Answered step by step

Verified Expert Solution

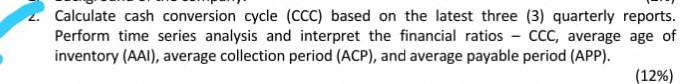

Question

1 Approved Answer

Company name is 100plus Calculate cash conversion cycle (CCC) based on the latest three (3) quarterly reports. Perform time series analysis and interpret the financial

Company name is 100plus

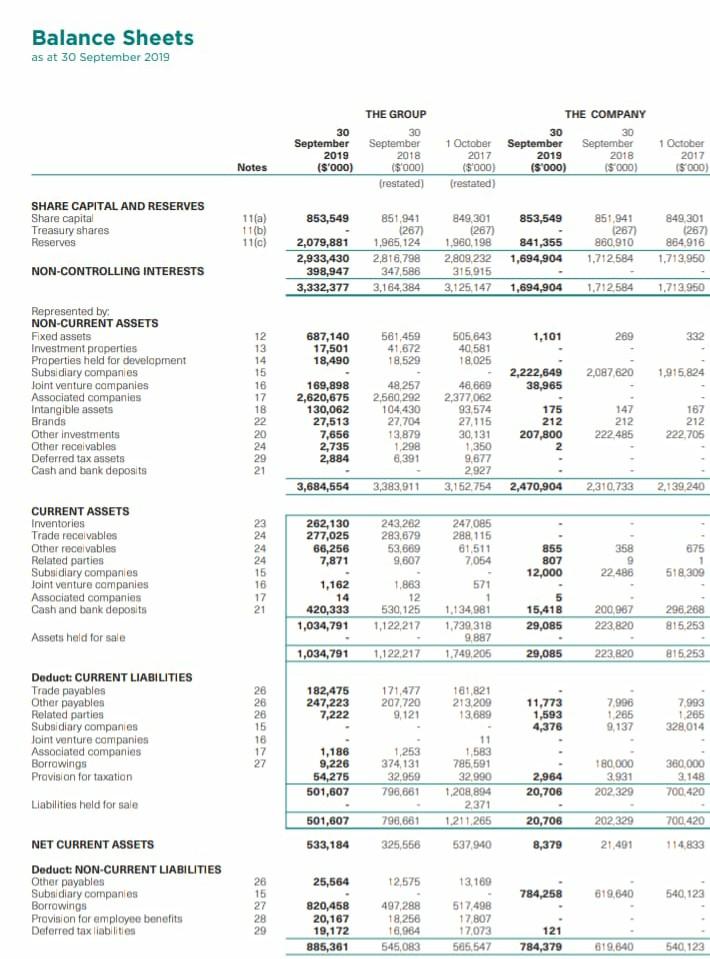

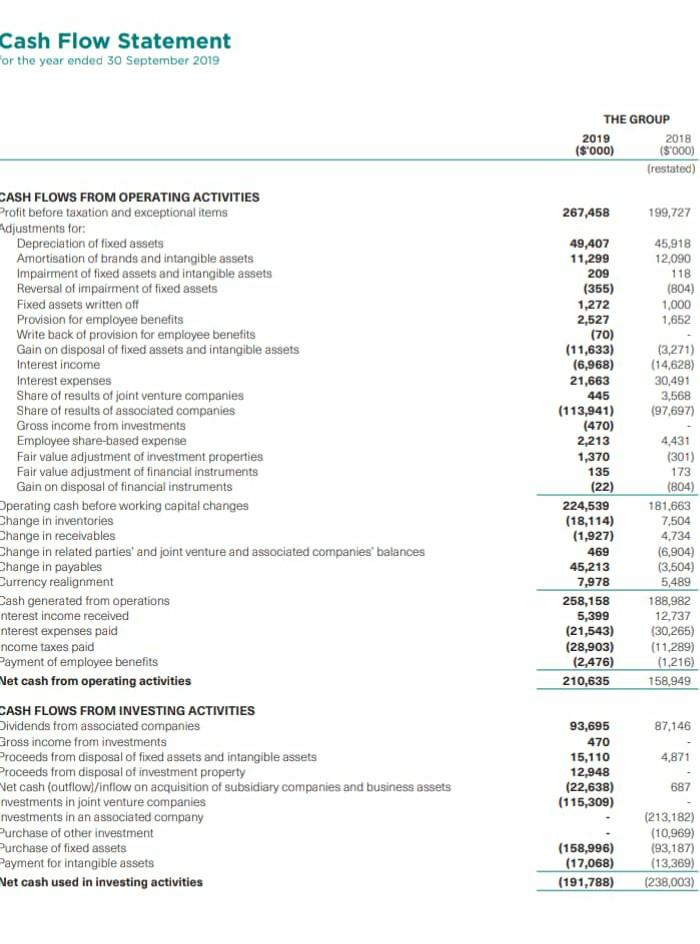

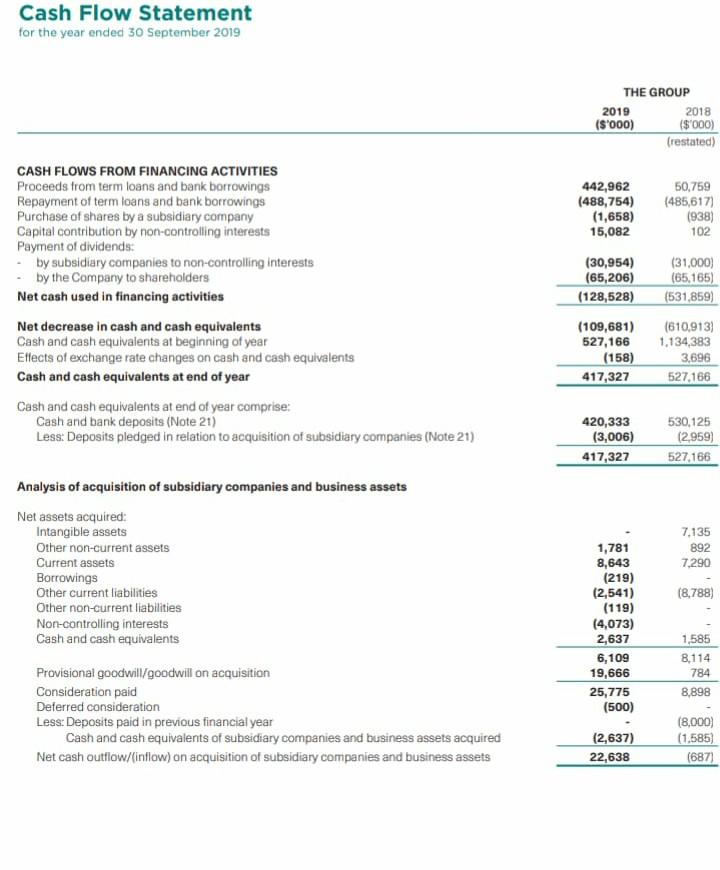

Calculate cash conversion cycle (CCC) based on the latest three (3) quarterly reports. Perform time series analysis and interpret the financial ratios - CCC, average age of inventory (AAI), average collection period (ACP), and average payable period (APP). (12%) Balance Sheets as at 30 September 2019 30 September 2019 (S'000) THE GROUP 30 September 2018 ($ 000) (restated) THE COMPANY 30 30 1 October September September 2017 2019 2018 (5000) (5'000) (5000) (restated) 1 October 2017 (5000) Notes SHARE CAPITAL AND RESERVES Share capital Treasury shares Reserves 11(a) 11(b) 11(c) 853,549 2,079,881 2,933,430 398,947 3,332,377 851,941 (267) 1,965,124 2,816,798 347,586 3,164,384 849,301 853,549 (267) 1,960,198 841,355 2,809,232 1,694,904 315,915 3.125, 147 1,694,904 851,941 12671 860,910 1,712 584 849 301 1267) 864,916 1.713,950 NON-CONTROLLING INTERESTS 1,712584 1.713.950 1,101 269 332 687,140 17,501 18,490 561,459 41,672 18,529 505,643 40,581 18,025 2,087620 1,915,824 Represented by: NON-CURRENT ASSETS Fixed assets Investment properties Properties held for development Subsidiary companies Joint venture companies Associated companies Intangible assets Brands Other investments Other receivables Deferred tax assets Cash and bank deposits 12 13 14 15 16 17 18 22 20 24 29 21 169,898 2,620,675 130,062 27,513 7,656 2,735 2,884 48,257 2,560,292 104.430 27.704 13,879 1,298 6,391 48,669 2,377,062 93,574 27.115 30,131 1,350 9,877 2927 3,152.754 2,222,649 38,965 175 212 207,800 2 147 212 222,485 167 212 222705 3,684,554 3,383,911 2,470,904 2,310,733 2,139 240 CURRENT ASSETS Inventories Trade receivables Other receivables Related parties Subsidiary companies Joint venture companies Associated companies Cash and bank deposits 23 24 24 24 15 16 17 21 262,130 277,025 66,256 7,871 243.262 283,679 53,689 9,807 358 247,085 288,115 61.511 7,054 855 12,000 807 675 1 518 309 22.486 1,162 14 420,333 1,034,791 1,863 12 530,125 1,122,217 571 1 1,134,981 1,739,318 9.887 1,749,205 5 15,418 29,085 200,967 223.820 296 268 815 253 Assets held for sale 1,034,791 1,122,217 29,085 223.820 815.253 26 26 26 182,475 247,223 7,222 171,477 207.720 9,121 181.821 213,209 13.689 11,773 1,593 4,376 7,995 1265 9,137 7.993 1265 328,014 Deduct: CURRENT LIABILITIES Trade payables Other payables Related parties Subsidiary companies Joint venture companies Associated companies Borrawings Provision for taxation Liabilities held for sale 15 18 17 27 1,186 9,226 54,275 501,607 1,253 374,131 32,959 796,681 11 1,583 785,591 32.990 1,208,894 2371 1.211.265 2,964 20,706 180,000 3,931 202 320 360,000 3.148 700,420 501,607 798,661 202 329 700 420 20,706 8,379 533,184 325,556 537940 21,491 114.833 NET CURRENT ASSETS Deduct: NON-CURRENT LIABILITIES Other payables Subsidiary companies Borrowings Provision for employee benefits Deferred tax liabilities 13,160 784,258 619,640 540,123 26 15 27 28 29 25,564 820,458 20,167 19,172 885,361 12,575 497,288 18,256 18,984 545,083 517,498 17 807 17,073 585,547 121 784,379 619,640 540,123 Cash Flow Statement or the year ended 30 September 2019 THE GROUP 2019 2018 ('000) (5000) (restated) 267,458 199,727 45,918 12,090 118 (804) 1,000 1,652 (3,271) (14,628) 30,491 3,568 (97,697) CASH FLOWS FROM OPERATING ACTIVITIES Profit before taxation and exceptional items Adjustments for: Depreciation of fixed assets Amortisation of brands and intangible assets Impairment of fixed assets and intangible assets Reversal of impairment of fixed assets Fixed assets written off Provision for employee benefits Write back of provision for employee benefits Gain on disposal of fixed assets and intangible assets Interest income Interest expenses Share of results of joint venture companies Share of results of associated companies Gross income from investments Employee share-based expense Fair value adjustment of investment properties Fair value adjustment of financial instruments Gain on disposal of financial instruments Operating cash before working capital changes Change in inventories Change in receivables Change in related parties and joint venture and associated companies' balances Change in payables Currency realignment Cash generated from operations nterest income received nterest expenses paid ncome taxes paid Payment of employee benefits Net cash from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Dividends from associated companies Gross income from investments Proceeds from disposal of fixed assets and intangible assets Proceeds from disposal of investment property Net cash (outflow]/inflow an acquisition of subsidiary companies and business assets nvestments in joint venture companies nvestments in an associated company Purchase of other investment Purchase of fixed assets Payment for intangible assets Vet cash used in investing activities 49,407 11,299 209 (355) 1,272 2,527 (70) (11,633) (6,968) 21,663 445 (113,941) (470) 2,213 1,370 135 (22) 224,539 (18,114) (1,927) 469 45,213 7,978 258,158 5,399 (21,543) (28,903) (2,476) 210,635 4.431 (301) 173 (804) 181,663 7,504 4,734 (6,904) (3,504) 5,489 188,982 12,737 (30,265) (11,289) (1,216) 158,949 87,146 4,871 93,695 470 15,110 12,948 (22,638) (115,309) 687 (158,996) (17,068) (191,788) (213,182) (10,969) (93,187) (13,369) (238,003) Cash Flow Statement for the year ended 30 September 2019 THE GROUP 2019 2018 (S'000) (restated) ($'000) 50,759 (485,617) 442,962 (488,754) (1,658) 15,082 (938) 102 CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from term loans and bank borrowings Repayment of term loans and bank borrowings Purchase of shares by a subsidiary company Capital contribution by non-controlling interests Payment of dividends: by subsidiary companies to non-controlling interests by the Company to shareholders Net cash used in financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of year Effects of exchange rate changes on cash and cash equivalents Cash and cash equivalents at end of year Cash and cash equivalents at end of year comprise: Cash and bank deposits (Note 21) Less: Deposits pledged in relation to acquisition of subsidiary companies (Note 21) (30,954) (65,206) (128,528) (31.000) (65.165) (531,859) (109,681) 527,166 (158) 417,327 (610,913) 1,134,383 3,696 527,166 420,333 (3,006) 417,327 530,125 (2,959) 527.166 Analysis of acquisition of subsidiary companies and business assets Net assets acquired: Intangible assets Other non-current assets Current assets Borrowings Other current liabilities Other non-current liabilities Non-controlling interests Cash and cash equivalents 7.135 892 7.290 (8,788) 1,781 8,643 (219) (2,541) (119) (4,073) 2,637 6,109 19,666 25,775 (500) 1,585 8,114 784 8,898 Provisional goodwill/goodwill on acquisition Consideration paid Deferred consideration Less: Deposits paid in previous financial year Cash and cash equivalents of subsidiary companies and business assets acquired Net cash outflow/(inflow) on acquisition of subsidiary companies and business assets (2,637) 22,638 (8,000) (1,585) (687) Calculate cash conversion cycle (CCC) based on the latest three (3) quarterly reports. Perform time series analysis and interpret the financial ratios - CCC, average age of inventory (AAI), average collection period (ACP), and average payable period (APP). (12%) Balance Sheets as at 30 September 2019 30 September 2019 (S'000) THE GROUP 30 September 2018 ($ 000) (restated) THE COMPANY 30 30 1 October September September 2017 2019 2018 (5000) (5'000) (5000) (restated) 1 October 2017 (5000) Notes SHARE CAPITAL AND RESERVES Share capital Treasury shares Reserves 11(a) 11(b) 11(c) 853,549 2,079,881 2,933,430 398,947 3,332,377 851,941 (267) 1,965,124 2,816,798 347,586 3,164,384 849,301 853,549 (267) 1,960,198 841,355 2,809,232 1,694,904 315,915 3.125, 147 1,694,904 851,941 12671 860,910 1,712 584 849 301 1267) 864,916 1.713,950 NON-CONTROLLING INTERESTS 1,712584 1.713.950 1,101 269 332 687,140 17,501 18,490 561,459 41,672 18,529 505,643 40,581 18,025 2,087620 1,915,824 Represented by: NON-CURRENT ASSETS Fixed assets Investment properties Properties held for development Subsidiary companies Joint venture companies Associated companies Intangible assets Brands Other investments Other receivables Deferred tax assets Cash and bank deposits 12 13 14 15 16 17 18 22 20 24 29 21 169,898 2,620,675 130,062 27,513 7,656 2,735 2,884 48,257 2,560,292 104.430 27.704 13,879 1,298 6,391 48,669 2,377,062 93,574 27.115 30,131 1,350 9,877 2927 3,152.754 2,222,649 38,965 175 212 207,800 2 147 212 222,485 167 212 222705 3,684,554 3,383,911 2,470,904 2,310,733 2,139 240 CURRENT ASSETS Inventories Trade receivables Other receivables Related parties Subsidiary companies Joint venture companies Associated companies Cash and bank deposits 23 24 24 24 15 16 17 21 262,130 277,025 66,256 7,871 243.262 283,679 53,689 9,807 358 247,085 288,115 61.511 7,054 855 12,000 807 675 1 518 309 22.486 1,162 14 420,333 1,034,791 1,863 12 530,125 1,122,217 571 1 1,134,981 1,739,318 9.887 1,749,205 5 15,418 29,085 200,967 223.820 296 268 815 253 Assets held for sale 1,034,791 1,122,217 29,085 223.820 815.253 26 26 26 182,475 247,223 7,222 171,477 207.720 9,121 181.821 213,209 13.689 11,773 1,593 4,376 7,995 1265 9,137 7.993 1265 328,014 Deduct: CURRENT LIABILITIES Trade payables Other payables Related parties Subsidiary companies Joint venture companies Associated companies Borrawings Provision for taxation Liabilities held for sale 15 18 17 27 1,186 9,226 54,275 501,607 1,253 374,131 32,959 796,681 11 1,583 785,591 32.990 1,208,894 2371 1.211.265 2,964 20,706 180,000 3,931 202 320 360,000 3.148 700,420 501,607 798,661 202 329 700 420 20,706 8,379 533,184 325,556 537940 21,491 114.833 NET CURRENT ASSETS Deduct: NON-CURRENT LIABILITIES Other payables Subsidiary companies Borrowings Provision for employee benefits Deferred tax liabilities 13,160 784,258 619,640 540,123 26 15 27 28 29 25,564 820,458 20,167 19,172 885,361 12,575 497,288 18,256 18,984 545,083 517,498 17 807 17,073 585,547 121 784,379 619,640 540,123 Cash Flow Statement or the year ended 30 September 2019 THE GROUP 2019 2018 ('000) (5000) (restated) 267,458 199,727 45,918 12,090 118 (804) 1,000 1,652 (3,271) (14,628) 30,491 3,568 (97,697) CASH FLOWS FROM OPERATING ACTIVITIES Profit before taxation and exceptional items Adjustments for: Depreciation of fixed assets Amortisation of brands and intangible assets Impairment of fixed assets and intangible assets Reversal of impairment of fixed assets Fixed assets written off Provision for employee benefits Write back of provision for employee benefits Gain on disposal of fixed assets and intangible assets Interest income Interest expenses Share of results of joint venture companies Share of results of associated companies Gross income from investments Employee share-based expense Fair value adjustment of investment properties Fair value adjustment of financial instruments Gain on disposal of financial instruments Operating cash before working capital changes Change in inventories Change in receivables Change in related parties and joint venture and associated companies' balances Change in payables Currency realignment Cash generated from operations nterest income received nterest expenses paid ncome taxes paid Payment of employee benefits Net cash from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Dividends from associated companies Gross income from investments Proceeds from disposal of fixed assets and intangible assets Proceeds from disposal of investment property Net cash (outflow]/inflow an acquisition of subsidiary companies and business assets nvestments in joint venture companies nvestments in an associated company Purchase of other investment Purchase of fixed assets Payment for intangible assets Vet cash used in investing activities 49,407 11,299 209 (355) 1,272 2,527 (70) (11,633) (6,968) 21,663 445 (113,941) (470) 2,213 1,370 135 (22) 224,539 (18,114) (1,927) 469 45,213 7,978 258,158 5,399 (21,543) (28,903) (2,476) 210,635 4.431 (301) 173 (804) 181,663 7,504 4,734 (6,904) (3,504) 5,489 188,982 12,737 (30,265) (11,289) (1,216) 158,949 87,146 4,871 93,695 470 15,110 12,948 (22,638) (115,309) 687 (158,996) (17,068) (191,788) (213,182) (10,969) (93,187) (13,369) (238,003) Cash Flow Statement for the year ended 30 September 2019 THE GROUP 2019 2018 (S'000) (restated) ($'000) 50,759 (485,617) 442,962 (488,754) (1,658) 15,082 (938) 102 CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from term loans and bank borrowings Repayment of term loans and bank borrowings Purchase of shares by a subsidiary company Capital contribution by non-controlling interests Payment of dividends: by subsidiary companies to non-controlling interests by the Company to shareholders Net cash used in financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of year Effects of exchange rate changes on cash and cash equivalents Cash and cash equivalents at end of year Cash and cash equivalents at end of year comprise: Cash and bank deposits (Note 21) Less: Deposits pledged in relation to acquisition of subsidiary companies (Note 21) (30,954) (65,206) (128,528) (31.000) (65.165) (531,859) (109,681) 527,166 (158) 417,327 (610,913) 1,134,383 3,696 527,166 420,333 (3,006) 417,327 530,125 (2,959) 527.166 Analysis of acquisition of subsidiary companies and business assets Net assets acquired: Intangible assets Other non-current assets Current assets Borrowings Other current liabilities Other non-current liabilities Non-controlling interests Cash and cash equivalents 7.135 892 7.290 (8,788) 1,781 8,643 (219) (2,541) (119) (4,073) 2,637 6,109 19,666 25,775 (500) 1,585 8,114 784 8,898 Provisional goodwill/goodwill on acquisition Consideration paid Deferred consideration Less: Deposits paid in previous financial year Cash and cash equivalents of subsidiary companies and business assets acquired Net cash outflow/(inflow) on acquisition of subsidiary companies and business assets (2,637) 22,638 (8,000) (1,585) (687)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started