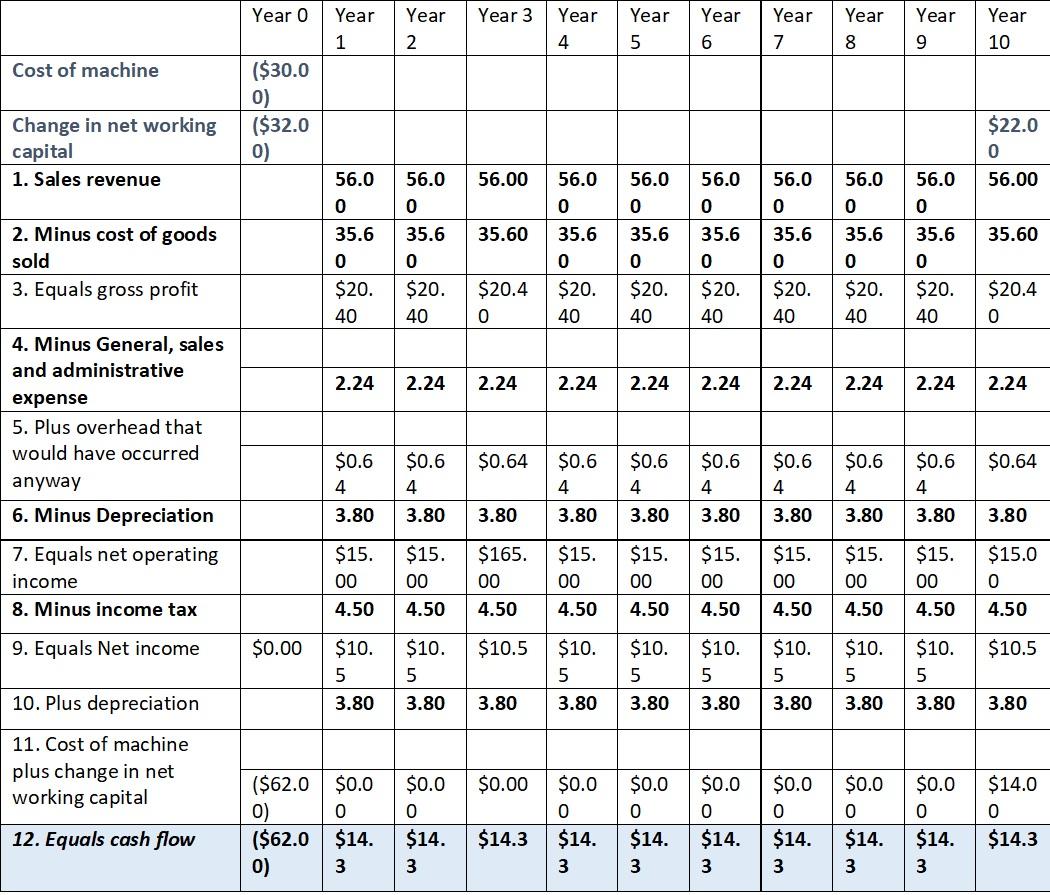

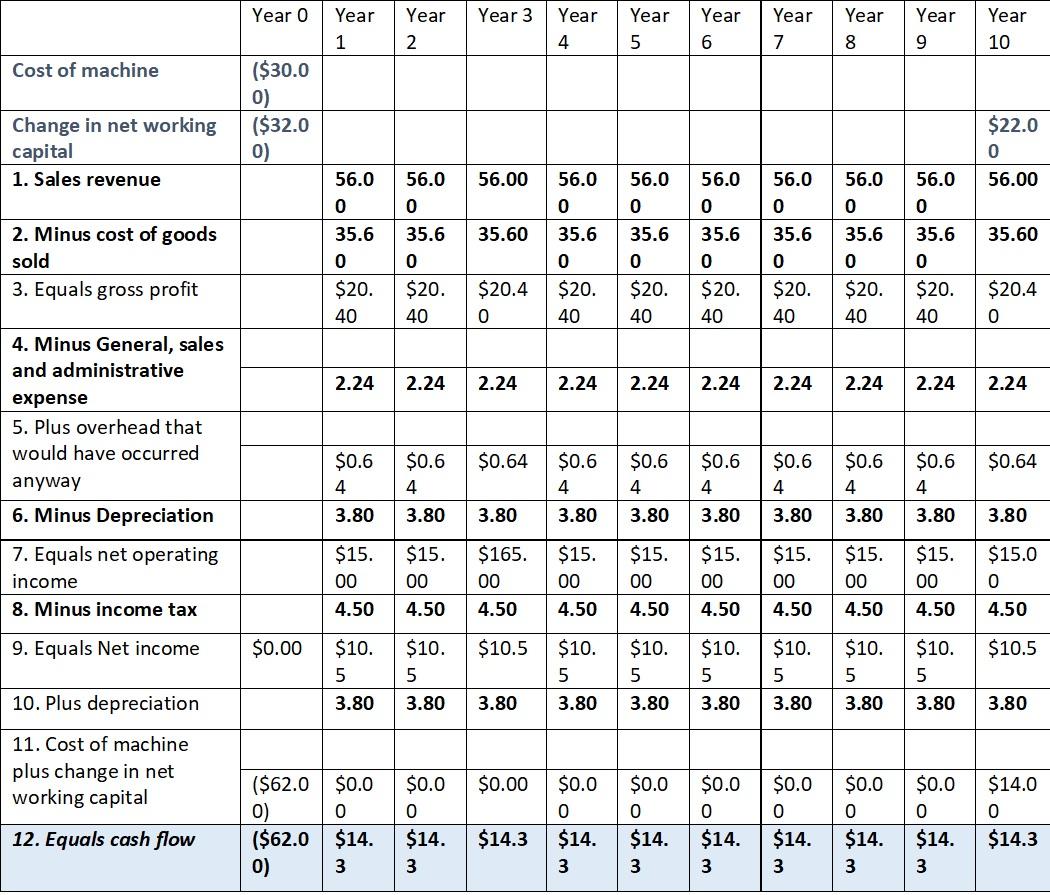

Company is considering making the following investments.

- If the cost of capital for this project is 12%, what is your estimate of the NPV of the new project?

- Conduct a scenario analysis when the cost of capital is 10% (optimistic scenario) or 14% (pessimistic scenario) as well as when the sales revenue are 10% higher (optimistic scenario) or 10% lower (optimistic scenario).

Year o Year Year Year 3 Year Year 4 Year Year 5 Year Year 7 Year 9 Year 10 1 2 6 8 Cost of machine ($30.0 0) ($32.0 0) Change in net working capital 1. Sales revenue $22.0 0 56.00 56.0 56.0 56.00 56.0 56.0 0 56.0 0 56.0 0 56.0 0 0 0 0 35.60 35.60 2. Minus cost of goods sold 3. Equals gross profit 35.6 0 35.6 0 56.0 0 35.6 0 $20. 40 35.6 0 $20. 40 35.6 0 35.6 0 $20. 40 35.6 0 $20. 40 35.6 0 $20. 40 $20.4 $20.4 0 $20. 40 $20. 40 $20. 40 0 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 $0.64 $0.64 4. Minus General, sales and administrative expense 5. Plus overhead that would have occurred anyway 6. Minus Depreciation 7. Equals net operating income 8. Minus income tax $0.6 4 3.80 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 3.80 3.80 3.80 3.80 3.80 $15. 00 4.50 $15. 00 4.50 $165. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15.0 0 4.50 9. Equals Net income $0.00 $10.5 $10.5 $10. 5 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 10. Plus depreciation 3.80 3.80 3.80 11. Cost of machine plus change in net working capital $0.00 $0.0 ($62.0 $0.0 0) 0 ($62.0 $14. 0) 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $14.0 0 $14.3 12. Equals cash flow $14.3 $14. 3 Year o Year Year Year 3 Year Year 4 Year Year 5 Year Year 7 Year 9 Year 10 1 2 6 8 Cost of machine ($30.0 0) ($32.0 0) Change in net working capital 1. Sales revenue $22.0 0 56.00 56.0 56.0 56.00 56.0 56.0 0 56.0 0 56.0 0 56.0 0 0 0 0 35.60 35.60 2. Minus cost of goods sold 3. Equals gross profit 35.6 0 35.6 0 56.0 0 35.6 0 $20. 40 35.6 0 $20. 40 35.6 0 35.6 0 $20. 40 35.6 0 $20. 40 35.6 0 $20. 40 $20.4 $20.4 0 $20. 40 $20. 40 $20. 40 0 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 2.24 $0.64 $0.64 4. Minus General, sales and administrative expense 5. Plus overhead that would have occurred anyway 6. Minus Depreciation 7. Equals net operating income 8. Minus income tax $0.6 4 3.80 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 $0.6 4 $0.6 4 3.80 3.80 3.80 3.80 3.80 3.80 $15. 00 4.50 $15. 00 4.50 $165. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15. 00 4.50 $15.0 0 4.50 9. Equals Net income $0.00 $10.5 $10.5 $10. 5 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 $10. 5 3.80 10. Plus depreciation 3.80 3.80 3.80 11. Cost of machine plus change in net working capital $0.00 $0.0 ($62.0 $0.0 0) 0 ($62.0 $14. 0) 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $0.0 0 $14. 3 $14.0 0 $14.3 12. Equals cash flow $14.3 $14. 3