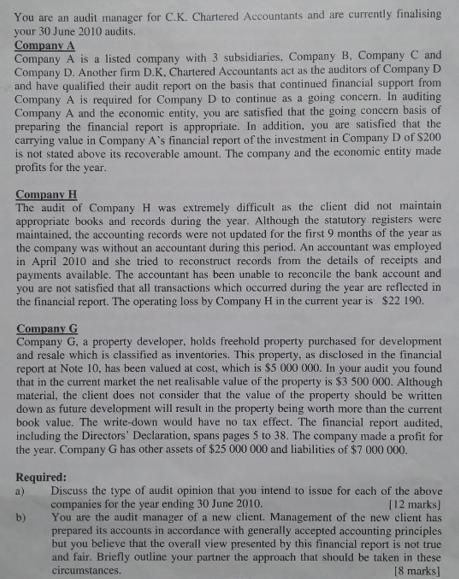

You are an audit manager for C.K. Chartered Accountants and are currently finalising your 30 June 2010 audits. Company A Company A is a listed company with 3 subsidianies, Company B, Company C and Company D. Another firm D.K. Chartered Accountants act as the auditors of Company D and have qualified their audit report on the basis that continued financial support from Company A is required for Company D to continue as a going concern. In auditing Company A and the economic entity, you are satisfied that the going concern basis of preparing the financial report is appropriate. In addition, you are satisfied that the carrying value in Company A's financial report of the investment in Company D of S200 is not stated above its recoverable amount. The company and the economic entity made profits for the year. Company H The audit of Company H was extremely difficult as the client did not maintain appropriate books and records during the year. Although the statutory registers were maintained, the accounting records were not updated for the first 9 months of the year as the company was without an accountant during this period. An accountant was employed in April 2010 and she tried to reconstruct records from the details of receipts and payments available. The accountant has been unable to reconcile the bank account and you are not satisfied that all transactions which occurred during the year are reflected in the financial report. The operating loss by Company H in the current year is $22 190. Company G Company G, a property developer, holds freehold property purchased for development and resale which is classified as inventories. This property, as disclosed in the financial report at Note 10, has been valued at cost, which is $5 000 000. In your audit you found that in the current market the net realisable value of the property is $3 500 000. Although material, the client does not consider that the value of the property should be written down as future development will result in the property being worth more than the current book value. The write-down would have no tax effect. The financial report audited, including the Directors' Declaration, spans pages 5 to 38. The company made a profit for the year. Company G has other assets of $25 000 000 and liabilities of $7 000 000. Required: Discuss the type of audit opinion that you intend to issue for cach of the above companies for the year ending 30 June 2010. You are the audit manager of a new client. Management of the new client has prepared its accounts in accordance with generally accepted accounting principles but you believe that the overall view presented by this financial report is not true and fair. Briefly outline your partner the approach that should be taken in these a) (12 marks) b) circumstances. [8 marks]

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Ans a Company A In the standard audit report of CK Chartered Accountants an explanatory language needs to be added to the below effect We did ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started