Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company name is Appliance Manufacturers Ltd. Please answer a) b) and c) 40 C) Budgeting and Planning Marks Accepting that there is now a greater

Company name is Appliance Manufacturers Ltd. Please answer a) b) and c)

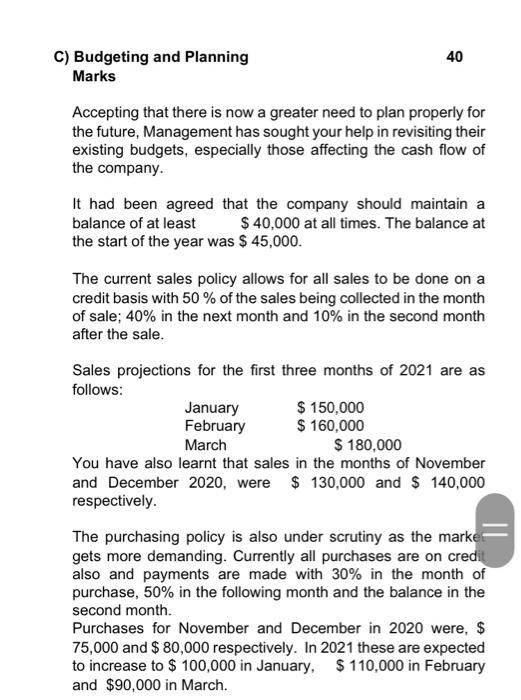

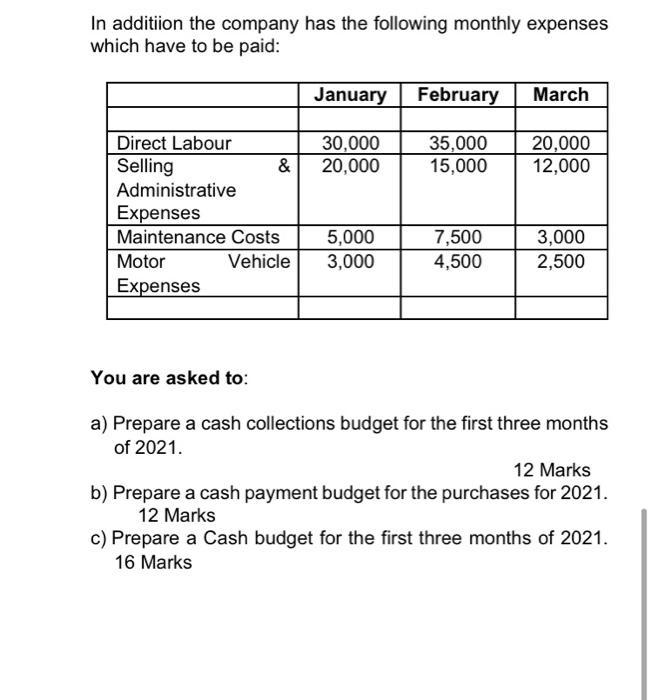

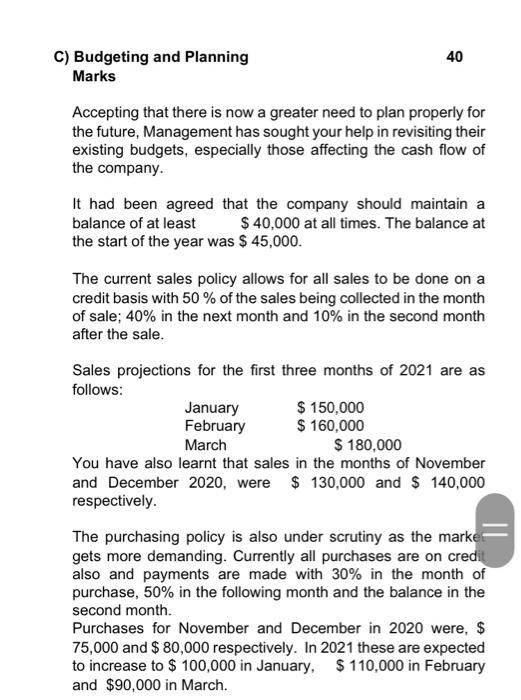

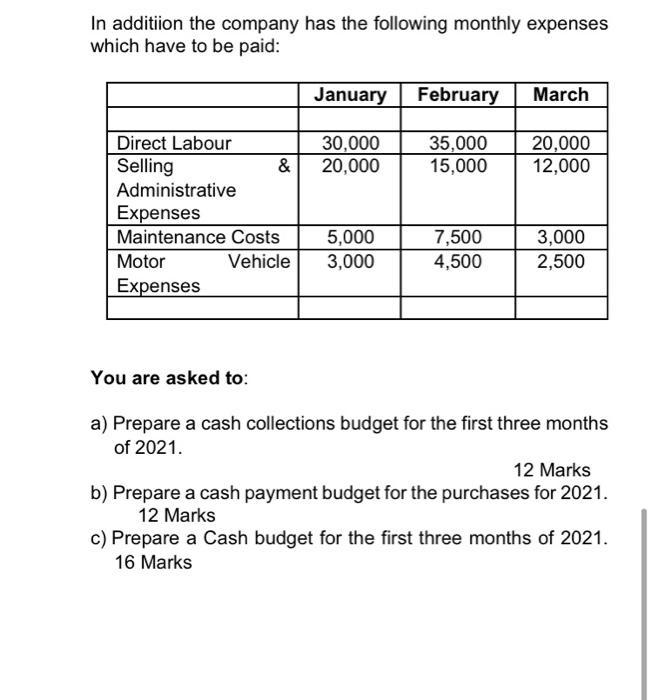

40 C) Budgeting and Planning Marks Accepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021 are as follows: January $ 150,000 February $ 160,000 March $ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The purchasing policy is also under scrutiny as the marke gets more demanding. Currently all purchases are on credit also and payments are made with 30% in the month of purchase, 50% in the following month and the balance in the second month. Purchases for November and December in 2020 were, $ 75,000 and $ 80,000 respectively. In 2021 these are expected to increase to $ 100,000 in January, $ 110,000 in February and $90,000 in March. In addition the company has the following monthly expenses which have to be paid: January February March 30,000 20,000 35,000 15,000 20,000 12,000 Direct Labour Selling & Administrative Expenses Maintenance Costs Motor Vehicle Expenses 5,000 3,000 7,500 4,500 3,000 2,500 You are asked to: a) Prepare a cash collections budget for the first three months of 2021. 12 Marks b) Prepare a cash payment budget for the purchases for 2021. 12 Marks c) Prepare a Cash budget for the first three months of 2021. 16 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started